Audio By Carbonatix

Ecobank Ghana earned a record total revenue of ¢1.58 billion and profit before tax of ¢642.4 million in the 2019 financial year marking a growth of 21% and 27% respectively over the prior year figures.

Terence Darko, Board Chairman of Ecobank said the bank's operating expenses growth were well controlled within inflationary levels with a resultant reduction in cost-to-income ratio from 51.5% in 2018 to 45.8% in 2019.

"This remarkable performance is reflective of the Bank’s consistent strategy of building a diversified business model with a focus on growing revenue and managing costs and risks, even in the face of a highly competitive environment.

"Ecobank also posted strong performance on all key balance sheet items, providing its shareholders with a return on equity of 25%. The Bank continues to be well capitalised with total equity of ¢1.78 billion, one of the highest in the industry and a capital adequacy ratio of 18.58%, well above the regulatory requirement of 13%," he said.

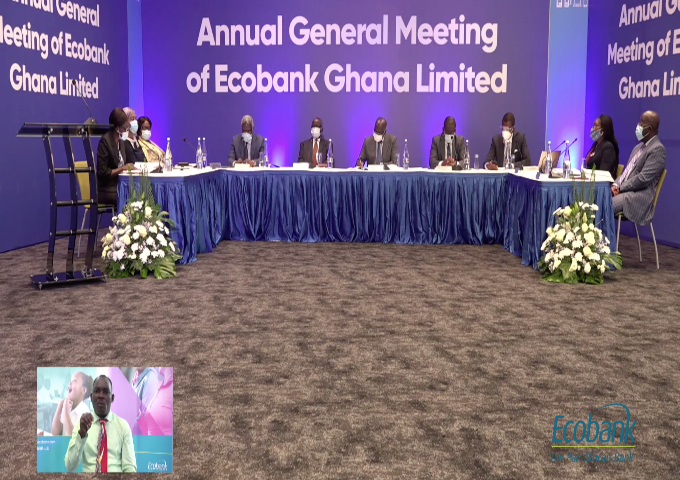

Speaking at Ecobank Ghana's 15th Annual General Meeting (AGM), he lauded the Directors for their hard work leading to the bank posting sterling financial results and maintaining its position as Ghana’s biggest bank.

This year’s AGM held virtually, highlighted strong growth in revenues and profits, strengthening of the Bank’s balance sheet as well as a dividend payout.

Speaking to shareholders at the AGM, Mr Darko said "the last two years have been marked by significant changes in the Ghanaian banking sector, largely underscored by the Central Bank’s clean-up activities across the industry.

"This has reduced the number of banks in Ghana from 34 to 23, and led to a stronger and more efficient banking system."

He gave a thorough overview of the global and domestic macroeconomic changes and how they have impacted businesses.

Ecobank Ghana ‘s credit rating has been affirmed by the Global Credit Rating Company at AA-(GH) and A1+(GH) in the long term and short term respectively with a stable outlook.

The current ratings reflect the Bank’s established domestic franchise value, resilient financial performance, risk appropriate capitalisation and adequate loan loss reserve.

Given the bank’s stellar performance, the Board proposed a dividend payout of 30 pesewas per share, which was unanimously approved by shareholders.

Latest Stories

-

Judiciary to roll out court decongestion measures, galamsey courts – Chief Justice

30 minutes -

Ugandan leader to extend 40-year rule after being declared winner of contested poll

59 minutes -

Residents demand action on abandoned Salaga–Kumdi–Kpandai road

1 hour -

Ghana, Japan explore ways to deepen long-standing bilateral ties

1 hour -

Ghana Navy foils illegal fuel bunkering operation along Volta coastline

2 hours -

Gov’t assures minimal power disruption during WAPCo gas pipeline maintenance

2 hours -

Burna Boy and Sporty Group unveil new single “For Everybody” celebrating Africa’s sports heritage and cultural excellence

2 hours -

Achieve By Petra partners Richie Mensah to drive financial independence

2 hours -

Kwakye Ofosu says cost of living eased under Mahama government

4 hours -

Total banking deposits stood at GH¢302.0bn in October 2025, but foreign currency deposits contracted by 21%

4 hours -

Interior Minister calls for collective action to enhance security in Ashanti Region

4 hours -

Baobab: Tree of life dying as climate change ravages Northern Ghana

4 hours -

Extradition of Ofori-Atta and Tamakloe-Attinou could take up to three years – Victoria Bright

4 hours -

Government pledges support for Accra commuters amid transport challenges

4 hours -

GES probes alleged feeding problems at Savelugu Senior High School

4 hours