Audio By Carbonatix

Managing Director of EDC Investment Ltd, Paul Kofi Mantey has urged Ghanaians to adopt a more strategic and disciplined approach to retirement planning, cautioning against common financial errors that could derail long-term stability.

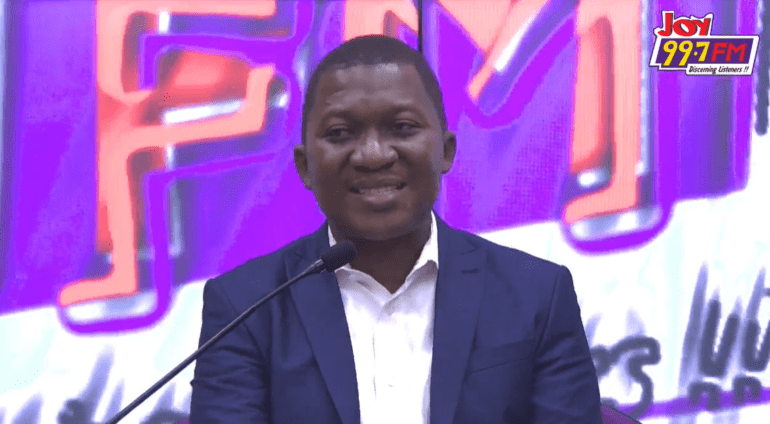

Speaking on Joy FM’s Super Morning Show on Monday, July 23, Mr Mantey highlighted several missteps he believes retirees frequently make, many of which can have long-lasting financial consequences.

“There are a number of mistakes we need to avoid during retirement,” he said.

“Top of the list is spending too much, too quickly especially when the lump sum payment comes in. Whether it’s from Tier Two, Tier Three or a personal investment, resist the temptation to splurge on family demands or lifestyle upgrades. Once it’s your retirement lump sum, it is not for spending.”

He also discouraged using retirement funds to launch capital-intensive projects without adequate preparation.

“Some people reach sixty, retire, and decide to invest their entire package into farming or real estate from scratch. It’s good to stay active post-retirement, and I encourage that but whatever you want to do after sixty must be planned long before. By the time you retire, the groundwork should already be in place,” he said.

Mr Mantey further advised retirees not to rely too heavily on their children for financial support, warning that such dependence could lead to disappointment and strain.

Another mistake he flagged was holding onto large properties after retirement.

“Living in a huge mansion might sound impressive, but it comes with higher utility bills and maintenance costs. A house is not an income-generating asset. Instead of locking all your money into one big home, I encourage retirees to downsize. Even if you own a big house, consider selling it and buying something smaller you could make a decent return on the transaction.”

He further advised against owning large vehicles in retirement. “Big engine cars come with higher running and maintenance costs, which simply don’t make sense when you’re no longer earning a regular income.”

Latest Stories

-

The prodigal artiste: Why Ghanaian musicians need to lawyer up

11 minutes -

Our politics is corrupt; rule by the rich is not democracy

19 minutes -

Sesi Technologies launches AI-Powered soil testing services for smallholder farmers

29 minutes -

Ghana Chamber of Shipping calls for a 3-month grace period on cargo insurance directive

34 minutes -

NACOC to begin licensing for medicinal and industrial cannabis cultivation

49 minutes -

It’s easier to move from GH₵100k to GH₵1m than from zero to GH₵100k- Ecobank Development Corporation MD

53 minutes -

Between faith and rights: A nuanced strategic view on the debate over an Islamic widow’s political ambition

1 hour -

At least Baba Jamal should have been fined – Vitus Azeem

1 hour -

Gender Minister visits the 31st December Women’s Day Care Centre and the Makola clinic

1 hour -

Ayawaso East NDC primary: Why feed people for votes? Are they your children? – Kofi Kapito

1 hour -

Ziavi Traditional area begins final funeral rites for Togbega Kwaku Ayim IV

1 hour -

Photos: Mahama swears in Presidential Advisory Group on Economy

1 hour -

Ghana intensifies boundary pillar construction with Côte d’Ivoire

1 hour -

NHIA settles December–January claims worth GH¢400m for service providers

2 hours -

Mahama warns economic advisers of ‘rough road ahead’ amid debt distress

2 hours