Audio By Carbonatix

For a company that rarely attracts public attention or features among Ghana’s most prominent state owned enterprises, the Ghana Publishing Company has dominated headlines in recent days. The attention follows a public dispute between the former Managing Director, David Asante, and the current management led by Nana Kwasi Boatey.

At the centre of the debate is a claim that the company’s asset base increased by more than 3,000% in 2023.

The previous management presents this as evidence of strong operational performance. The current administration argues that the claim is misleading.

In a Facebook post on January 14, 2026, the former Managing Director, David Asante, wrote:

“Mr. President, I’m sure prior to your visit to the company last week, your handlers must have briefed you and made available to you copies of the audited accounts of the company for the period 2019 to 2024, showing among others profit and over 3,000% increase in net assets of the company specifically for the year 2023, amongst other remarkable and well documented successes for the company.”

The current management of the Ghana Publishing Company issued a detailed rebuttal, disputing the basis of the claim.

In its response, current management stated:

“The former MD claims that the company’s assets increased by 3,000% in 2023 and attributes this increment to retooling of the company. The 2023 audited financial statement of the company shows clearly that the 3,000% increase in assets constitutes revaluation surplus after the assets of the company were revalued and not retooling as is claimed by the former MD.”

So which claim holds up under scrutiny?

Net assets represent what a company owns after subtracting what it owes. In simple terms, they are total assets minus total liabilities.

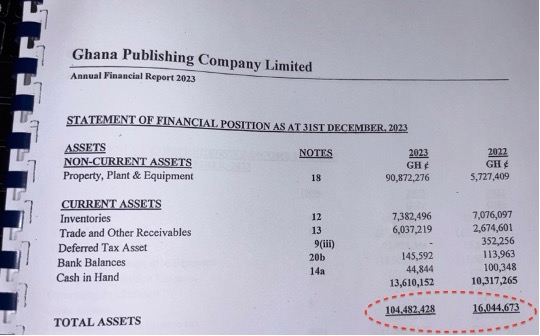

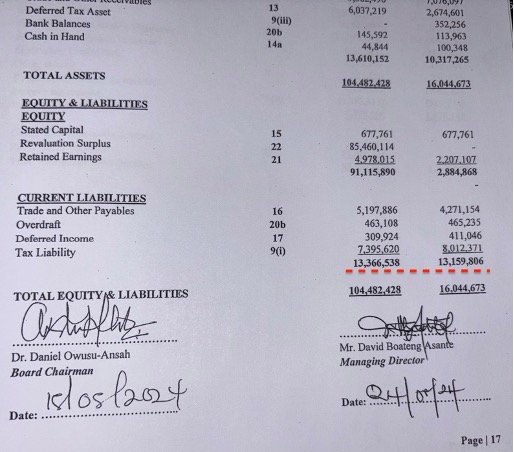

According to the company’s 2023 audited financial statements, total assets stood at GHS 16 million in 2022.

By 2023, total assets had risen sharply to GHS 104.4 million.

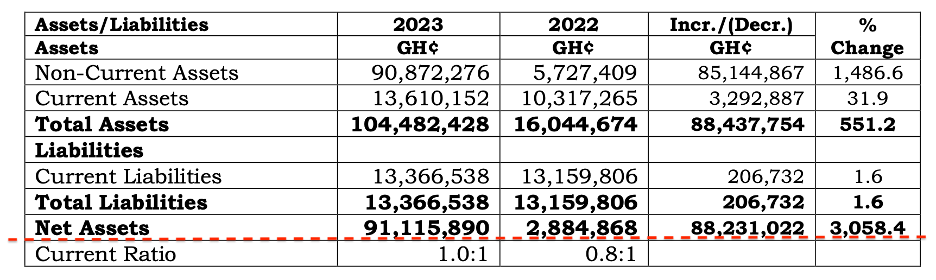

Liabilities, however, barely changed. They increased marginally from GHS 13.1 million in 2022 to GHS 13.3 million in 2023.

This means net assets rose from GHS 2.8 million in 2022 to GHS 91.1 million in 2023.

That represents a 3,058% increase, confirming that the headline figure itself is accurate.

The key question is what caused such a dramatic jump.

A close review of the 2023 financial statements shows that the increase was overwhelmingly driven by asset revaluation and not operational investment.

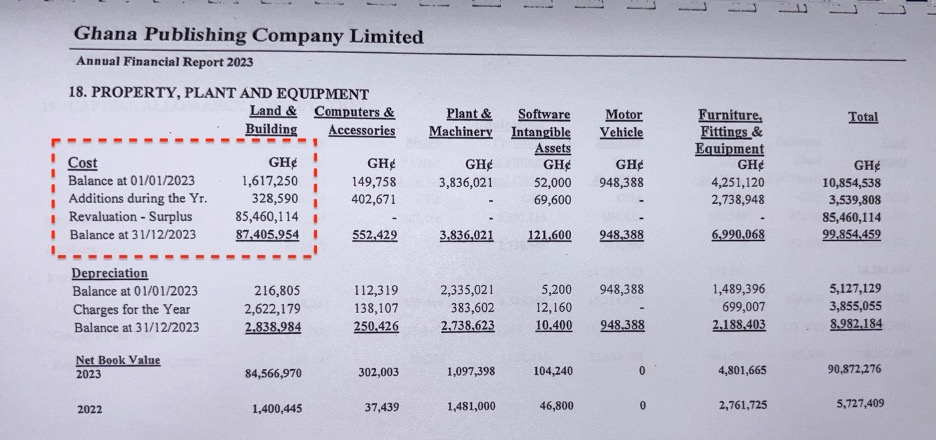

In 2022, the company’s land and buildings were valued at GHS 1.6 million. In 2023, a revaluation exercise added GHS 85.4 million to the value of those same assets.

The company did make new purchases in 2023, including computers, software, furniture, and land. However, these additions amounted to GHS 3.5 million.

In other words, while some retooling did occur in 2023, it accounted for only a small fraction of the increase in asset value. The overwhelming driver of the roughly 3,000 percent rise in net assets was the revaluation of existing land and buildings.

That revaluation would have been driven largely by land values, though any refurbishment or improvement to the buildings over the years would also have contributed to the revaluation gain.

Verdict

The claim that the more than 3,000% increase in net assets in 2023 was the result of retooling is wrong and misleading.

The increase was primarily due to a one off revaluation gain of GHS 85.4 million on land and buildings, not a significant expansion of the company’s productive capacity.

Latest Stories

-

Middle East turmoil threatens to derail Ghana’s single-digit gains

21 minutes -

Free-scoring Semenyo takes burden off Haaland

22 minutes -

Explainer: Why did the US attack Iran?

30 minutes -

Peaky Blinders to The Bride!: 10 of the best films to watch in March

60 minutes -

Crude oil price crosses $91 as Strait of Hormuz blockade chokes 22% of global supply

1 hour -

Dr. Hilla Limann Technical University records 17% admission surge; launches region’s first cosmetology laboratory

2 hours -

Over 50 students hospitalised after horror crash ends sports tournament

3 hours -

Accra–Dubai flights cancelled as Middle East tensions deepen

3 hours -

See the areas that will be affected by ECG’s planned maintenance from March 1-5

4 hours -

Kane scores twice as Bayern beat rivals Dortmund

4 hours -

Lamine Yamal hits first hat-trick in Barcelona win

4 hours -

Iran says US and Israel strikes hit school killing 108

4 hours -

What we know so far: Supreme Leader Khamenei killed, Trump says, as Iran launches retaliatory strikes

5 hours -

Trump says Iran’s Supreme Leader Ali Khamenei dead after US-Israeli attacks

5 hours -

Ghana cautions nationals against non-essential travel to and from the Middle East as tensions escalate

7 hours