Audio By Carbonatix

Ghanaians who fail to disclose their sources of taxable income overseas risk being penalized by the Ghana Revenue Authority.

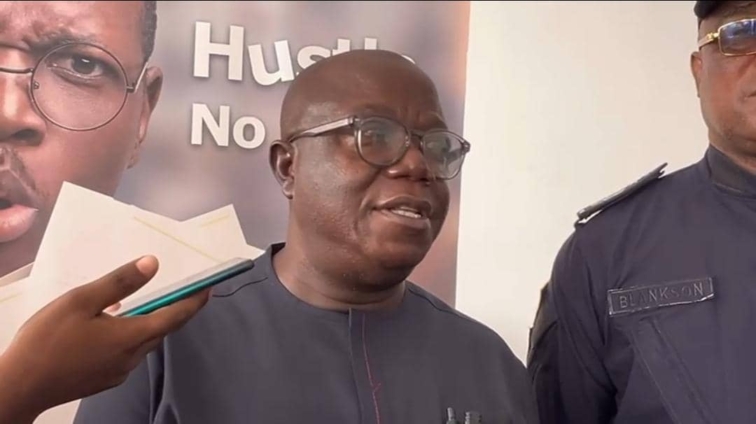

This was disclosed by the Commissioner of Domestic Tax Revenue Division, Edward Gyamerah, on the sidelines of a management retreat in Takoradi in the Western region.

The move which is part of the Authority’s strategy to increase revenue generation in the country is under the voluntary disclosure programme.

According to Mr. Gyamerah, the voluntary disclosure programme will allow residents with income abroad to disclose their earnings without payment of penalty.

He explained that in 2016 when the Income Tax Act 896 was amended, Ghana moved away from the source of jurisdiction to global.

“Over the years, this has been a big challenge where most people are not disclosing this. Now we’ve signed an arrangement with other jurisdictions. Currently, we have 145 countries that are providing us with information on resident Ghanaians having accounts elsewhere”.

“So we’ve gone through a process and come up with how individuals, persons, companies, entities, etc. have this income and have not disclosed to the Ghana Revenue Authority to use this opportunity to provide the source to GRA.

Sanctions

On sanctions to be applied to those found culpable, he said “We have the administrative sanction and we have the judicial sanctions. So for us, we first raise an assessment of you, expecting you to come [and pay up]. If you fail to pay, of course, we have the judicial aspect where we can go to court and let the judiciary help us enforce the collection of the tax”.

“We will use all enforcement procedures to ensure the collections of the tax”, he added.

The retreat was on the theme “Tax, Transparency, and Certainty, the GRA way”.

Latest Stories

-

Retired military personnel to receive long-delayed gratuity arrears this week — GAF

10 minutes -

Black Queens arrive in Dubai ahead of Pink Ladies Cup

22 minutes -

Ghana Police Service warns public against fake traffic violation messages

36 minutes -

Kwadwo Poku recounts two-hour wait at Komfo Anokye Teaching Hospital over emergency care

42 minutes -

GOC backs Ghana Sports Fund as game-changer for sports development

48 minutes -

Sefa and Stonebwoy unite on playful Afrobeat anthem ‘Busy Body’

52 minutes -

Cocoa sector crisis poses a national security threat and danger to Ghana’s economy – IERPP to Government

1 hour -

Today’s Front pages: Wednesday, February 25, 2026

1 hour -

What is wrong with us? When Filth Becomes Our Normal

2 hours -

Dome-Kwabenya MP hands over library to boost learning at community SHS

2 hours -

When the School Bell Rings for Violence: A National Wake-Up Call

2 hours -

Who has ever heard of the Department of Community Development?

3 hours -

Debt, dignity and the cocoa farmer: Separating political noise from structural truth in Ghana’s cocoa crisis

3 hours -

NDC and NPP are parties of the elites – Yaw Nsarkoh laments political drift

3 hours -

Talking 2028 in 2026 – Yaw Nsarkoh blasts NDC and NPP ‘party of the elites’ politics

3 hours