Audio By Carbonatix

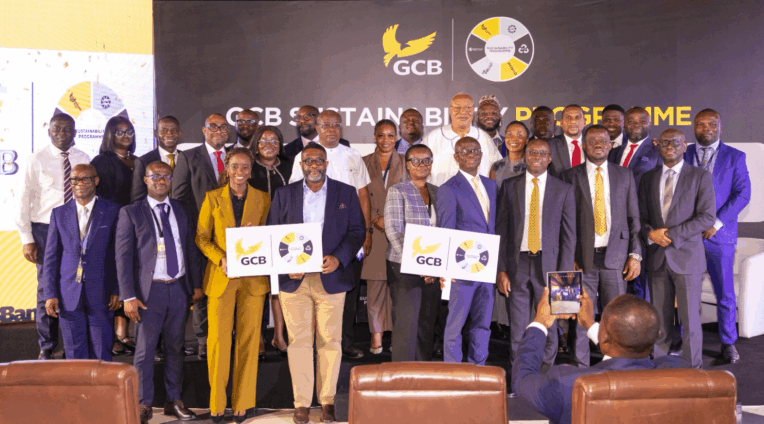

GCB Bank Plc has unveiled a bold, comprehensive sustainability programme that sets a new standard for responsible banking in Ghana.

At the heart of the programme are six flagship initiatives: Sheagles Soar, R³ (Reduce, Reuse & Recycle), i-360, Evolve, and EagleTouch.

Each is crafted to embed social impact, environmental stewardship, and strong governance across the bank’s operations. Together, they position GCB as a leader in sustainable finance.

Launching the programme, Board Chairman Professor Joshua Alabi called it a “blueprint for a sustainable future,” stressing that GCB is forging ahead to lead sustainable banking in Ghana and beyond.

“As the premier bank, we must lead by example. By putting people and planet first in all our operations, we will secure profit in the truest sense: profit that is inclusive, resilient, and beneficial to all stakeholders,” Prof. Alabi said.

Managing Director Farihan Alhassan underscored that sustainability is not an add-on but a cultural shift within GCB.

“Our strategy is anchored in a baseline assessment aligned with national and global commitments, including the Paris Agreement and the UN SDGs.

"Built on three pillars: Environmental Stewardship, Social Responsibility, and Ethical Governance, it reflects the triple bottom line of people, planet, and profit.”

Head of Special Projects and Investor Relations, George Fuachie, added that GCB is determined to lead the charge: “Sustainability is no longer a buzzword. It has become a way of doing business.”

The launch featured a dynamic panel discussion titled “People, Planet, and Profit: Sustainable Operations for Impact and Opportunity.”

It was moderated by Cynthia Ofori-Dwumfuo, Chief Marketing, Communications and Customer Experience Officer of GCB Bank. The panel included GCB Board Member Pamela Addo, SUCCA Africa’s Mark Ofori Kwafo, and GCB’s Head of Credit Risk, Edward Sasu Adofo.

Panellists called for sustainability to be fully integrated into banking operations, highlighting financial inclusion, gender-responsive products, youth banking, and climate-smart agriculture as central to long-term impact.

They cautioned that climate risks pose real threats but also open opportunities in renewable energy, green jobs, and sustainable farming.

Profitability, they stressed, must advance hand in hand with social empowerment and environmental care.

With this programme, GCB Bank takes a decisive step to embed sustainability at its core.

The Bank pledged to invest in innovative solutions, forge transformative partnerships, and keep driving impact that balances people, planet, and profit

Latest Stories

-

NAIMOS has failed in galamsey fight; it’s time for a state of emergency – DYMOG to President Mahama

2 hours -

Mahama to open African Court judicial year in Arusha, mark 20th anniversary

3 hours -

Ghana begins partial evacuation of Tehran Embassy as Middle East tensions escalate

3 hours -

EPA tightens surveillance on industries, moves to cut emissions with real-time monitoring system

3 hours -

Police conduct show of force exercise ahead of Ayawaso East by-election

5 hours -

Ghana launches revised Early Childhood Care and Development Policy to strengthen child development framework

5 hours -

AI to transform 49% of jobs in Africa within three years – PwC Survey

5 hours -

Physicist raises scientific and cost concerns over $35m EPA’s galamsey water cleaning technology

6 hours -

The road to approval: Inside Ghana’s AI strategy and KNUST’s leadership

6 hours -

Infrastructure deficit and power challenges affecting academics at AAMUSTED – SRC President

6 hours -

Former US diplomat sentenced to life for abusing two girls in Burkina Faso

6 hours -

At least 20 killed after military plane carrying banknotes crashes in Bolivia

6 hours -

UK reaffirms investment commitment at study UK Alumni Awards Ghana 2026

7 hours -

NCCE pays courtesy call on 66 Artillery Regiment, deepens stakeholder engagement

7 hours -

GHATOF leadership pays courtesy call on Chief of Staff, Julius Debrah

7 hours