Audio By Carbonatix

A downswing in business activity in Ghana may be softening after a staff-level funding agreement with the International Monetary Fund caused the cedi to rally, easing price pressures that have plagued industry for more than a year.

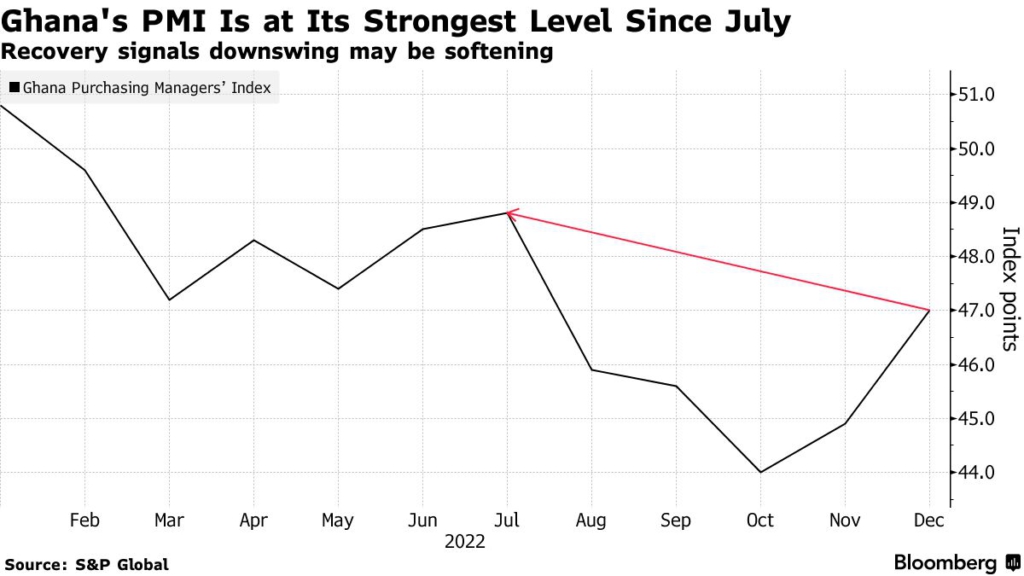

The Purchasing Managers’ Index compiled by S&P Global, which measures the performance of the private sector economy, inched up to 47 in December, from 44.9 in November, but remained below the 50-mark that separates growth from contraction for a 11th straight month.

“Although business conditions remained challenging for companies in Ghana at the end of 2022, there were some tentative signs that the worst of the current downturn may have passed,” Andrew Harker, economics director at S&P Global Market Intelligence, said in a statement.

Optimism among survey participants rose sharply over the month, reaching the highest levels since April 2022, according to the statement. More than 75% of respondents expressed a positive outlook for output over the course of this year, while just 4% were pessimistic.

Ghana approached the IMF in July for help after investor concerns about ballooning government debt — forecast to exceed the size of its economy in 2022 — led to a selloff of government bonds that effectively locked the country out of global capital markets.

Ghana clinched the deal with the IMF for a $3 billion bailout on Dec. 12, a key step in the West African nation’s plans to restructure its debt. That caused the cedi to appreciate 41% against the dollar last month and trimmed its losses for 2022 to 39%, softening inflation and providing some respite for firms in their efforts to secure new business, Harker said.

Annual inflation in November was quintuple the 10% ceiling of the central bank’s target range — the seventh-highest rate in the world among 120 nations, including the eurozone, tracked by Bloomberg. High inflation has sapped consumer spending and crimped economic growth.

S&P Global Market Intelligence forecasts that the economy will expand 3.5% this year, down from 4.6% in 2022.

Latest Stories

-

Barca dominate Levante to claim La Liga top spot

2 hours -

Managing Man Utd the ‘ultimate role’ – Carrick

2 hours -

‘Educate yourself and your kids’ – Fofana and Mejbri racially abused

2 hours -

Vinicius scores but Real Madrid beaten by Osasuna

2 hours -

Arokodare & Mundle latest players to be racially abused

3 hours -

GPL 2025/26: Hohoe United hold Aduana FC in Dormaa

3 hours -

Eze ‘wanted to prove something’ as he torments Spurs again

3 hours -

US ambassador’s Israel comments condemned by Arab and Muslim nations

3 hours -

Man jailed nine months for stealing

3 hours -

Woman found dead at Dzodze, police launch investigation

3 hours -

Group of SHS students allegedly assault night security guard at BESS

3 hours -

Jasikan Circuit Court remands two for conspiracy, trafficking of narcotics

4 hours -

GPL 2025/26: Asante Kotoko beat Young Apostles to go fourth

4 hours -

T-bills auction: Interest rates fell sharply to 6.4%; government exceeds target by 170%

6 hours -

Weak consumption, high unemployment rate pose greater threat to economic recovery – Databank Research

7 hours