A downswing in business activity in Ghana may be softening after a staff-level funding agreement with the International Monetary Fund caused the cedi to rally, easing price pressures that have plagued industry for more than a year.

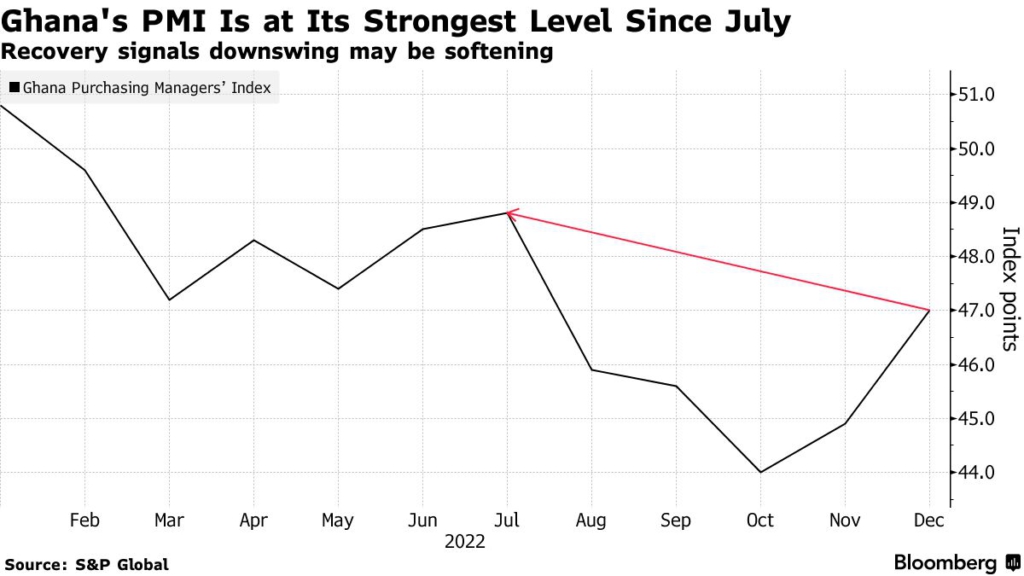

The Purchasing Managers’ Index compiled by S&P Global, which measures the performance of the private sector economy, inched up to 47 in December, from 44.9 in November, but remained below the 50-mark that separates growth from contraction for a 11th straight month.

“Although business conditions remained challenging for companies in Ghana at the end of 2022, there were some tentative signs that the worst of the current downturn may have passed,” Andrew Harker, economics director at S&P Global Market Intelligence, said in a statement.

Optimism among survey participants rose sharply over the month, reaching the highest levels since April 2022, according to the statement. More than 75% of respondents expressed a positive outlook for output over the course of this year, while just 4% were pessimistic.

Ghana approached the IMF in July for help after investor concerns about ballooning government debt — forecast to exceed the size of its economy in 2022 — led to a selloff of government bonds that effectively locked the country out of global capital markets.

Ghana clinched the deal with the IMF for a $3 billion bailout on Dec. 12, a key step in the West African nation’s plans to restructure its debt. That caused the cedi to appreciate 41% against the dollar last month and trimmed its losses for 2022 to 39%, softening inflation and providing some respite for firms in their efforts to secure new business, Harker said.

Annual inflation in November was quintuple the 10% ceiling of the central bank’s target range — the seventh-highest rate in the world among 120 nations, including the eurozone, tracked by Bloomberg. High inflation has sapped consumer spending and crimped economic growth.

S&P Global Market Intelligence forecasts that the economy will expand 3.5% this year, down from 4.6% in 2022.

Latest Stories

-

Paris 2024: Opening ceremony showcases grandiose celebration of French culture and diversity

2 hours -

How decline of Indian vultures led to 500,000 human deaths

3 hours -

Paris 2024: Ghana rocks ‘fabulous fugu’ at olympics opening ceremony

3 hours -

Trust Hospital faces financial strain with rising debt levels – Auditor-General’s report

4 hours -

Electrochem lease: Allocate portions of land to Songor people – Resident demand

4 hours -

82 widows receive financial aid from Chayil Foundation

4 hours -

The silent struggles: Female journalists grapple with Ghana’s high cost of living

4 hours -

BoG yet to make any payment to Service Ghana Auto Group

4 hours -

‘Crushed Young’: The Multimedia Group, JL Properties surprise accident victim’s family with fully-furnished apartment

5 hours -

Asante Kotoko needs structure that would outlive any administration – Opoku Nti

5 hours -

JoyNews exposé on Customs officials demanding bribes airs on July 29

6 hours -

JoyNews Impact Maker Awardee ships first consignment of honey from Kwahu Afram Plains

7 hours -

Joint committee under fire over report on salt mining lease granted Electrochem

7 hours -

Life Lounge with Edem Knight-Tay: Don’t be beaten the third time

7 hours -

Pro-NPP group launched to help ‘Break the 8’

8 hours