Audio By Carbonatix

Ghana is likely to end 2025 with an inflation rate in single digits, below the Bank of Ghana's revised end-2025 target of 12%, Deloitte has predicted in its West Africa Inflation update.

According to the professional services firm, the sustained disinflationary trend gives the Bank of Ghana sufficient headroom to resume its interest rate cuts, which could start at its July MPC meeting.

“An ease in interest rates will encourage more lending to the real sector and support further output and overall economic growth”, it added.

Deloitte continued that the combination of fiscal consolidation and further policy adjustments will ensure a sustained decline in inflation in the second half of the year.

It, however, warned of upside risks including ongoing global shocks and tariff adjustments example, the 2.45% increase in electricity tariffs, resulting in higher production costs and prices of goods and services.

Again, it expressed worry about the implementation of the GH¢1.00 fuel levy on petroleum products, as it described it as another upside risk that could increase fuel and transport costs.

Decline in Inflation Widens Positive Real Return

Ghana’s June 2025 inflation declined to 13.7% from 18.4% in the prior month. This was attributed to lower domestic fuel prices, reduced transport costs, a fall in food prices and the appreciation of the cedi.

The month-on-month inflation moved in tandem with the headline index, recording its first monthly deflation of -1.2% since August 2024.

The food and non-food sub-indices decelerated to 16.3% and 11.4% respectively in the review month.

Deloitte said the further decline in inflation widens the positive real rate of return on investment to 14.3% from 6.2% in June 2024, using the monetary policy rate as a benchmark.

Transport Records Negative Inflation Rate

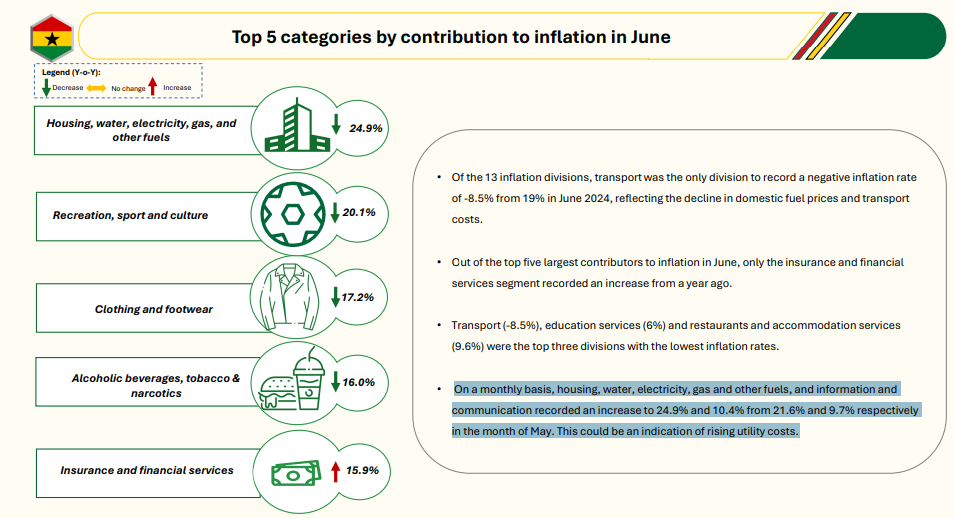

Of the 13 inflation divisions, Transport was the only division to record a negative inflation rate of -8.5% from 19% in June 2024, reflecting the decline in domestic fuel prices and transport costs.

Out of the top five largest contributors to inflation in June, only the insurance and financial services segment recorded an increase from a year ago.

On a monthly basis, housing, water, electricity, gas and other fuels, and information and communication recorded an increase to 24.9% and 10.4% from 21.6% and 9.7% respectively in the month of May. This could be an indication of rising utility costs.

Latest Stories

-

IEA rejects proposed mining royalty reform, calls for full national ownership

3 minutes -

Single digit now! GUTA demands fast-tracked lending rate cuts after BoG policy shift

13 minutes -

Somali woman executed for murdering a child in a case that sparked outrage

15 minutes -

Banknote bouquets could land you in jail – Kenya’s central bank warns

27 minutes -

Ghana Medical Trust Fund engages College of Nurses and Midwives on Specialist Training ahead of April rollout

29 minutes -

Ghanaian young forward Listowell Lord Hinneh joins Middlesbrough

32 minutes -

Developing nations must have stronger voice in global rule-making — Mahama

34 minutes -

Samini confirms February 12 for release of eighth album, ORIGIN8A

36 minutes -

Kpeve maintenance works to temporarily disrupt water supply on Thursday – GWL

38 minutes -

‘We don’t eat gold’ — CFA-Ghana President warns of cocoa farms being destroyed by galamsey

40 minutes -

What is wrong with us? Why wasteful expenditure persists and why a mindset shift is central to solving our economic challenges

52 minutes -

Blue Water Guard initiative achieving results -Lands Minister

56 minutes -

GSFP conducts monitoring exercise in Volta, Bono and Bono East regions

1 hour -

Full text: President Mahama’s speech at World Governments Summit 2026

1 hour -

Africa deserves climate justice, not just climate action – Mahama

1 hour