Audio By Carbonatix

Ghana has increasingly relied on domestic borrowing over the past decade to finance its budget and manage debt pressures, mirroring a broader trend across low income countries, according to the International Debt Report 2025.

The report shows that public domestic debt has risen steadily in countries classified under the Low Income Country Debt Sustainability Framework, as governments seek to meet growing financing needs while reducing exposure to foreign exchange risks. Ghana is cited as one of the frontier economies that successfully deepened its domestic debt market during this period.

Between 2014 and 2024, public domestic debt in low income countries more than doubled relative to the size of their economies. On average, domestic debt rose from 8 percent of gross domestic product to 17 percent. Nearly half of this increase occurred before the coronavirus pandemic, reflecting structural financing pressures rather than temporary shocks.

The World Bank noted that domestic borrowing has helped countries like Ghana manage widening fiscal deficits at a time of slow revenue growth and rising development needs.

“Expanding domestic debt markets has allowed governments to finance critical spending while reducing their exposure to exchange rate volatility,” the World Bank said in the report.

For Ghana, the development of the local bond market has been a key feature of this shift. The report highlights Ghana as one of a few low income frontier countries that were able to issue local currency bonds with maturities longer than 15 years. This marked an important step in extending debt maturities and reducing refinancing pressure.

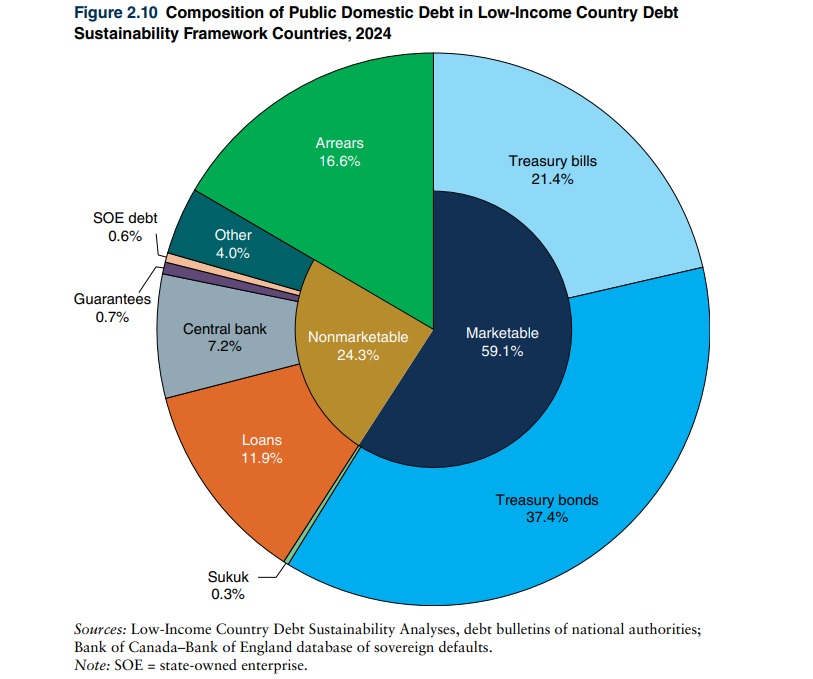

The structure of domestic debt across low income countries is increasingly dominated by marketable instruments such as treasury bills and treasury bonds. By the end of 2024, about 59 percent of domestic debt was issued in marketable securities. Loans and central bank financing accounted for 24 percent, while arrears made up the remaining 17 percent.

Ghana’s experience reflects this broader pattern, with a growing share of government borrowing raised through the domestic market. The World Bank observed that this shift has also supported improvements in debt transparency in some countries.

However, the report cautions that rising domestic debt comes with new risks. While most of the existing domestic debt stock in 2024 was medium to long term, borrowing patterns began to change in 2025. New issuance increasingly shifted toward short term instruments.

According to the report, 41 percent of new domestic debt issued in 2025 was at short maturities, including financing from central banks. This trend increases refinancing and interest rate risks, especially in countries with limited fiscal space.

“The increased reliance on domestic debt has reduced exchange rate risks, but it has also heightened refinancing and interest rate pressures,” the World Bank said.

The report added that the typical maturity of new longer term domestic debt in low income countries is now about four and a half years. For frontier economies such as Ghana, it is slightly longer at around five years, but still shorter than what is needed for long term development financing.

The World Bank said it will continue to support countries, including Ghana, to strengthen domestic debt markets with greater focus on capital market development and risk management.

As Ghana works to stabilise its economy and restore confidence, the report underscores the need for careful monitoring of domestic debt growth. While local borrowing has provided relief from foreign currency risks, managing maturity profiles and interest costs will remain critical to safeguarding long term debt sustainability.

Latest Stories

-

Woman found dead at Dzodze

2 hours -

Bridging Blight and Opportunity: Mark Tettey Ayumu’s role in Baltimore’s vacant property revival and workforce innovation

2 hours -

Court blocks Blue Gold move as investors fight alleged plot to strip shareholder rights

2 hours -

Nana Aba Anamoah rates Mahama’s performance

3 hours -

Ghana selects Bryant University as World Cup base camp

3 hours -

Nana Aba Anamoah names Doreen Andoh and Kwasi Twum as her dream interviewees

4 hours -

Religious Affairs Minister urges Christians to embrace charity and humility as Lent begins

5 hours -

Religious Affairs Minister calls for unity as Ramadan begins

5 hours -

Willie Colón, trombonist who pioneered salsa music, dies aged 75

6 hours -

Ga Mantse discharged from UGMC following Oti Region accident

6 hours -

Guardiola tells team to chill with cocktails as Man City pile pressure on Arsenal

6 hours -

Majority blasts Minority over Burkinabe border bloodbath claims

7 hours -

Analyst says Burkina Faso killings were a calculated signal to Ghana

8 hours -

Veep extends Ramadan greetings, donates to Cape Coast Central Mosque

9 hours -

Watch the moment President Mahama visited the Ga Mantse at UGMC after horrific accident

9 hours