Audio By Carbonatix

The Government of Ghana has formalized a crucial debt treatment agreement with its Official Creditors Committee (OCC) by signing a Memorandum of Understanding (MoU), a significant step towards restoring long-term debt sustainability.

The agreement, co-chaired by China and France, was disclosed in a statement from the Ministry of Finance dated January 29, 2025.

This milestone comes after Ghana, in December 2022, suspended portions of its external debt servicing to commercial and bilateral lenders amid a deep economic crisis.

At the time, inflation had soared to a staggering 54%, while international reserves had plunged to less than two months of import cover. The nation embarked on a comprehensive debt restructuring journey, including the successful completion of its Domestic Debt Exchange Programme (DDEP) in 2023.

A year ago, on January 12, 2024, Ghana reached an agreement with its Official Creditors under the G20 Common Framework for Debt Treatments, going beyond the Debt Service Suspension Initiative (DSSI).

However, it has taken another year to finalize and formalize the terms through the MoU.

“With the MoU now signed, the agreed terms will be implemented through bilateral agreements with each OCC member,” the Finance Ministry’s statement confirmed.

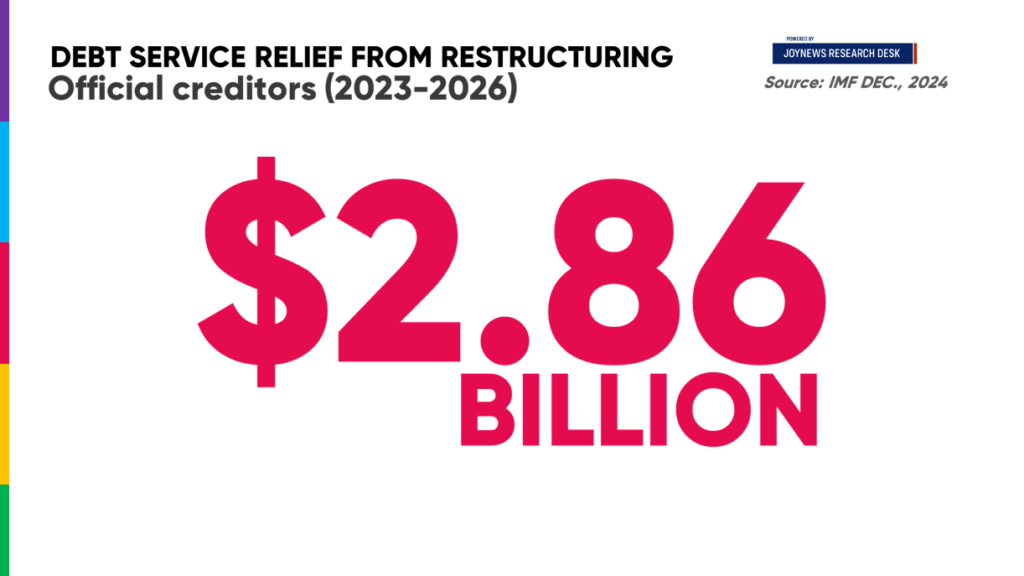

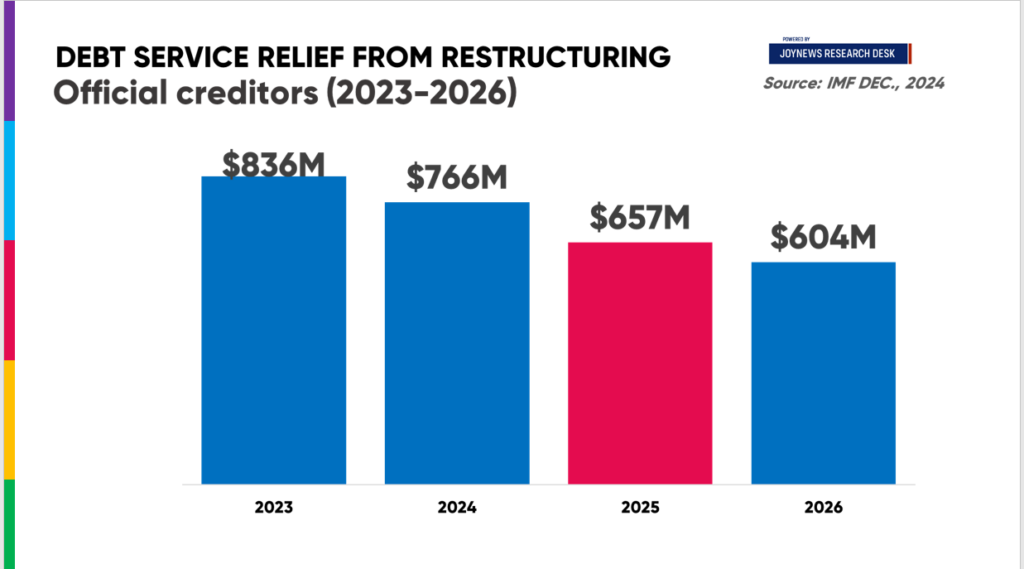

According to the International Monetary Fund’s December 2024 report, Ghana is set to benefit from a substantial debt servicing relief of approximately $2.86 billion.

Of this amount, an estimated $657 million is expected to be realized within 2025, providing much-needed fiscal space for economic recovery.

A breakdown of the debt relief figures shows that Ghana has already benefited from $1.6 billion (2023 and 2024) and is set to receive an additional $1.26 billion. Of this amount, $657 million is expected to be disbursed this year, while the remaining $604 million will be released in 2026 when the bilateral moratorium expires.

About the writer:

Isaac Kofi Agyei is the Lead Data & Research Analyst/Journalist at JoyNews based in Accra, where he covers mostly finance, economics, banking, and politics across Ghana and West Africa, from detailed analytical reports on all key issues to debt crises to IMF programmes. He also serves as the data and research correspondent for SBM Intelligence, an Africa-focused market/security leader in strategic research, providing actionable analyses of West Africa’s socio-political and economic landscape. With his solid academic background in economics and statistics and additional training from credible institutions such as the UNDP, Afrobarometr, Ghana Statistical Service, and a host of others, Isaac has honed his skills in effective data storytelling, reporting, and analysis.

Latest Stories

-

OpenAI changes deal with US military after backlash

39 minutes -

Mexican drug lord ‘El Mencho’ buried in golden coffin

49 minutes -

Building gold reserves, losing hospitals? – Finance professor flags 1% GDP cost

1 hour -

My mother’s prophecy fulfilled – Baba Jamal as he heads back to Parliament

4 hours -

Trump ‘does not care’ if Iran play at World Cup

4 hours -

Burna Boy’s associate, Rahman Jago confirms singer converted to Islam

4 hours -

Amazon says drones damaged three facilities in UAE and Bahrain

5 hours -

NDC’s Baba Jamal wins Ayawaso East by-election

5 hours -

Integrity over individuals: Economic Fighters League maintains vote-buying stance in Ayawaso East

5 hours -

How to follow European football

5 hours -

A new dawn: Formula One charges into an unpredictable 2026

5 hours -

Trump threatens to halt trade with Spain over military base access

6 hours -

Trump says US Navy will protect ships in Middle East ‘if necessary’

6 hours -

Ghana shines in GSMA DNSI and DPRI 2025 report due to E-Levy repeal and tech neutrality

7 hours -

NJA College of Education inducts 379 students amidst infrastructure gains and calls for professional discipline

7 hours