Audio By Carbonatix

Fitch Solutions has maintained that Ghana will reach a staff-level agreement with the International Monetary Fund (IMF) by the first quarter of 2023.

This will mean that the country could secure a programme from the Fund by the end of quarter 1, 2023 or the second quarter of 2023.

Some economists and experts were anticipating that the country could reach a staff-level agreement with the Fund before the end of 2022 to pave way for a programme by the first quarter of 2023.

But in its latest paper on “Division within Ghana's Ruling Party to Weigh on Political Stability”, the international research firm also said should the Finance Minister, Ken Ofori-Atta, be replaced, negotiations with the IMF would likely remain largely unaffected.

“While Ofori-Atta remained opposed to an IMF bailout – we believe that he would take a more accommodative approach towards negotiations with the Fund. As such, we believe that a change of finance minister would most likely not impact the timeline of IMF negations and we would retain our view that a staff-level agreement will be reached in Q123 [quarter 1, 2023]”, it explained.

Government to face additional pressure from frequent protests

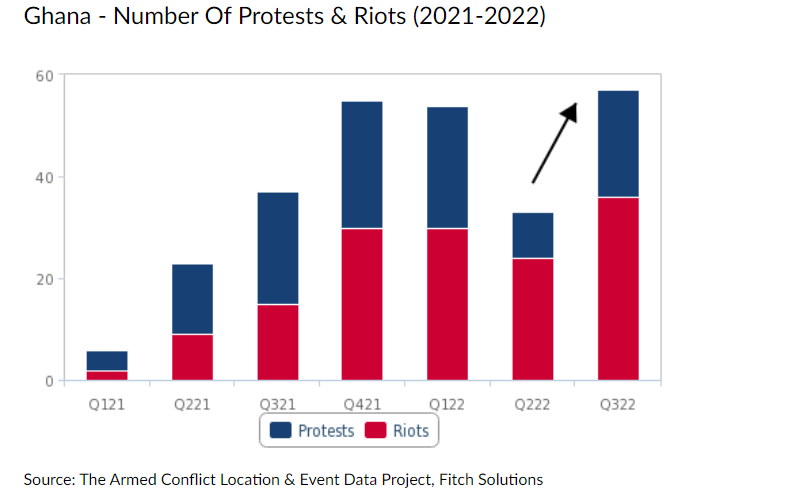

Furthermore, it said the government will face additional pressure from more frequent protests and industrial action.

“Worsening living standards amid rising consumer prices – inflation reached 40.4% year-on-year in October 2022, the highest reading since 2001 – and tighter monetary conditions have led to a 72.7% quarter-on-quarter increase in protests and riots across in quarter 3 2022. The country has also seen large industrial action in recent months, including a three-day retail strike in Accra in October [2022]".

Inflation to remain elevated, weighing on living standards

Fitch Solutions also expects inflation to remain elevated in the months ahead.

“Given that inflation is primarily driven by currency weakness, we expect price growth to remain elevated in the months ahead. Indeed, significant capital and financial account outflows caused by weakening investor sentiment will continue to weigh on the currency”.

“Our view is further informed by the fact that previous periods of significant exchange rate weakness in Ghana all lasted roughly 12-14 months, suggesting that the cedi will continue to depreciate into quarter 1, 2023 (the current sell-off started in January 2022). This will keep inflation high, weighing on living standards and eroding support for the government”.

Latest Stories

-

Black Queens players stranded in UAE over Israel-Iran conflict

33 minutes -

James Owusu declares bid for NPP–USA chairman, pledges renewal and unity

57 minutes -

Trump threatens strong force if Iran continues to retaliate

1 hour -

Lekzy DeComic gears up for Easter comedy special ‘A Fool in April’

3 hours -

Iran declares 40 days of national mourning after Ayatollah Ali Khamenei’s death

3 hours -

Family of Maamobi shooting victim makes desperate plea for Presidential intervention

4 hours -

Middle East turmoil threatens to derail Ghana’s single-digit gains

5 hours -

Free-scoring Semenyo takes burden off Haaland

5 hours -

Explainer: Why did the US attack Iran?

6 hours -

Peaky Blinders to The Bride!: 10 of the best films to watch in March

7 hours -

Crude oil price crosses $91 as Strait of Hormuz blockade chokes 22% of global supply

7 hours -

Dr. Hilla Limann Technical University records 17% admission surge; launches region’s first cosmetology laboratory

8 hours -

Over 50 students hospitalised after horror crash ends sports tournament

8 hours -

Accra–Dubai flights cancelled as Middle East tensions deepen

9 hours -

See the areas that will be affected by ECG’s planned maintenance from March 1-5

9 hours