Audio By Carbonatix

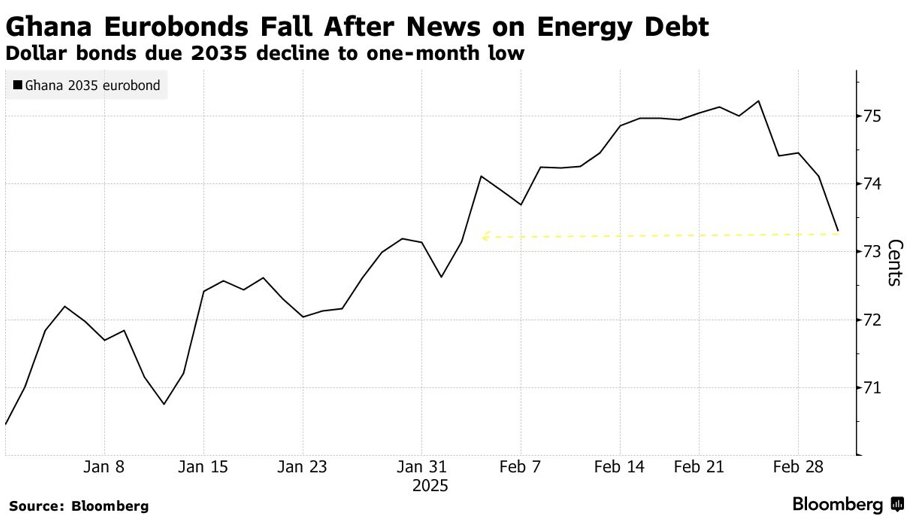

Ghana’s Eurobonds fell sharply on Tuesday, 4th March 2025 ranking among the worst-performing assets in emerging markets.

This followed Finance Minister Cassiel Ato Forson’s warning during the national economic dialogue in Accra, on Monday, 3rd March 2025 that the country’s energy sector debt could double to $9 billion by 2027 without urgent intervention.

When the cedi depreciates, Ghana’s debt burden increases, making repayments more expensive. Investor confidence in Ghana’s Eurobonds fluctuates based on economic stability, fiscal policies, and debt management strategies.

According to Bloomberg data, Ghana’s dollar bonds maturing in 2035 dropped by 1.1% to 73.3 cents on the dollar, reaching their lowest level in a month, while securities due in 2030 fell by 0.9% to 77.83 cents.

The Electricity Company of Ghana (ECG) has been a major contributor to the rising energy debt, Forson explained, as it can only account for 62% of the electricity it purchases due to distribution and collection inefficiencies. He also attributed the crisis to low electricity tariffs and lack of competition in power generation.

Despite restructuring most of its 737 billion cedis ($47.5 billion) public debt in October—including Eurobonds—Ghana remains in negotiations with 60 international banks to restructure $2.7 billion in loans. President Mahama has pledged to curb government spending, refine the IMF’s $3 billion programme, and rebuild investor confidence in Ghana.

Energy Minister John Abdulai Jinapor has indicated that the government will explore private sector participation in energy distribution and revenue collection. Within six months, a decision will be made on whether to pursue full privatisation or a concession model, where a private entity would manage operations for a fixed period before handing control back to the state.

Latest Stories

-

GPL 2025/26: Abaidoo strikes late to earn Chelsea a point against Young Apostles

2 minutes -

Mid-March hearing expected after Ofori-Atta bond case stalls

15 minutes -

Legend of the week – Daddy Lumba

22 minutes -

No hearing took place on February 19 — Ofori-Atta’s lawyers clarify

30 minutes -

GPL 2025/26: Hohoe United defeat Samartex to move closer to safety

41 minutes -

GPL 2025/26: Asante Kotoko held by 10-man Vision FC

44 minutes -

Today’s Front pages: Monday, March 2, 2026

50 minutes -

Africa’s Energy sovereignty is being tested in the Strait of Hormuz

58 minutes -

TikToker “Duabo King” arrested for spreading false claims about Kumasi police officers

1 hour -

Senyo Amekplenu pledges seed funds to re-energize TESCON in Volta Region ahead of 2028

1 hour -

Paediatric Society of Ghana warns galamsey threatens children’s brain development

1 hour -

Volta Regional Minister reaffirms government’s commitment to promote quality education

1 hour -

Goldfields optimistic about Tarkwa lease renewal, confirms Damang exit

1 hour -

NPA raises fuel price floor for March 1 window; petrol now GH¢10.46, diesel GH¢11.42

2 hours -

UCC to honour Veep Prof. Jane Opoku-Agyemang with Distinguished Fellow Award

2 hours