Audio By Carbonatix

In a historic reversal of a 30-year trend, the Ghana cedi has concluded the 2025 fiscal year with a performance that has stunned global economists and local traders alike.

Breaking a cycle of annual decline that had persisted since the early 1990s, the local currency capitalised on a surge in bullion prices and a retreating U.S. dollar to reclaim its seat as a heavyweight in the foreign exchange market.

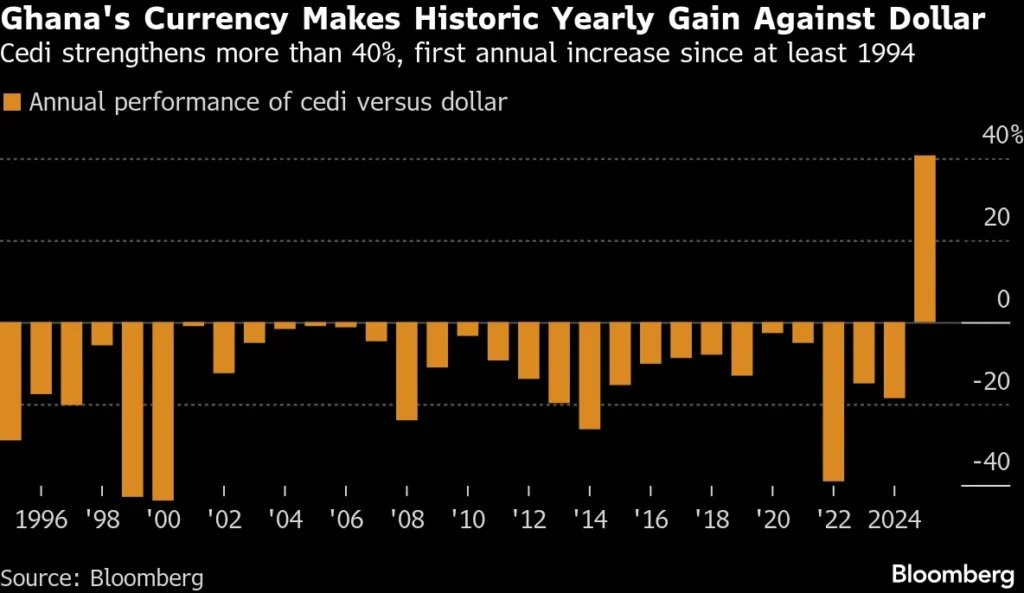

According to year-end market data, the cedi posted a remarkable 41% appreciation against the greenback over the past twelve months, according to Bloomberg.

This surge represents the currency’s first annual gain since at least 1994—the year Bloomberg first began compiling comprehensive exchange data for the country—marking a definitive end to three decades of consistent depreciation.

Defying Thirty Years of Gravity

Since the mid-90s, the cedi has been synonymous with vulnerability, often ranking among Africa's most volatile currencies.

However, 2025 became the year the pacesetter spirit of the nation translated into fiscal resilience.

The cedi's rally was not merely a local victory but a global phenomenon.

In a year defined by volatile emerging market trends, the cedi emerged as the best performer among 144 currencies tracked by Bloomberg, surpassed only by the Russian ruble.

The ‘Golden’ Catalysts of 2025

Analysts attribute this unprecedented gain to a perfect storm of favourable conditions:

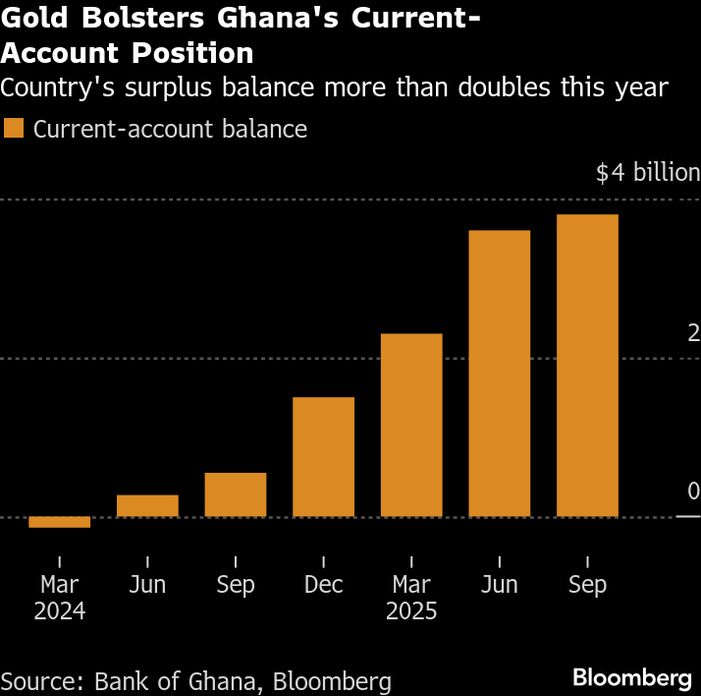

- The Gold Boom: As Africa’s largest producer of the precious metal, Ghana benefited immensely from historic highs in global gold prices, which touched record peaks throughout the year.

- Dollar Vulnerability: The Bloomberg Dollar Index is currently headed for its worst decline since 2017, as shifts in global trade and U.S. monetary policy cooled the greenback’s long-standing dominance.

- Domestic Resilience: Strategic interventions by the Bank of Ghana, including the "Gold for Oil" and "Gold for Reserves" programmes, helped stabilise foreign exchange supply at critical intervals.

Impact on the "Ground": A Mixed Paradox

While the macroeconomic data paints a picture of triumph, the impact on everyday Ghanaians remains a topic of intense debate.

The 41% climb has begun to stabilise the prices of imported essentials like fuel and electronics, but many households are still navigating the price stickiness of retail goods.

| Metric | Historical Trend (1994–2024) | 2025 Performance | Economic Impact |

| Annual Movement | Consistent Depreciation | +41% Appreciation | Reduced Debt Service Costs |

| Global Ranking | Frequently Bottom-Tier | 2nd Globally | Boosted Investor Confidence |

| Inflation Link | Major Driver of Inflation | Stabilizing Force | Easing Import Costs |

Sustainability: A New Chapter or a "Nine-Day Wonder"?

The Finance Ministry has been quick to assure stakeholders that this appreciation is "not a nine-day wonder" but the result of deliberate policy.

With the next major debt restructuring payments due in mid-2026, the current strength of the cedi provides a crucial buffer for the nation's treasury.

As the first sun of 2026 rises, the narrative of the cedi has officially changed. For the first time in an entire generation, the local currency hasn’t just survived the year; it has conquered it.

Latest Stories

-

Securing children’s tomorrow today: Ghana launches revised ECCD policy

1 hour -

Protestors picket Interior Ministry, demand crackdown on galamsey networks

1 hour -

Labour Minister highlights Zoomlion’s role in gov’t’s 24-hour economy drive

1 hour -

Interior Minister receives Gbenyiri Mediation report to resolve Lobi-Gonja conflict

2 hours -

GTA, UNESCO deepen ties to leverage culture and AI for tourism growth

2 hours -

ECG completes construction of 8 high-tension towers following pylon theft in 2024

2 hours -

Newsfile to discuss 2026 SONA and present reality this Saturday

3 hours -

Dr Hilla Limann Technical University records 17% admission surge

3 hours -

Meetings Africa 2026 closes on a high, Celebrating 20 years of purposeful African connections

3 hours -

Fuel prices to increase marginally from March 1, driven by crude price surge

3 hours -

Drum artiste Aduberks holds maiden concert in Ghana

3 hours -

UCC to honour Vice President with distinguished fellow award

4 hours -

Full text: Mahama’s State of the Nation Address

4 hours -

Accra Mayor halts Makola No. 2 rent increment pending negotiations with facility managers

4 hours -

SoulGroup Spirit Sound drops Ghana medley to honour gospel legends

4 hours