The government has revised the country’s overall fiscal deficit target in 2022 to 6.6% of Gross Domestic Product (GDP), from the earlier 7.4%.

This is due to cuts in expenditure and expected improvement in revenue for the rest of the year.

Again, the government has revised the primary surplus target to 0.4% of GDP, up from a surplus of 0.1% of GDP.

Government in March 2022 announced the implementation of the 30% discretionary expenditure cuts and other expenditure measures.

Some expenditure measures were the moratorium on foreign travels except pre-approved critical and/or statutory travels, 50% cut in fuel coupon allocations for all political appointees and heads of government institutions, including State Owned Enterprises, effective April 1st, 2022.

The government also recently approved 15% Cost of Living Allowance (COLA) to all public servants.

Accordingly, total Revenue and Grants have now been revised to ¢96.84 billion (16.4% of GDP) in 2022, from the 2022 Budget target of ¢100.51 billion (20.0% of GDP). This represented 3.7% reduction.

Total Expenditure including payments for the clearance of arrears has also been revised downward to ¢135.74 billion (22.9% of GDP), from the original budget projection of ¢137.52 billion (27.4% of GDP).

Interest Payments have however been revised upwards from ¢37.44 billion (7.5% of GDP) to ¢41.36 billion (7.0% of revised GDP). This is mainly on account of inflationary pressures and exchange rate depreciation resulting in a higher cost of financing.

The revisions in government’s fiscal operations results in a fiscal deficit (on cash basis) of ¢38.900 billion (6.6% of revised GDP), up from the 2022 Budget deficit target of ¢37.012 billion (7.4% of GDP).

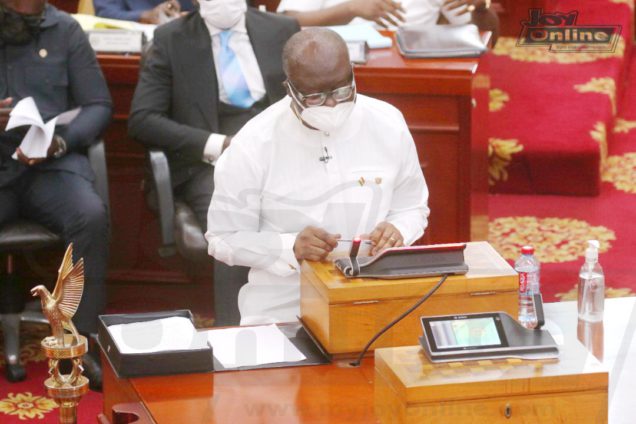

Finance Minister, Ken Ofori-Atta said although the deficit is expected to be financed from both foreign and domestic sources, domestic financing will be the key driver while Government works to regain external market access.

Latest Stories

-

Paris 2024: Opening ceremony showcases grandiose celebration of French culture and diversity

3 hours -

How decline of Indian vultures led to 500,000 human deaths

4 hours -

Paris 2024: Ghana rocks ‘fabulous fugu’ at olympics opening ceremony

4 hours -

Trust Hospital faces financial strain with rising debt levels – Auditor-General’s report

5 hours -

Electrochem lease: Allocate portions of land to Songor people – Resident demand

5 hours -

82 widows receive financial aid from Chayil Foundation

5 hours -

The silent struggles: Female journalists grapple with Ghana’s high cost of living

5 hours -

BoG yet to make any payment to Service Ghana Auto Group

5 hours -

‘Crushed Young’: The Multimedia Group, JL Properties surprise accident victim’s family with fully-furnished apartment

6 hours -

Asante Kotoko needs structure that would outlive any administration – Opoku Nti

6 hours -

JoyNews exposé on Customs officials demanding bribes airs on July 29

7 hours -

JoyNews Impact Maker Awardee ships first consignment of honey from Kwahu Afram Plains

8 hours -

Joint committee under fire over report on salt mining lease granted Electrochem

8 hours -

Life Lounge with Edem Knight-Tay: Don’t be beaten the third time

8 hours -

Pro-NPP group launched to help ‘Break the 8’

8 hours