The Ghana Government saved ¢220 million from the significant fall in Treasury bills yields.

According to the Executive Director of Dalex Finance, Joe Jackson, the interest rates on the Treasury bills will even drop further in the coming weeks.

The government on Tuesday, March 7, 2023, beat the cost of its Treasury bills down significantly, securing ¢6.15 billion from the auction, about 121.6% oversubscription.

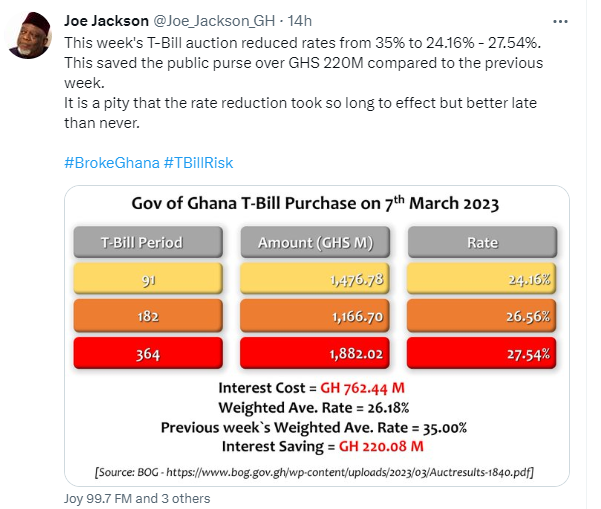

According to results from the Bank of Ghana, the government reduced the pricing of the short term instruments from 35% to a yield of 24.16% for the 91-day T-bills.

However, that of the 182-day and 364-day bills were sold at 26.55% and 27.54% respectively.

In a tweet, Mr. Jackson said it is a pity that the rate reduction took so long to effect but better late than never.

“This T-Bill auction reduced rates from 35% to 24.16% - 27.54%. This saved the public purse over ¢220 million compared to the previous week”

“It is a pity that the rate reduction took so long to effect but better late than never”, he added.

The interest cost for the March 7, 2023 T-bills auction was ¢762.4 million, as the Weighted Average Rate was 26.18%”.

The government on Friday, March 3, 2023, rejected all the bids for the short term securities, after raising concerns about the increasing debt service burden at the current rates. The rates were hovering around 35%.

It therefore reopened the tender for the auction on March 7, 2023.

Latest Stories

-

I’ll win TGMA Artiste of the Year at the right time – Kofi Kinaata

9 mins -

Meet Fred Amugi’s 100-year-old mother

25 mins -

Brazil great Marta to retire from international duty

1 hour -

Otto Addo was forced to accept Black Stars coaching job – Mohammed Polo

1 hour -

Karim Zito qualified to be Black Stars head coach – Mohammed Polo

1 hour -

Platinum Cup makes return on April 27

1 hour -

MoE is not changing uniforms or re-painting all public schools – Kwasi Kwarteng clarifies

2 hours -

16th Africa Aquatics Swimming Championships: Nubia and Harry to represent Ghana in Angola

2 hours -

Four defendants in NDA case by OSP open defence today

2 hours -

GFA commissions first set of floodlights at Ghanaman Soccer Centre of Excellence

2 hours -

Basic public school uniform change an initiative, not a policy – Kwasi Kwarteng

2 hours -

Bawumia appeals for peace in Gonjaland, donates GHȼ100K, bull

2 hours -

Drake: AI Tupac track gone from rapper’s Instagram after legal row

2 hours -

Repainting schools, changing uniforms a misplaced priority – Joy FM listeners on rebranding of basic public schools

3 hours -

UEFA U-16 Tournament: Black Starlets bounce back with 5-1 win over Serbia

3 hours