Government has announced that it will invest $500 million as seed capital into the Ghana Financial Stability Fund (GFSF) expected to take off before the end of October 2023.

This was captured in the Operational Document of the Ghana Financial Stability Fund released by Finance Ministry on October 9, 2023.

According to the Finance Ministry, the government will provide financing support to the Fund in line with the resources envisaged by the Extended Credit Facility (ECF) macro-framework baseline, and intends to deploy these resources in phases to address the recapitalization efforts of the financial sector.

How will the GFSF be financed?

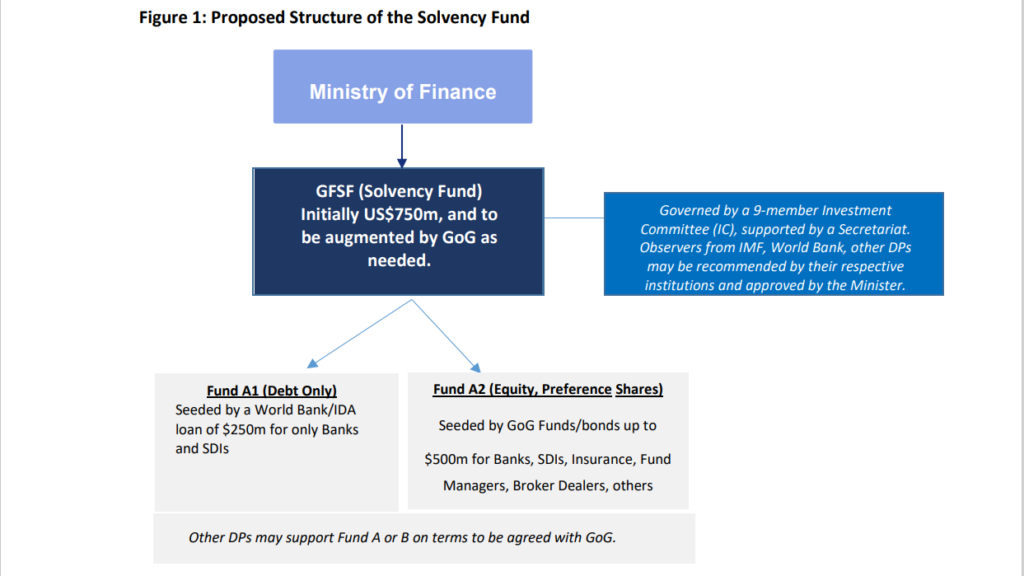

The Finance Ministry has disclosed that the government will commit the cedi equivalent of $750 million to the first phase funding of the GFSF, which will be funded as follows: $250m concessional loan from the World Bank/IDA and $500 million from government - from cash and marketable bonds to support the rebuilding of capital buffers for the financial sector following the impact of the government debt operation.

The Government of Ghana Bond will also tap into the issuance of one of the longest-dated new benchmark bond series issued under the Domestic Debt Exchange Programme (DDEP).

Government is also expected to provide the necessary fiscal backstop in helping preserve the stability of the financial system.

The Ministry of Finance will address any cash flow gaps in close consultation with the IMF, given tight financing conditions in the domestic market.

Governance Structure of Fund

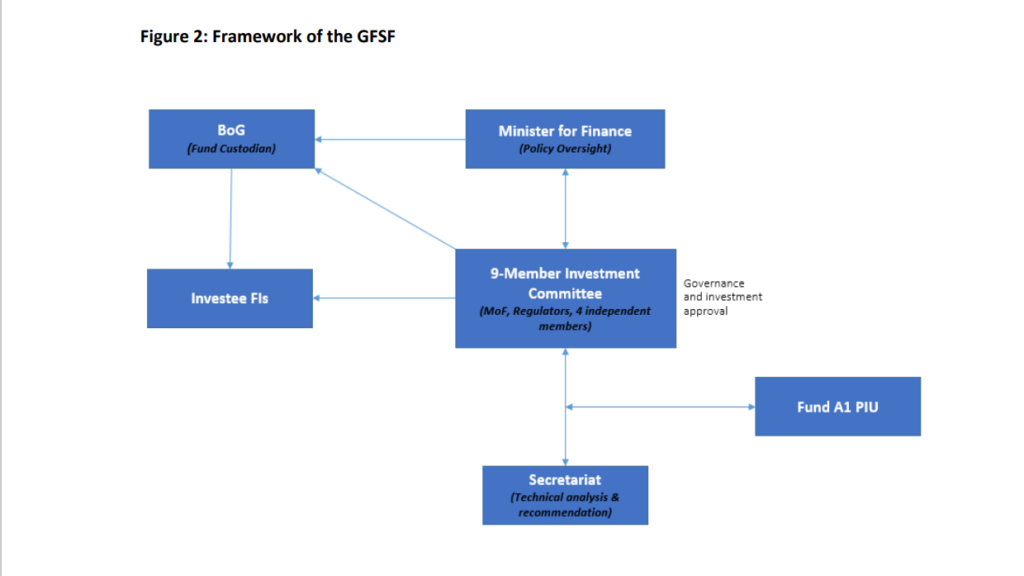

To ensure effective governance of the GFSF: a. the Fund will be governed by a nine member Investment Committee (IC), with four independent experts recommended by industry associations and approved by the Ministry of Finance.

b. Development Partners may recommend observers to the committee subject to the approval of the Minister for Finance. Other DPs may support Fund A or B on terms to be agreed with GoG.

Fund A2 (Equity, Preference Shares) Seeded by GoG Funds/bonds up to $500m for Banks, SDIs, Insurance, Fund Managers, Broker Dealers, others Fund A1 (Debt Only) Seeded by a World Bank/IDA loan of $250m for only Banks and SDIs Ministry of Finance confidential.

The Bank of Ghana and other relevant Regulators will approve recapitalization plans, instruments, and criteria for their respective financial institutions. Based on these, the IC will take investment decisions regarding eligible financial institutions.

The Ghana Amalgamated Trust Fund (GAT) will serve as the Secretariat for Solvency Fund A2 and will set up a ring-fenced operational framework for managing the Fund. e. Fund A1 will have a project unit at Ministry of Finance as pertains to World Bank funded projects.

According to the Finance Ministry, government will also stand ready to do all it takes within the resource envelope to preserve the stability of the financial system. The Ministry of Finance (MoF) will work with the IMF to address any cash flow gaps, especially in light of the tight financing conditions in the domestic market

Institutions that the Ghana Stabilization Fund will support

A. Banks

B. Special deposit-taking institutions (SDIs) and Rural and Community Banks (RCBs)

C. Insurance companies, d. fund managers, collective investment schemes and broker-dealers

What is the Ghana Stabilization Fund?

The Ghana Financial Sector Strengthening Strategy serves as the blueprint for the establishment of the Ghana Financial Stability Fund (the “Fund”) which seeks to mitigate the potential impact the DDEP may have on the financial institutions (Banks, SDIs, Insurance, and the Capital Market). Parallel to this strategy is the development of the Insurance Sector Strengthening Strategy (ISSS) which is a sub-strategy to be implemented with the assistance of AfDB by 2024.

According to government, the allocating budgetary resources for the establishment of the Ghana Financial Stability Fund (GFSF) is to minimize the adjustment burden on the financial sector, particularly, banks, and insurance companies over the medium-term, and to avoid any systemic financial crisis.

The Ghana Financial Stability Fund (GFSF) is being established by GoG as an additional safety net provider to help mitigate the potential impact of the GoG debt operations on the financial sector.

What is in the Operational Framework for the Stability Fund

This document, the operational framework of the GFSF, sets out in detail the setup of the fund including the sources of funding, PFIs eligibility criteria for accessing the fund, the terms and conditions, and governance arrangements of the fund

Conditions for Funding Banks and other financial institutions

The operational document shows that Funding for the solvency support will be structured on commercial terms as would be offered to a private investor, and shall not be bailouts. In some instances, concessionary commercial rates may be considered with improved governance structures.

The GFSF will provide solvency support to eligible financial institutions (FIs). The design of the GFSF, including its target size, duration, sources of funding, access conditions, and governance arrangements, will help to avoid moral hazard and provide incentives for orderly unwinding and market-based solutions in the long-term.

Funding for the solvency support will be structured on commercial terms as would be offered to a private investor, and shall not be bailouts. In some instances, concessionary commercial rates may be considered with improved governance structures.

Generally, the sources of recapitalization by banks and other FIs over the next three years will be the following, in the order of priority:

a. recapitalisation by existing shareholders in line with the capital rules of the respective regulators.

b. injection of new equity capital by new investors accepted by existing shareholders and certified as fit and proper by the respective regulators.

c. support from government for eligible FIs that meet agreed prescribed criteria for accessing solvency support from the GFSF.

Latest Stories

-

African Development Council establishes mission in Benin for Francophone countries

2 mins -

Okyeame Kwame reveals his secret to longevity in music industry

6 mins -

Youthful-looking 60-year-old woman qualifies for Miss Argentina contest

10 mins -

Ejisu By-Election: Campaign heats up as NPP holds final rally ahead of Polls on Tuesday

13 mins -

Rwanda plan: Irish government wants to send asylum seekers back to UK

32 mins -

Ice cubes now cost more than bread and milk in parts of Mali

2 hours -

Titanic gold pocket watch sells for £900,000

3 hours -

Elon Musk in China to discuss enabling full self driving – reports

3 hours -

Foreign Affairs Ministry advises against travelling to Northern Mali

3 hours -

After dating him for three years, I proposed to my husband

3 hours -

Beatrice ‘Bee’ Arthur tackles plastic pollution through artistic exploration

4 hours -

Hundreds turn out for Luv FM/Telecel Fitness Walk in Kumasi

4 hours -

Ghana Post launches Asantehene Commemorative Stamp

4 hours -

Police fire tear gas to disperse Benin wage protest

4 hours -

Airline keeps mistaking 101-year-old woman for baby

4 hours