Audio By Carbonatix

The Government of Ghana would require between US$600.0 million and US$800.0 million for external debt service in 2024.

Out of this, an estimated US$477.0 million would be used for Eurobond debt service.

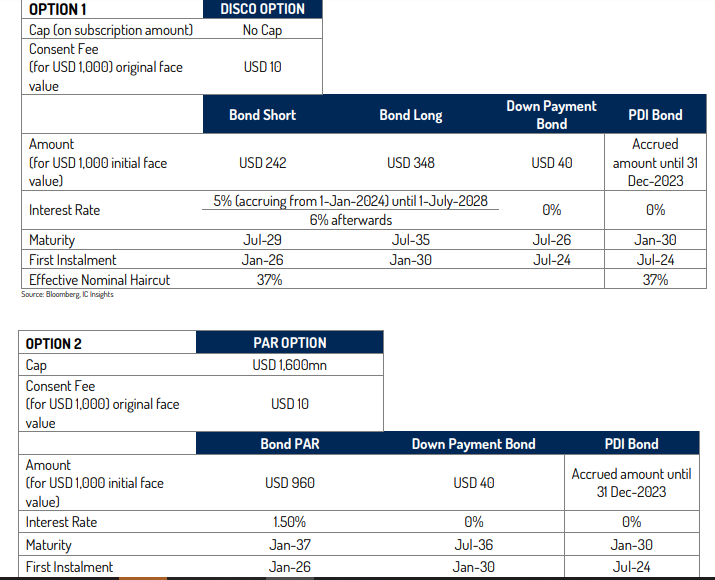

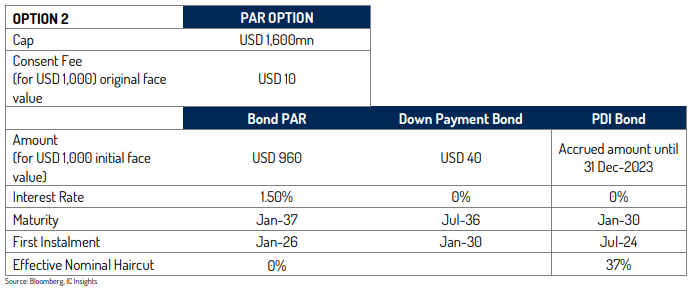

According to IC Africa Research, the estimated cash flow on the restructured Eurobonds envisages the resumption of debt service on the restructured Eurobonds from July 2024.

“Accounting for the ongoing multilateral debt service (given that these debts were outside the perimeter of debt restructuring), we think the authorities would require between US$600.0 million – US$800.0 million for external debt service in 2024. These estimates exclude the US$1.6 billionn legacy arrears owed to the Independent Power Producers, out of which only US$400.0 million has been paid, and other commercial creditors”.

“Extending the outlook, the cash flow forecast shows intensified debt service obligation from 2026 – 2030, from peak US$1.4bn to US$1.1 billion on the Eurobonds alone”, it added.

However, Ghana’s forex reserves (excluding oil funds and encumbered assets) stood at US$4.3 billion in April 2024 (2.0 months of import).

This, IC Africa Research said emphasises its longstanding view that the government have been in reserves accumulation mode in anticipation of external debt service resumption rather than sufficient foreign exchange market support.

Consequently, it stressed that it remained less bullish on the outlook for the Ghanaian cedi as it sees limited sources of sizable foreign exchange (FX) inflow to the market.

Limited upside risks for secondary market pricing

Following the significant move in restructuring the Eurobonds, IC Africa Research added that it envisages limited upside for secondary market pricing due to the deeper haircut and slashed coupon.

“Following our early May 2024 update note on the initial proposal in which we anticipated upside of between 10.0% and 20.0%, Ghanaian Eurobonds have posted an average price gain of 3.8% as of mid-day 24 June 2024. However, we opine that the new terms impose deeper losses on investors via the effective haircuts on principal and PDI, as well as the 50 basis points reduction in the stepped-up coupon rate (6.0%) while the lower coupon of 5.0% is extended for one extra year.”

“In view of this, we now see limited upside scope from the current average market cash price of US$53.4 per US$100.0 face value, with upside potential of between 5.0% – 7.0%.

Latest Stories

-

Flights in and out of Middle East cancelled and diverted after Iran strikes

1 minute -

Dr Maxwell Boakye to build 50-bed children’s ward at Samartex Hospital in honour of late mother

12 minutes -

One killed and 11 injured at Dubai and Abu Dhabi airports as Iran strikes region

19 minutes -

Former MCE, 8 others remain in custody over alleged land fraud in Kumasi

24 minutes -

Black Queens players stranded in UAE over Israel-Iran conflict

1 hour -

James Owusu declares bid for NPP–USA chairman, pledges renewal and unity

1 hour -

Trump threatens strong force if Iran continues to retaliate

2 hours -

Lekzy DeComic gears up for Easter comedy special ‘A Fool in April’

3 hours -

Iran declares 40 days of national mourning after Ayatollah Ali Khamenei’s death

4 hours -

Family of Maamobi shooting victim makes desperate plea for Presidential intervention

5 hours -

Middle East turmoil threatens to derail Ghana’s single-digit gains

6 hours -

Free-scoring Semenyo takes burden off Haaland

6 hours -

Explainer: Why did the US attack Iran?

7 hours -

Peaky Blinders to The Bride!: 10 of the best films to watch in March

7 hours -

Crude oil price crosses $91 as Strait of Hormuz blockade chokes 22% of global supply

8 hours