Audio By Carbonatix

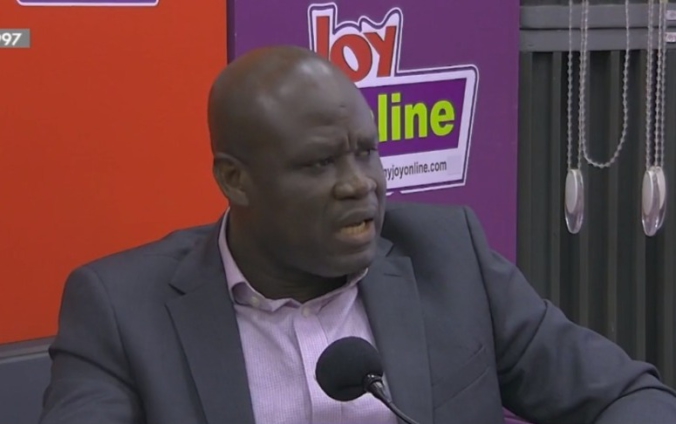

The CEO of the Ghana Chamber of Commerce and Industry (GNCCI), Mark Badu-Aboagye, has stressed the importance of financing the private sector to stimulate economic growth, especially in an environment where borrowing from the government has dominated the financial space.

Speaking on Joy News’ PM Express Business Edition, he stated that banks must conduct a proper risk analysis to ensure their money reaches viable private sector ventures.

“If you want to do proper banking, give money to the private sector. You need to assess their profile, their credit readiness, and their project viability. You follow up, monitor, and get your money back,” Mr Badu-Aboagye stated.

He explained that the current dominance of government borrowing reduces the incentive for banks to lend to the private sector.

“If government decides it’s not borrowing as much, the money sitting with the banks will compel them to give it to the private sector,” he said.

However, Badu-Aboagye acknowledged the challenges banks face in lending to businesses, particularly small and medium-sized enterprises (SMEs).

He cited the high interest rates, which make borrowing difficult for SMEs, whose profit margins are already slim.

“SMEs want money. Our economy depends on SMEs. Try getting money as an SME, and they give you 30% interest. How do you expect an SME to borrow at 30-40%, make a profit, and also pay you back?” he questioned.

He noted that businesses in Ghana are generally productive and profitable, but external factors such as high interest rates and a difficult business environment are driving them into losses.

“At the micro level, businesses are productive. It’s when you bring in interest rates and taxes that they start running at a loss,” he concluded.

Latest Stories

-

Ghana pays tribute to 1948 heroes at 78th anniversary observance

3 minutes -

Allowance payout will strengthen Ghana’s decentralization framework – Tano North Assembly Members

4 minutes -

Two arrested in connection with Effiakuma viral video

40 minutes -

Keta MP lays mother to rest

1 hour -

We must put an end to cocoa politics – Victoria Bright

2 hours -

There is a cabal in electricity sector determined to rip off Ghanaians – Prof Agyemang-Duah

2 hours -

NSA pays January 2026 allowance to National Service Personnel

2 hours -

24-Hour Economy not just talk — Edudzi Tamakloe confirms sector-level implementation

2 hours -

Four arrested over robbery attack on okada rider at Fomena

2 hours -

NDC gov’t refusing to take responsibility for anything that affects Ghanaians – Miracles Aboagye

3 hours -

Parental Presence, Not Just Provision: Why active involvement in children’s education matters

3 hours -

24-Hour economy policy fails to create promised jobs – Dennis Miracles Aboagye

4 hours -

Ghana Embassy in Doha urges nationals to take shelter after missile attack

4 hours -

Government’s macroeconomic stability commendable, but we need focus on SME growth – Victoria Bright

4 hours -

Macro stability won’t matter without food self-sufficiency- Prof. Agyeman-Duah

4 hours