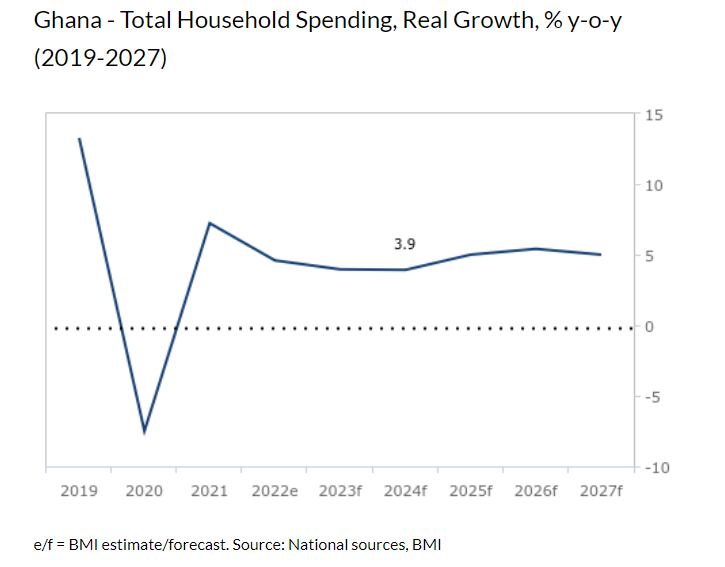

Fitch Solutions is forecasting that real household spending in Ghana will grow by 3.9% year-on-year to ¢114.2 billion in 2024.

This it says is due to the easing of both inflationary pressures and debt servicing.

“Stability in the labour market will help to improve the prospects for consumer spending, as consumer confidence begins a path of recovery following years of stubbornly high inflation over 2022 and 2023. In real terms (2010 prices), household spending is set to reach ¢114.2 billion in 2024, higher than the ¢101.9b billion posted in 2019, pre-Covid”, it said.

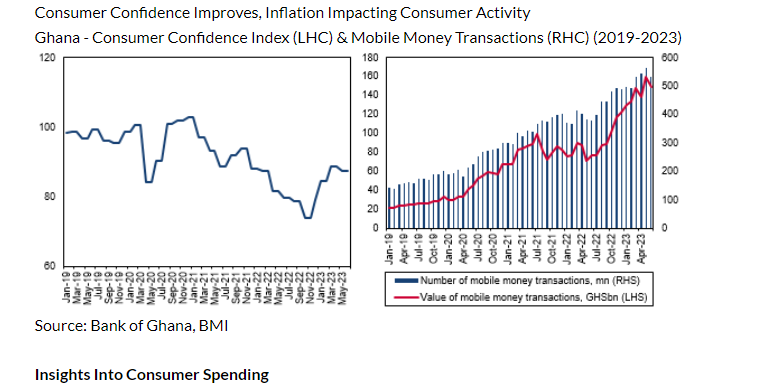

In June 2023, consumer confidence in Ghana fell back to 87.5, after increasing to 88.8 in April 2023.

While this level is substantially higher than the 79.7 level in June 2022, Fitch Solutions said it remains lower than the 96.5 average over the year of the Covid-19 pandemic (2020).

According to the UK-based firm, high levels of inflation, slower economic growth, rising levels of dissatisfaction with government policy and interest rate hikes are all contributing to a downbeat Ghanaian consumer.

Consumer activity in Ghana faltered in the second quarter of 2023, with the total value of mobile money transactions dropping from ¢159.7bn ($14.0bn) in March 2023 to ¢149.4bn ($13.1bn) in June 2023.

“We highlight that much of the increase in nominal values since quarter 4, 2021 can be accounted for by inflation, which averaged 33.4% year-on-year between October 2021 and July 2023. Similarly, the reacceleration of inflation (discussed in greater detail below) saw the number of transactions decline from 563 million transactions in May 2023, to 532 million transactions in June 2023, as consumers have scaled back the volume of purchases.

Latest Stories

-

‘What are the real causes of the erratic power outages?’ GUTA demands from ECG

13 mins -

Implementing ESG framework in Ghana’s energy sector for sustainability

47 mins -

CAFCC: Dreams FC exit competition after 3-0 defeat in Kumasi

48 mins -

The detrimental effects of political interference on Ghana’s electricity sustainability

51 mins -

Prof. Opoku-Agyemang’s appointment as running mate intimidates the NPP – Benjamin Quashie

57 mins -

Black Stars physical trainer dead

58 mins -

Bawumia to kick off nationwide campaign for Election 2024 tomorrow

1 hour -

GUTA charges ECG to provide ‘dumsor’ timetable for businesses to plan

1 hour -

Reason for training professional counsellors is to heal a hurting world – CCP president

3 hours -

Woman allegedly brings dead man to bank to take out a loan

3 hours -

It’s a good feeling to score against PSG because I’m a Marseille boy – Andre Ayew

4 hours -

Joe Lartey Sr: A voice that brought life to Ghana sports and beyond

4 hours -

Bawumia promises to tackle issue most dear to Ghanaians as he begins nationwide campaign

6 hours -

Indian couple donate $24m fortune to charity to adopt monkhood

6 hours -

Australians call for tougher laws on violence against women after killings

6 hours