The government was revised its 2023 appropriation to ¢206.0 billion, from ¢227.7 billion as presented and approved in November 2022.

This is in line with Regulations 24 sub-regulation (3) of Public Financial Management Act Regulations 2019 (L.I. 2378).

The downward adjustment in appropriation is due to the lower domestic interest payment and amortization, following the completion of a part of the Domestic Debt Exchange Programme (DDEP), and the reduction in the foreign financed capital expenditure.

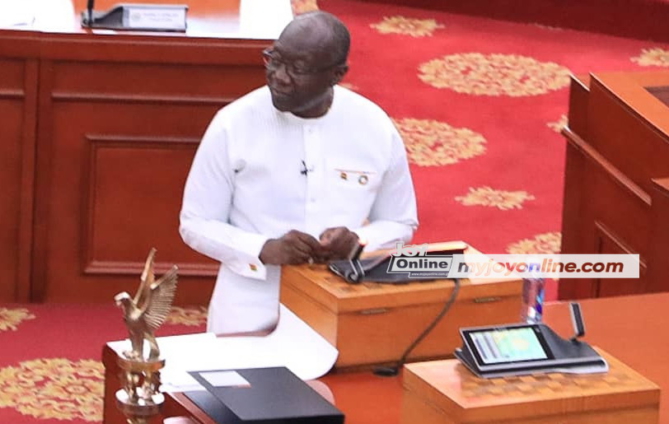

According to Finance Minister, Ken Ofori-Atta, this is to balance revenue with expenditure.

“For the first six months of the year, we continue making progress to exceed our non-oil revenue targets for the year. We have seen improvements in non-oil tax revenue collection despite some noticeable shortfalls in VAT. However, oil revenues have fallen short of expectations due to changes in global prices. We will, therefore, undertake a downward review of the oil-related revenue as well as the corresponding expenditures to align with the underperformance of some of our revenue handles”, he mentioned in Parliament when presenting the 2023 Mid-Year Budget Review”.

“Specifically, this will impact the Annual Budget Funding Amount (ABFA)”, he added.

Government committed to pursuing robust growth

Continuing, Mr. Ofori-Atta said the government is, however, committed to pursuing a robust growth strategy within the limited fiscal space and our fiscal consolidation programme.

This, he said, will be done by attracting domestic and foreign private sector investments and expanding production, which will be encouraged and stimulated by government policies and agencies. He mentioned that the Government’s Mutual Prosperity Dialogue with the private sector, will seek to facilitate the ease of doing business in order to crowd-in private domestic and foreign investments

Latest Stories

-

Which will you vote for in 2024 Election: Honesty, Character, or Campaign Promises?

3 hours -

The ball is in Iran’s court after US pressure pays off

4 hours -

‘Japa’ sweeps Nigeria’s hospitals

4 hours -

Obuasi: Catholic Voices GH choral peace concert unites NPP, NDC

4 hours -

Lordina Supports NDC campaign in Ketu North with donation of medical equipment to Afife Health Centre

4 hours -

MTN Foundation delivers crucial technology tools to Eastern Regional Hospital

4 hours -

Galien Forum Africa: Enhaning African women’s role in climate and environmental crises

10 hours -

7th Galien Africa Forum ends with emphasis on health, innovation, and climate action in Africa

10 hours -

Ruthless Barcelona thrash Real Madrid to go 6 points clear

11 hours -

National Farmers’ Day scheduled for November 8

11 hours -

Samson’s Take: Why over 75% vote but only 5% join protests

12 hours -

Krachi East Chiefs applaud Bawumia for campaigning on issues with evidence

13 hours -

National Security Ministry dismisses Reuters’ claims that militants are using Ghana as logistical base

13 hours -

BOST and its CEO win big at 8th Ghana Energy Awards

15 hours -

Accused person in protest over alleged $3m BOST scandal discharged

15 hours