Audio By Carbonatix

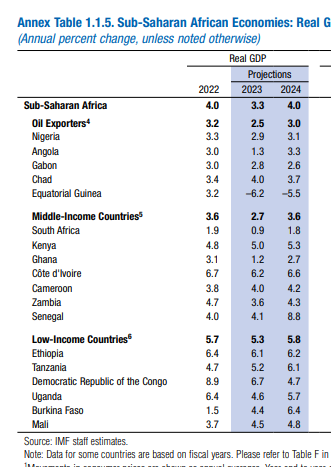

The International Monetary Fund has further lowered Ghana’s growth rate to 1.2%, from the July 2023 forecast of 1.6%.

This is the second time the Fund has revised Ghana’s Gross Domestic Product (GDP) growth for this year.

In April 2023, the Fund predicted a 2.8% growth rate for Ghana in its World Economic Outlook (WEO) Report.

The World Bank had also slightly lowered the country’s growth rate forecast for this year to 1.5%, according to its October 2023 Africa Pulse Report.

The Fund again cited fiscal slippages as a result of high debt and budget deficit, reducing government spending in infrastructure and investments, as major reasons.

In 2024, the Fund projected a 2.7% expansion of the Ghanaian economy, far lower than the pre-pandemic average of 5%.

Global economy recovers slowly

Meanwhile, the global economy continues to recover slowly from the blows of the pandemic, Russia’s invasion of Ukraine, and the cost-of-living crisis.

In retrospect, the resilience has been remarkable.

“Despite the disruption in energy and food markets caused by the war, and the unprecedented tightening of global monetary conditions to combat decades-high inflation, the global economy has slowed, but not stalled. Yet growth remains slow and uneven, with growing global divergences. The global economy is limping along, not sprinting”, the report stated.

Global growth will slow from 3.5% in 2022 to 3.0 this year and 2.9% next year, a 0.1 percentage point downgrade for 2024 from our July projections.

This remains well below the historical average.

Risks

The report furthered that while some of the extreme risks—such as severe banking instability—have moderated since April 2023, the balance remains tilted to the downside.

“First, the real estate crisis could deepen further in China, an important risk for the global economy. The policy challenge is complex. Restoring confidence requires promptly restructuring struggling property developers, preserving financial stability, and addressing the strains in local public finance”, it stated

Western sanctions on Russian crude oil exports have had mixed effects: export flows of Russian oil have remained fairly steady, and its price discount relative to Brent oil has shrunk over time—Russian oil is trading above the $60 price cap imposed by the Group of Seven (G7) countries—as the size of the non-Western-aligned oil tanker fleet carrying Russian oil has increased, and as Russia appears to have set up its own maritime insurance

Second, commodity prices could become more volatile under renewed geopolitical tensions and disruptions linked to climate change.

Since June, oil prices have increased by about 25%t, on the back of extended supply cuts from OPEC+ (the Organization of the Petroleum Exporting Countries plus selected nonmembers) countries.

Food prices also remain elevated and could be disrupted further by an escalation of the war in Ukraine, causing important hardship for many low-income countries. This, of course, represents a serious risk to the disinflation strategy

(from $96.4 in 2022) and continue to fall in coming years, to $72.7 in 2026 (Figure 1.SF.1, panel 2). The International Energy Agency expects oil demand to increase by 2.2 mb/d, reaching 102.2 mb/d in 2023, outstripping supply in the second half of the year. Uncertainty around this price outlook is elevated (Figure 1.SF.1, panel 3). Upside price risks stem from additional OPEC+ production cuts, a military escalation in the Black Sea, and insufficient investment in fossil fuel extraction. Downside price risks stem from a widespread global economic relapse, a slowdown in Chinese oil demand, and faster penetration of electric vehicles

Latest Stories

-

NAIMOS has failed in galamsey fight; it’s time for a state of emergency – DYMOG to President Mahama

36 minutes -

Mahama to open African Court judicial year in Arusha, mark 20th anniversary

41 minutes -

Ghana begins partial evacuation of Tehran Embassy as Middle East tensions escalate

56 minutes -

EPA tightens surveillance on industries, moves to cut emissions with real-time monitoring system

1 hour -

Police conduct show of force exercise ahead of Ayawaso East by-election

3 hours -

Ghana launches revised Early Childhood Care and Development Policy to strengthen child development framework

3 hours -

AI to transform 49% of jobs in Africa within three years – PwC Survey

3 hours -

Physicist raises scientific and cost concerns over $35m EPA’s galamsey water cleaning technology

4 hours -

The road to approval: Inside Ghana’s AI strategy and KNUST’s leadership

4 hours -

Infrastructure deficit and power challenges affecting academics at AAMUSTED – SRC President

5 hours -

Former US diplomat sentenced to life for abusing two girls in Burkina Faso

5 hours -

At least 20 killed after military plane carrying banknotes crashes in Bolivia

5 hours -

UK reaffirms investment commitment at study UK Alumni Awards Ghana 2026

5 hours -

NCCE pays courtesy call on 66 Artillery Regiment, deepens stakeholder engagement

5 hours -

GHATOF leadership pays courtesy call on Chief of Staff, Julius Debrah

5 hours