Audio By Carbonatix

The Institute of Statistical, Social and Economic Research (ISSER) has thrown a spotlight on the effectiveness of Ghana's E-levy in its 2022 State of the Ghanaian Economy report, published on October 31, 2023.

The report examines the recent history of the E-levy and its impact on alternate payment systems, leaving a critical question in its wake: "Is the E-levy rate optimal?"

The ISSER report reveals that the reduction of the E-levy rate to 1% from 1.5% in January 2023 initially resulted in "a drop in alternate payment systems' usage."

Quoting the report, "However, the figures shot up in February."

This abrupt increase in usage of non-taxed payment channels such as mobile money, cheques, and internet banking suggests that the favourable effect of lowering the E-levy rate was short-lived.

The report underscores the significance of this trend and its potential implications for the country's revenue collection strategy. It raises the vital question: "Is the E-levy rate optimal?"

This query arises against the backdrop of evolving patterns in alternate payment systems.

The ISSER report notes that even before the introduction of the E-levy in 2022, there was already substantial growth in alternate payment systems, as individuals sought to circumvent the new tax.

After the E-levy's implementation in mid-2022, the usage of these systems witnessed a decline, only to surge again in February 2023, despite the rate reduction.

The report highlights these continuous fluctuations as indicators that the E-levy rate may still be too high, potentially deterring formal, taxable mobile money transactions. As a result, the report suggests the necessity for further optimisation.

The ISSER report not only focuses on Ghana but also offers a broader perspective on tax policies, emphasizing the importance of the tax rate.

The report states, "In all the countries examined, the taxes failed to provide the anticipated revenues."

It also highlights the significant impact that marginal reductions in tax rates can have on stakeholder acceptance and the overall success of tax policies.

Ghana's experience with the E-levy, as outlined in the report, underscores the sensitivity of the population to taxation and the potential ramifications of high tax rates.

The report serves as a valuable resource for policymakers and stakeholders, encouraging a reconsideration of the E-levy rate to optimise its effectiveness in generating revenue while preserving consumer engagement in taxable transactions.

Latest Stories

-

Police assessing Stansted Airport private flights over Epstein ties

4 minutes -

Nine arrested in France over death of far-right student

15 minutes -

EPA to probe seizure of over 200 suspected galamsey machines at Tema port

17 minutes -

Ghana–Russia Center, Kuban Agrarian University seal deal to advance agricultural innovation

36 minutes -

Mahama opens maiden Tree Crop Investment Summit, pushes value addition and jobs

36 minutes -

Police recover five assault rifles after Bono shootout, one suspect killed

49 minutes -

Nana B slams Special Prosecutor over presidential primaries investigations

1 hour -

The ‘Ghana Must Go’ bag of integrity: 3 police officers return GH₵85k

1 hour -

Ghana must help Burkina Faso tackle terror threat – Expert says

1 hour -

Police return GH¢85,000 found on Techiman–Kumasi highway to owner

1 hour -

NSA assures service personnel of prompt payment of outstanding allowances

1 hour -

The Wahala Playbook: A quintessential guide to burying national scandals with internet gossip

1 hour -

Burkina Faso attack: Travel advisory insufficient, urgent security measures needed – Samuel Jinapor

1 hour -

Daily Insight for CEOs: Decision-Making Speed and Quality.

2 hours -

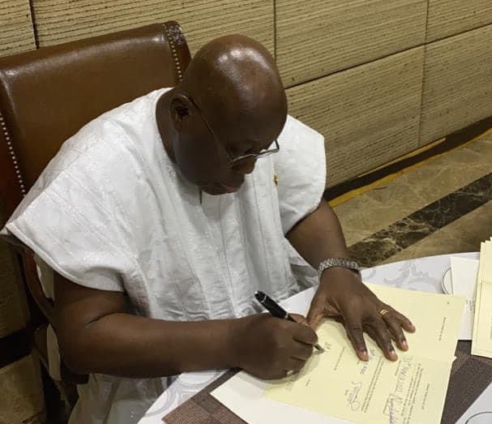

Emmanuel Bedzrah cuts sod for 17 educational infrastructure projects in Ho West

2 hours