Audio By Carbonatix

The Bank of Ghana (BoG) Credit Reporting for 2024 has shown a reduction in the issuance of dud cheques. A dud cheque is a cheque that a bank or financial institution refuses to honor because the account holder does not have enough money to cover the cheque's value. It is a criminal offense under the Bank of Ghana Act.

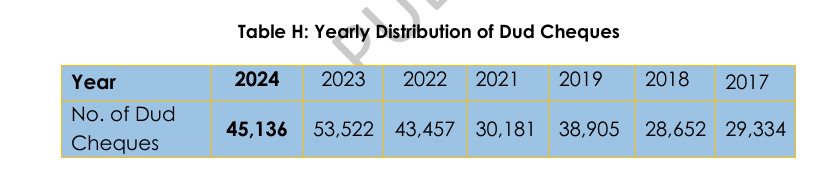

The report showed that in 2024, a total of 45,136 dud cheques were submitted by Banks and Specialised Deposit-Taking Institutions to credit bureaus.

This represents a 15.19% decrease from the 2023 figure of 53,522. The Bank of Ghana explained that the decline is attributable to the regulator’s constant sensitization of the public on the negative implications of issuing dud cheques on their ability to secure credit facilities.

The Bank of Ghana said it will continue to raise public awareness and enforce the directive on dud cheques to help boost public confidence in the cheque system.

The report pointed out that in 2024, bank customers who flouted the dud cheque directives were sanctioned accordingly.

Breakdown of the data

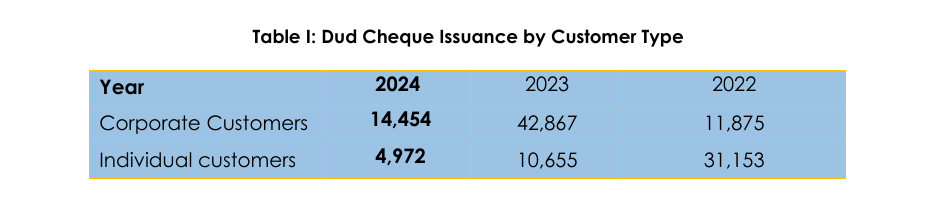

“Dud cheques issued by individuals decreased from 10,655 in 2023 to 4,972 in 2024. Corporate customers issued a total of 14,454 dud cheques in 2024, representing a decrease of 49.6 percent compared to 42,867 dud cheques in 2023”, the report said.

According to the Bank of Ghana, the notable reduction in dud cheque incidents, increased usage of credit reports by financial institutions and other lenders and enhanced public awareness of credit reporting systems are testaments to the growing robustness of the sector.

The central bank said it remains committed to strengthening the credit information infrastructure enforcement, and public education.

“These efforts are essential to fostering a credit reporting requirements through continuous stakeholder collaboration”.

Latest Stories

-

Africa’s future workforce, customers are already here and they are young – Nii Armah Quaye

3 minutes -

Telecel Turns Up University of Ghana with Black Sherif, KiDi & Kweku Smoke on Val’s Day

6 minutes -

When culture trends: How Mahama’s fugu revival can boost local sales

7 minutes -

The Ghanaian talent shift: Key insights employers can’t ignore from the Jobberman 2026 Jobs Market Report

10 minutes -

More than 30 killed in blast at Pakistan mosque, officials say

15 minutes -

Investing in youth is Africa’s most strategic business decision – Nii Armah Quaye

16 minutes -

We had sex in a Chinese hotel, then found we had been broadcast to thousands

16 minutes -

Nigerian court orders UK to pay £420m over 1949 killing of miners

16 minutes -

Ministry of Finance relocates offices to Kanda

18 minutes -

Amazon shares fall as it joins Big Tech AI spending spree

18 minutes -

TikTok told to change ‘addictive design’ by EU or face massive fines

19 minutes -

Fisherman fleeing elephants killed by crocodile in Zambia

20 minutes -

JoyNews’ Emefa Atiamoah-Eli wins REMAPSEN’s Best Journalist in Health Reporting award for West and Central Africa

33 minutes -

UMB outdoors redesigned mobile app; UMB SpeedApp to serve customers better

1 hour -

GFA strengthens Black Stars backroom staff with five key appointments for 2026 World Cup

1 hour