Audio By Carbonatix

Folks, it looks like the financial misreporting and creative accounting that we have been served with in the last six years is not coming to an end anytime soon as the Ken Ofori-Atta cum Dr Bawumia-led EMT takes its financial misreporting to a whole new level by misreporting to the IMF yet again ahead of the new IMF programme.

The IMF team was in town to engage government ahead of a debt sustainability analysis which would inform the type of programme or bailout they would provide for Ghana.

At that engagement, government provided the IMF with a GDP figure of $590 billion when its projected GDP for the end of the year 2022 was actually $509 billion.

We don’t know what the $81 billion or 15% increase in GDP value is attributed to considering the economic challenges we have encountered this year.

Again, if the end of your projection in the 2022 budget is $509 billion, how did government come by $590 billion at the beginning of the third quarter?

For those who don’t understand the significance of a bloated GDP, let me explain; it is the GDP figure that is used to calculate the debt-to-GDP ratio.

What this means is that any increase in GDP would lead to a lower debt-to-GDP ratio which will be used to create the impression that Ghana is not debt distressed.

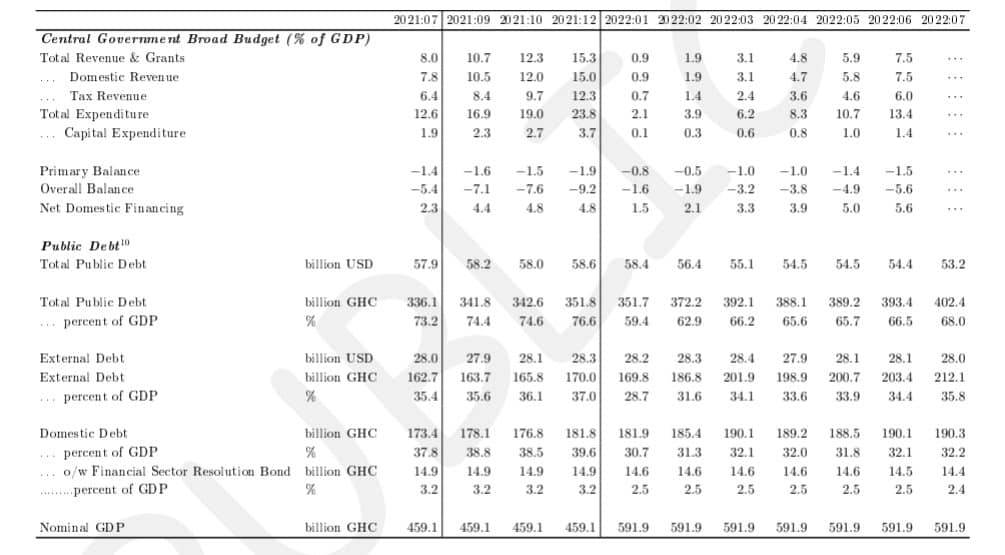

So with the current GDP value of $590 billion, our debt to GDP ratio would be 68% when actually our debt to GDP is over 90%.

This cosmetic 68% would be used to explain to the IMF that Ghana doesn’t need a debt restructuring and that its debt is actually sustainable when in fact we all know it’s not.

Secondly and most importantly, it is this same cosmetic GDP value of $590 billion that would be used to calculate the revenue-to-GDP ratio and by using $590 billion as the new GDP value, our Revenue to GDP ratio comes to a paltry 14%.

Now this 14% would be used to back a false narrative to the IMF that the problem Ghana is facing is not corruption, reckless and wasteful expenditures but revenue generation and that it is Ghanaians who are not paying taxes.

All this would inform the type of programme the IMF would admit Ghana to, a programme that emphasises revenue generation instead of cutting wastefulness.

Look at the chart below on the data government provided to the IMF and see the magical accounting for yourself.

For anyone who had a hope that an IMF programme would bring about any changes in how this country has been managed in the last six years, brace yourself for a major disappointment because the data provided to the IMF would culminate into the type of programme government would eventually present to the IMF, the government wants to do the same things that led us into this ditch, profligate expenditures, ostentatious spending and unwarranted largesse at the expense of the poor taxpayers but most importantly the imminent IMF programme would be very aggressive on taxes because guess what the government has told the IMF; it is not reckless but it is you who are not paying your taxes…!!

******

The writer is the Executive Director of the Alliance for Social Equity And Public Accountability (ASEPA).

Latest Stories

-

Interior Minister receives Gbenyiri Mediation report to resolve Lobi-Gonja conflict

9 minutes -

GTA, UNESCO deepen ties to leverage culture and AI for tourism growth

24 minutes -

ECG completes construction of 8 high-tension towers following pylon theft in 2024

46 minutes -

Newsfile to discuss 2026 SONA and present reality this Saturday

55 minutes -

Dr Hilla Limann Technical University records 17% admission surge

1 hour -

Meetings Africa 2026 closes on a high, Celebrating 20 years of purposeful African connections

1 hour -

Fuel prices to increase marginally from March 1, driven by crude price surge

1 hour -

Drum artiste Aduberks holds maiden concert in Ghana

2 hours -

UCC to honour Vice President with distinguished fellow award

2 hours -

Full text: Mahama’s State of the Nation Address

2 hours -

Accra Mayor halts Makola No. 2 rent increment pending negotiations with facility managers

2 hours -

SoulGroup Spirit Sound drops Ghana medley to honour gospel legends

2 hours -

ECG reinforces ‘Operation Keep Light On’ in Ashanti Region

2 hours -

UK remains preferred study destination for Ghanaians – British Council

2 hours -

Ghana Medical Trust Fund: Maame Samma Peprah ignites chain of giving through ‘Kyerɛ Wo Dɔ Drive’

3 hours