Audio By Carbonatix

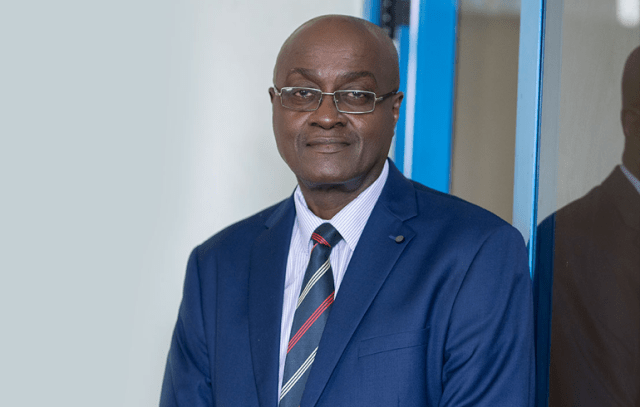

A banking consultant, Dr Richmond Atuahene, has condemned the proposed merger of the National Investment Bank (NIB) and the Agricultural Development Bank (ADB).

The government has been working over the years to merge ADB and NIB to create the National Development Bank due to the struggles of the two banks.

But speaking in an interview on Joy FM’s Top Story on Thursday, September 28, Dr Atuahene stated that it was not the right call.

“I don’t think merging NIB and ADB is solving any problem, it is not a solution at all,” he told Evans Mensah.

He contends that the government should not rush on the matter but take its time to conduct a diagnostic study of the two banks first.

According to him, the NIB has suffered from corporate government crises in addition to its current fiscal challenges noting that the buildup to the current point started in 2016.

He added ADB is also going through the same challenges based on a report published in 2022.

In light of this, Mr Atuahene believes ADB does not have the capacity to acquire NIB. He said even if government refinances ADB, it may not be enough to take over NIB's debts.

For this reason, he suggested that both banks – NIB and ADB be recapitalised, explaining that “you don’t bring a weak institution to buy a bad institution. You have what we call a good bank buying a bad bank, there is a theory there but the two of them are not good for anything.”

Speaking on the same show, the Minority Spokesperson on Finance, Isaac Adongo supported the call for both banks to be recapitalised.

He explained that "ADB itself is suffering from capital adequacy. If you do the adjustment of the risk-based capital of the ADB consistent with Articles 2 and 3, you would find that it doesn’t have 13% capital adequacy which is the minimum threshold."

“The 2.4 hole doesn’t disappear because you have merged them and the capital adequacy problem of ADB doesn’t get away because you have merged them. The cumulative effect is that you will have a much bigger disease to address.. so you need to treat them for their individual illness," he stressed.

The Bolga Central MP also revealed that the Managing Director of NIB, Samuel Sarpong, had been managing the ailing bank via zoom for close to a year from Canada. This he said was part of the poor corporate governance that had led to the current situation the bank was in.

“We haven’t given NIB the kind of attention that it deserves given that it has been in crisis… the Managing Director sat in Canada and zoom-managed NIB for almost a year. How can we be serious with that?

“A bank that requires arm holding, proper nurturing, the Managing Director sat in Canada for one year and what he was doing was zoom managing that bank. Even very good performing banks cannot be managed by zoom for one year so clearly there are issues,” he said on JoyFM’s Top Story.

Mr. Adongo earlier alleged that this plan was merely a smokescreen to sell off the two banks after their merger to government cronies as part of state capture efforts.

"It is clear that this is not about the interest of NIB. This is the last step towards passing through the back door to acquire NIB and ABD for themselves in a state capture," he said.

The Minority Leader, Dr Cassiel Ato Forson is also cautioning against severe job losses should the government go ahead to collapse or merge the banks.

Dr Ato Forson says such a move will lead to significant job losses and the subsequent destabilisation of about 4,000 households.

Dr Bawumia, Ken Ofori-Atta is working closely with Mr. Printer – Dr Addison to either collapse the NIB or merge it with the ADB. We contend that collapsing NIB is not an option. Merging NIB with ADB is simply not an option because it will come with its corresponding job losses. Already we have issues with unemployment,” he said.

“Their families – we want to assure them that the Minority will fight for them. We want to assure them that we cannot add to the unemployment situation in the country,” the lawmaker added.

According to him, the Minority believes that both banks have the space to survive separately, therefore the country deserves both banks to be in operation.

Latest Stories

-

World Para Athletics: UAE Ambassador applauds Ghana for medal-winning feat

28 minutes -

Photos: Ghana’s path to AU Chairmanship begins with Vice Chair election

30 minutes -

Chinese business leader Xu Ningquan champions lawful investment and deeper Ghana–China trade ties

50 minutes -

President Mahama elected AU First Vice Chair as Burundi takes over leadership

1 hour -

Police work to restore calm and clear road after fatal tanker crash on Suhum–Nsawam Highway

2 hours -

Four burnt, several injured in Nsawam-Accra tanker explosion

3 hours -

Police arrest suspect in murder of officer at Zebilla

3 hours -

SUSEC–Abesim and Adomako–Watchman roads set for upgrade in Sunyani

4 hours -

CDD-Ghana calls for national debate on campaign financing

4 hours -

INTERPOL’s decision on Ofori-Atta: What it means for his U.S. bond hearing and the legal road ahead

4 hours -

Parties can use filing fees to cover delegates’ costs, end vote-buying – Barker-Vormawor

4 hours -

Boxing in Bukom: Five months without the bell

5 hours -

Political parties can end vote-buying by disqualifying offenders – Barker-Vormawor

5 hours -

Ministry of Gender investigates alleged sharing of intimate videos by foreign national

5 hours -

Cocoa must be treated as business, not politics- Nana Aduna II

6 hours