Audio By Carbonatix

Government says it will streamline the country’s tax regime to prevent large companies from abusing tax exemptions.

With Ghana losing about five per cent of its Gross Domestic Product (GDP) annually due to excesses in taxes of companies operating in the free zone, government says it is putting in place measures to handle wasteful tax exemptions.

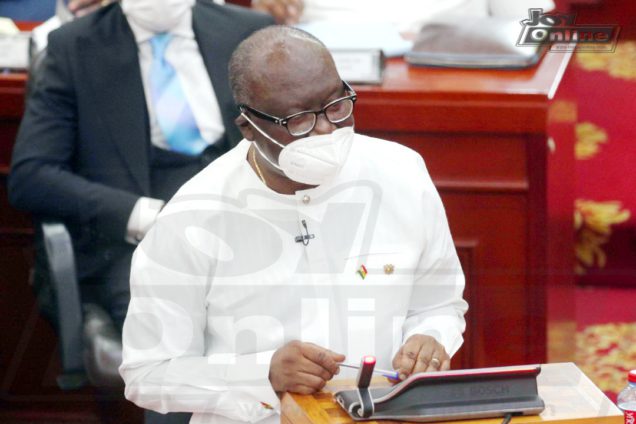

Minister of Finance, Ken Ofori-Atta disclosed this on Wednesday during his presentation of the 2022 budget statement and economic policy to Parliament.

He said government through the Exemptions Bill which will be laid in the house in 2022 will trim down wasteful tax exemptions to ensure the country gain significant returns from companies enjoying tax exemptions.

“We wish to reiterate that we are in challenging times, which require radical measures, so let us embrace these new policies to enable Government to address the fundamental issues affecting the economy, to ensure that, our Nation continues to maintain its position,” he said.

More reliefs for textile industry

The Minister also announced a two-year extension of the Value Added Tax (VAT) relief on African prints for textile manufacturers in the country.

According to him, the extension is to enable them to resuscitate their operations and provide affordable textiles to the market.

Limiting of VAT flat rate to retailers

Mr Ofori-Atta also indicated that the three per cent VAT flat rate on the supply of goods by wholesalers and retailers which was introduced in 2017 will now be limited to only retailers explaining that all other supplies of goods and services will attract the standard rate.

This the Minister explained that the object of the flat rate is to provide a simplified system for small scale enterprises noting that to ensure that this objective is achieved, the rate will be applied to retailers with annual turnover not exceeding ¢500,000.

All other retailers and wholesalers will charge the standard rate.

Latest Stories

-

Republic Bank reveals benefits of joining the “Republic Verse” – A bold banking universe

11 minutes -

Workers calling for my resignation have not paid attention to GIADEC law – CEO dismisses calls for removal

19 minutes -

Cocoa farmers who sell farms to galamsey operators will face jail – Concerned Farmers Association

23 minutes -

Crush Smoothies, Luv FM to host unforgettable ‘Luv and Music’ Valentine’s event in Kumasi

24 minutes -

Wovenu SHS matron, police officer arrested over alleged diversion of students’ food items

25 minutes -

Parliament to launch corporate strategic plan 2026–2030

25 minutes -

Prudential Bank, Nita Travels to take customers on Korea, Turkey, China business trips

27 minutes -

Socodevi worried over threat of galamsey on cocoa farms

28 minutes -

Vote-buying is a criminal matter, not an internal party issue – Haruna Mohammed

29 minutes -

‘Unfortunate’ — Akwatia MP reacts to JoyNews galamsey exposé

37 minutes -

GNFS contains gas leak after explosion at Buduburam filling station

47 minutes -

Finance Minister to outline Cabinet’s cocoa reforms in national address on Feb 12

58 minutes -

Where National Health Insurance ends, we begin – GMTF Boss

1 hour -

I’ll work relentlessly to secure victory for NPP in 2028—Bawumia

1 hour -

Unite to end digital violence: Why online safety Is a gender justice issue

1 hour