Audio By Carbonatix

The National Petroleum Authority (NPA) has revoked the licenses of 30 Oil Marketing Companies (OMCs) for breaching the regulations of the industry.

Some of the OMCs are said to owe the government over ¢400 million cedis in the form of unpaid taxes by the end 0f 2022.

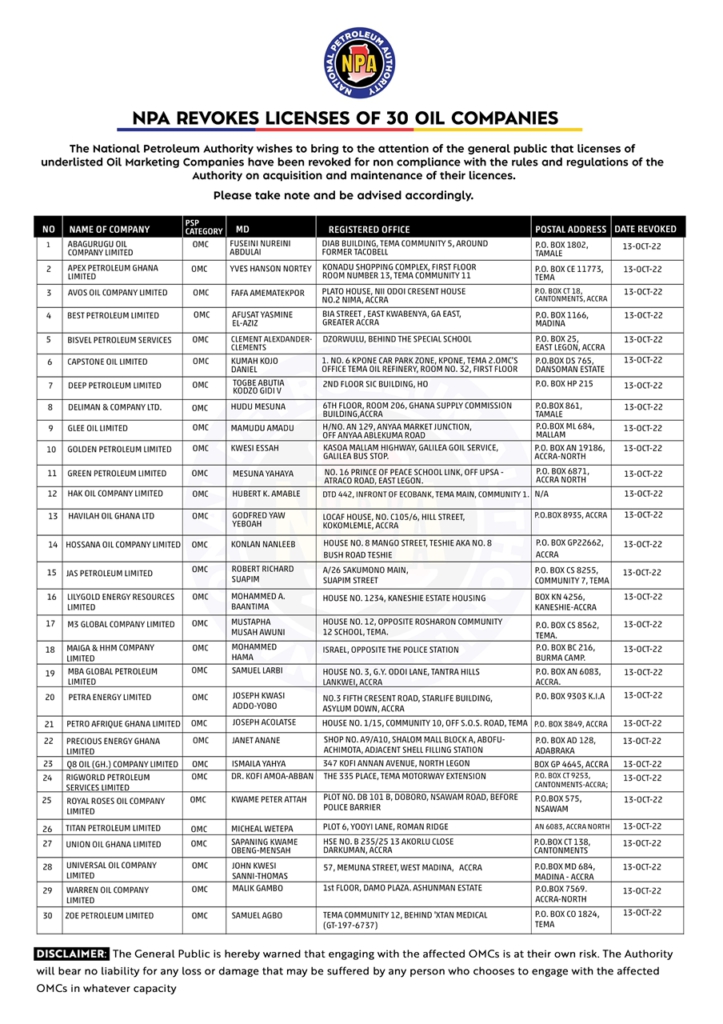

A list of the companies published by the NPA said the licenses of the “OMCs have been revoked for non-compliance with the rules and regulations of the authority on acquisition and maintenance of their licenses".

The NPA cautioned that it will bear no liability for any loss or damage that may be suffered by any person who chooses to engage with the affected OMCs in whatever capacity.

“The General Public is hereby warned that engaging with the affected OMCs is at their own risk”, it added.

Below is the list of the OMCs

NPA goes after OMCs for owing

The NPA in September 2022 went after the directors and shareholders of some 45 Oil Marketing Companies (OMC) over debts running into more than ₵400 million.

These were margins and other levies that have been collected by the OMCs since 2021, but have failed to pay the monies to the NPA.

¢68 million cedis out of the debt was coming from the Primary Distribution Margin Fund

These monies were paid by consumers at the pumps, and were supposed to be repaid to the regulator at the end of every operational month.

Proposed actions by NPA

The NPA stated that these companies had up until the end of September 2022 to settle these debts.

The authority warned that failure to settle these debts, will result in the publishing of names of the directors and shareholders of these companies in the national dailies.

It had also indicated that it will not hesitate to take the necessary legal against the directors of these firms as an additional action.

Latest Stories

-

24-Hour Economy, a major boost for private sector—GUTA President

4 minutes -

Ghana’s housing challenge: A Historical, structural, and policy perspective

10 minutes -

GIPC CEO calls for strategic investment in coconut value chain

16 minutes -

Pink Ladies Cup: Three home-based players named in Black Queens squad

19 minutes -

GES and NIA step up plans for nationwide registration of children

19 minutes -

Heavy politicisation of cocoa industry has affected sector – Professor Peprah

22 minutes -

PBC MD appeals to COCOBOD to end cocoa payment delays

24 minutes -

Pink Ladies Cup: Six debutants named in Black Queens squad for tournament

32 minutes -

Open letter to Education Minister: Rising student deviance and the urgent need for national parental responsibility framework

42 minutes -

President Mahama to deliver State of the Nation Address on February 27

42 minutes -

Dr Kotia backs Ghana’s move to refer maritime boundary dispute with Togo to International arbitration

44 minutes -

When “substantive ” become a security strategy — Rev Ntim Fordjour’s nameplate doctrine

50 minutes -

No plan to pay cocoa farmers, yet ready to change NIB to BNI—Dr Ekua Amoakoh

51 minutes -

COCOBOD is not your cover story. It will not be your scapegoat

52 minutes -

BOST Energies welcomes Salifu Nat Acheampong as new Deputy Managing Director

59 minutes