Audio By Carbonatix

From Recovery to Positioning

Earlier in March 2024, I wrote about managing risk in a recovering economy, emphasizing that an improvement in macroeconomic indicators does not translate into a simultaneous decline in risk at all levels of the economy. Recovery often signals a shift in phase, not the disappearance of embedded vulnerabilities. While systemic conditions may stabilize, firm-specific and sector-level risks can remain elevated, uneven, and in some cases become more pronounced.

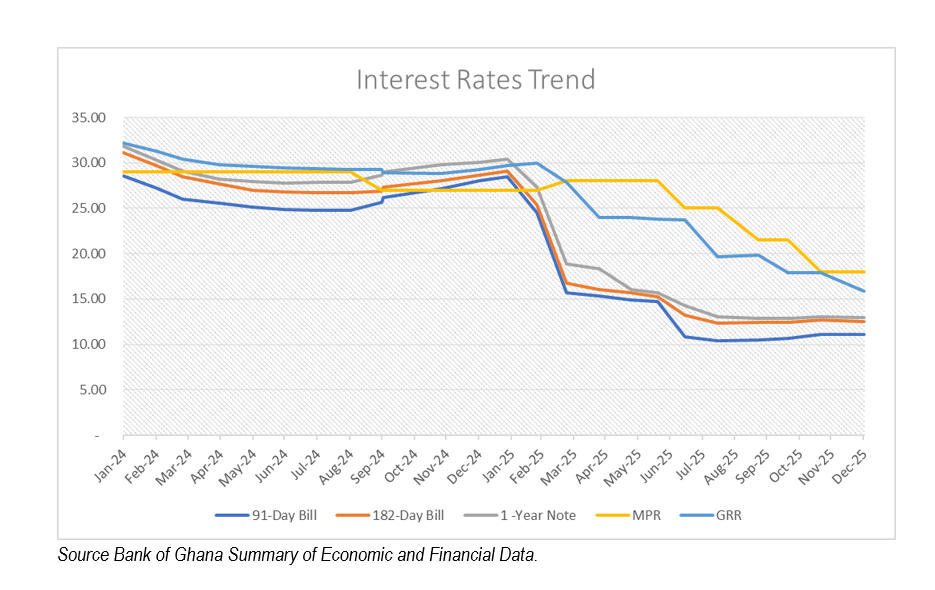

This distinction is particularly relevant as Ghana enters a period of easing monetary conditions. Although the downward trend in interest rates is expected to support real sector activities, the benefits will not be evenly distributed across all small and medium-sized enterprises. Access to cheaper funding is not uniform. Each SME faces a tailored risk premium, determined by how banks classify its credit, operational, and cash-flow risks. Enterprises with weak financial records, informal structures, or volatile earnings will continue to attract higher risk premiums, limiting the extent to which lower policy rates translate into lower borrowing costs.

Conversely, SMEs that position themselves strategically by strengthening governance, formalizing operations, maintaining transparent financial statements, and demonstrating predictable cash flows are more likely to be assessed as lower risk and therefore benefit meaningfully from the evolving rate environment. In the next growth cycle, monetary easing will create opportunity, but it is risk classification, not headline rates, that will ultimately determine which SMEs are able to convert that opportunity into sustainable expansion.

The Reality of SME Formality in Practice

In Ghana, many SMEs are formally registered and active within the economy, yet day-to-day operations often remain highly informal. Business and personal finances are frequently intermingled, not all transactions pass through bank accounts, and financial records are maintained inconsistently if not at all. These practices may not prevent survival in tight conditions, but they become binding constraints when businesses seek to scale up or access formal financing, even in a lower interest rate environment.

As the economy transitions into a growth phase, this gap between legal formality and financial discipline becomes more visible and more consequential.

Lower Interest Rates Do Not Eliminate Credit Risk

A reduction in the policy rate lowers the cost of funds within the financial system, but it does not remove the underlying credit risk considerations that guide lending decisions. Banks continue to assess SMEs primarily on cash-flow sustainability, repayment capacity, governance quality, operational continuity and lastly environmental and social impact.

SMEs positioning for growth must therefore shift their focus from the expectation of cheaper credit to the fundamentals of bankability. This includes disciplined account conduct, a clear understanding of existing debt obligations, and the ability to explain convincingly why funding is required, how it will be deployed, and how it will be repaid.

Financial Transparency as a Growth Enabler

As lending conditions improve, financial transparency becomes not a regulatory burden but a competitive advantage. SMEs that maintain basic financial statements, separate personal and business accounts, and ensure that business inflows and outflows consistently pass through their bank accounts allow lenders to see their operations clearly.

Even simple, well-kept records significantly reduce information gaps and shorten credit assessment timelines. In contrast, informality increases uncertainty and limits access, regardless of prevailing interest rates.

Cash Flow Discipline Takes Centre Stage

Cash flow management sits at the center of SME readiness in a lower interest rate environment. While profitability is often used as a measure of success, lenders focus more closely on the timing and reliability of cash generation.

SMEs that understand their cash-conversion cycles, manage receivables actively, and anticipate seasonal liquidity pressures are better positioned to service debt sustainably. In growth phases, weak cash-flow discipline can undermine otherwise promising businesses, particularly when expansion increases working capital demands.

Governance Matters More in Growth Phases

As economic conditions improve, governance and business structure take on greater importance. Clear ownership arrangements, defined management roles, and basic internal controls provide assurance that the business can absorb growth without operational strain.

Growth often exposes weaknesses more quickly than downturns. SMEs that invest early in structure and decision-making disciplines are better positioned to scale responsibly when financing conditions become more accommodative.

Productive Borrowing Determines Outcomes

Borrowing in a lower interest rate environment is most effective when it is clearly linked to productive use. SMEs that align financing requests with capacity expansion, efficiency improvements, or revenue-enhancing investments are more likely to attract favorable terms.

Lenders respond positively to funding proposals that demonstrate how borrowed resources will translate into stronger cash flows and improved resilience over time, rather than short-term consumption or loosely defined expansion.

Relationship Banking Still Counts

Relationship banking remains an important factor in SME financing, though often underestimated. Regular engagement with financial institutions, consistent account activity, and open communication about business performance help build familiarity and trust.

SMEs that cultivate these relationships before funding becomes urgent are better positioned to access credit when lending appetite improves and conditions become more favorable.

Environmental and Social Impact

Increasingly, banks are integrating environmental and social risk considerations into their credit assessment frameworks. SMEs are now expected to demonstrate responsible business practices, including compliance with environmental regulations, safe working conditions, and ethical supply-chain management.

Businesses with high environmental exposure, weak labour standards, or unresolved community concerns are more likely to face higher risk premiums or restricted access to financing, regardless of prevailing interest rates. Conversely, enterprises that embed sustainability into their operations enhance their long-term viability and attractiveness to lenders.

As Ghana’s financial sector aligns more closely with global ESG standards, SMEs that proactively manage environmental and social risks will be better positioned to access funding and participate competitively in future growth cycles.

Conclusion: Readiness Is the Real Differentiator

Lower interest rates create a more supportive backdrop for real sector growth, but they do not, on their own, resolve the structural challenges that limit SME access to finance. For many businesses, the central issue is no longer registration or policy direction, but financial discipline, transparency, and readiness.

As Ghana enters this next phase of economic transition, SMEs that strengthen these foundations will be best placed to convert monetary easing into sustainable growth. Policy may open the door, but preparedness ultimately determines who is able to walk through it.

Author:

Ernestina Mensah is a Market Risk Specialist and Economic Policy Analyst with experience in banking and financial markets. She is the Founder of the Glimmer of Hope Foundation, which focuses on empowering young people through education and mentorship.

Latest Stories

-

Trump lashes out at Supreme Court justices over tariffs ruling

37 minutes -

Refrain from mass marketing or public promotional campaigns on virtual assets – BoG to VASPs

2 hours -

Government bans land transit of cooking oil; orders crackdown on customs complicity

2 hours -

NPA engages industry stakeholders on 24-hour economy pilot in petroleum sector

3 hours -

Ablakwa outlines key bilateral agreements with Burkina Faso to boost trade, security and border cooperation

3 hours -

Ghana, Burkina Faso deepen security ties after terrorists kill 8 Ghanaians in Titao

3 hours -

Luv FM launches 7th edition of Primary Schools Quiz; pupils urged to embrace Ghanaian culture

4 hours -

Nollywood star Michael Dappa stuns fans with big chop ahead of new film role

4 hours -

NPA slams gas ‘shortage’ rumours; assures over one month’s cover

4 hours -

BoG, SEC order the removal of all crypto billboards within 48 hours

5 hours -

Majority Leader fires back at Sefwi protesters

6 hours -

New Horizon Fun Games: Vice President calls for stronger national commitment to inclusion

6 hours -

Prof. Amoah warns Africa against becoming China’s ‘Dumping Ground’

6 hours -

President Mahama commissions B5 Plus Steel Ball Mill and Manufacturing Plant to ignite industrial revolution

7 hours -

Fighters demand amnesty for cannabis convicts following massive policy shift

8 hours