Audio By Carbonatix

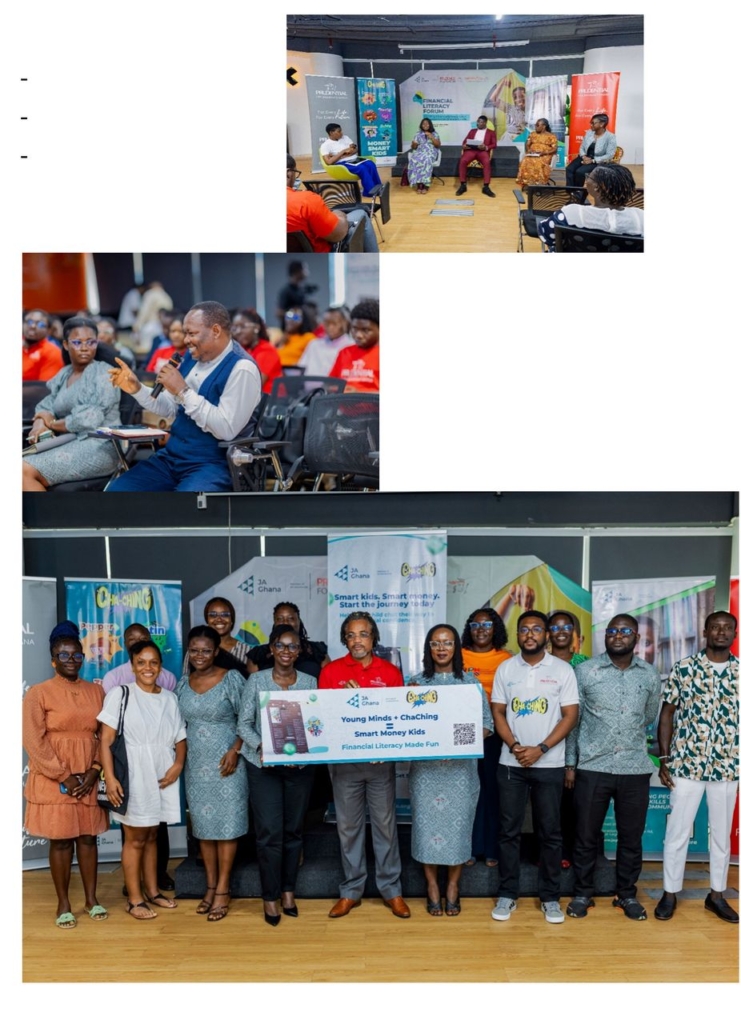

Prudential Life Insurance Ghana, in partnership with Junior Achievement (JA) Ghana have hosted a stakeholder forum in Accra, Ghana’s capital to celebrate the impact of the Cha-Ching Financial Literacy Programme and explore ways to integrate financial literacy into Ghana’s basic education curriculum.

The Cha-Ching program, funded by Prudence Foundation; the community investment and outreach arm of Prudential PLC is designed to teach children essential money management skills using the Earn, Save, Spend, and Donate framework. The initiative is active in Ghana and six other countries, Uganda, Nigeria, Vietnam, Indonesia, Malaysia, and the Philippines.

The forum brought together key stakeholders in Ghana’s education sector, including officials from the Ghana Education Service, school heads, teachers, proprietors, and other partners whose institutions have benefited from the program.

The forum was also used to launch a WhatsApp chatbot to expand the reach of Cha-Ching and financial education to all Ghanaians.

In his remarks, Edem Amesu-Addor, Executive Director of JA Ghana, highlighted the strength of the partnership in promoting financial empowerment among young people.

He said, “Our collaboration with Prudential Life Insurance Ghana continues to empower the next generation of leaders with the financial skills they need to thrive.”

Over the past five years, the Cha-Ching programme has made a remarkable impact in Ghana, reaching over 400 schools, training more than 900 educators and volunteers, and touching the lives of over 36,000 students across six regions.

During a panel discussion, Gloria Henrietta Yamson, Acting Chief Commercial Officer of Prudential Life Insurance Ghana, reaffirmed the company’s commitment to community empowerment.

She said, “Empowering communities to thrive economically and socially is at the heart of what we do. We encourage parents and educators to nurture financial responsibility in children from an early age.”

The panel featured experts from the public and private education sectors, finance, and civil society. All participants unanimously agreed that integrating financial literacy into Ghana’s basic education curriculum is essential for securing the financial wellbeing of future generations and the county.

This vision aligns with Prudential Life Insurance Ghana’s mission; “to be the most trusted partner and protector for this generation and the next, by providing simple, accessible financial solutions.” The company remains committed to fostering financial empowerment across Ghana—one child, one classroom, and one community at a time.

Latest Stories

-

Karpowership Ghana empowers female engineering students at UG to mark International Women’s Day

36 minutes -

Government weighs options on Ghanaian troops in Lebanon after missile attack

39 minutes -

Dumelo commits to supporting UG’s School of Engineering Sciences at during IWD engagement

44 minutes -

Ghana’s tax system from a gender lens: Why women-entrepreneurs are integral to tax revenue mobilisation

51 minutes -

Mahama to embark on 5-day working visit to South Korea

1 hour -

When women lead, mining thrives…the story of Newmont’s Abena Acheampomaa Ankomah

1 hour -

COPEC urges creation of strategic fuel reserve fund to shield Ghana from supply shocks

1 hour -

Empowering women key to national prosperity – Mahama marks International Women’s Day

1 hour -

Brogya Genfi rejects claims of leadership gap at Defence Ministry

2 hours -

Explosion reported outside US embassy in Oslo, police say

4 hours -

Trump accuses UK PM of seeking to ‘join wars after we’ve already won’

4 hours -

See the areas that will be affected by ECG’s planned maintenance today, March 8

5 hours -

First Lady champions ‘Give to Gain’ spirit for International Women’s Day

5 hours -

Ghana@69: Ghana mission in Canada promotes investments and partnerships

6 hours -

Lebanon condemns ‘grave breach’ as missiles strike Ghanaian UN base

6 hours