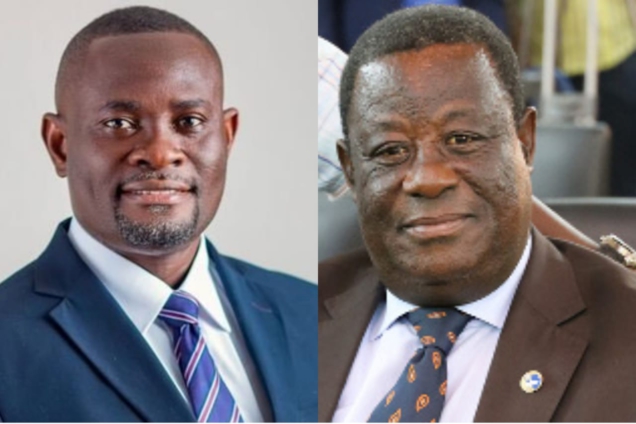

Roads and Highways Minister, Kwasi Amoako-Attah, and Deputy Finance Minister, John Kumah have given contrary indications of government's plans for proceeds from the proposed Electronic Transaction (E-levy).

Addressing the inaugural ceremony of the Ashanti Regional Youth Parliament on March 2, John Kumah, indicated that the revenue from the E-Levy will not be used as collateral for the government’s debt.

According to him, the revenue generated from E-Levy will be a game-changer in the government’s quest to address the infrastructural deficit in the country.

“We need revenue to construct roads. We have a huge infrastructural gap in our country. The road tolls were giving the country 78 million cedis annually.

The e-levy was going to give about 6.9 billion cedis. If Ghana was going to set aside 1.5 billion cedis from the e-levy to construct roads. It means there is an increase in capacity. Therefore, it’s untrue the E-levy will be used as collateral,” he said.

Touching on the claims of a dwindling economy, he dismissed the assertions that government will not be able to pay the salaries of public sector workers in some months to come.

But in contrast to this, Roads and Highways Minister, Kwasi Amoako-Attah, has revealed that the government will securitise revenue to be generated from the Electronic Transactions Levy (E-levy) to raise bonds for road construction.

Speaking on the floor of Parliament on Friday, he indicated that the government looks forward to the immediate passage of the E-levy Bill to accelerate the country’s revenue collection drive.

He made this revelation in response to an urgent question from the Minority, on how his outfit is faring, following the abolishing of the road toll.

“The government, in its wisdom, has proposed the passage of the E-levy to bring in more revenue to build the road infrastructure of our country for all of us,” he said.

“Government is looking forward to the passage of the E-levy that will bring in greater revenue that will be securitised and then used to raise a bond if possible, to build the road sector infrastructure,” he disclosed.

Meanwhile, government is still rallying support for the Bill which remains a controversial subject on the train of public discourse. In this regard, some government officials, including the Finance Minister, Ken Ofori-Atta and the Information Minister, Kojo Oppong Nkrumah continued to argue for the need for the passage of the E-levy at the 5th town hall meeting at Ho, on Friday.

E-Levy

Finance Minister, Ken Ofori-Atta, during the presentation of the 2022 budget announced that government intends to introduce an Electronic Transactions Levy (E-levy).

The Levy, he revealed, is being introduced to “widen the tax net and rope in the informal sector.”

The proposed Levy, which was expected to come into effect in January, 2022, charges 1.75% on the value of electronic transactions.

It covers mobile money payments, bank transfers, merchant payments, and inward remittances. There is an exemption for transactions up to GH¢100 per day.

Although the government has argued that it is an innovative way to generate revenue, scores of citizens and stakeholders have expressed varied sentiments on its appropriateness, with many standing firmly against it.

Even though others have argued in support of the Levy, a section of the populace believe that the 1.75% E-levy is an insensitive tax policy that will deepen the already prevailing hardship in the country.

Latest Stories

-

Paris 2024: Opening ceremony showcases grandiose celebration of French culture and diversity

3 hours -

How decline of Indian vultures led to 500,000 human deaths

3 hours -

Paris 2024: Ghana rocks ‘fabulous fugu’ at olympics opening ceremony

4 hours -

Trust Hospital faces financial strain with rising debt levels – Auditor-General’s report

4 hours -

Electrochem lease: Allocate portions of land to Songor people – Resident demand

5 hours -

82 widows receive financial aid from Chayil Foundation

5 hours -

The silent struggles: Female journalists grapple with Ghana’s high cost of living

5 hours -

BoG yet to make any payment to Service Ghana Auto Group

5 hours -

‘Crushed Young’: The Multimedia Group, JL Properties surprise accident victim’s family with fully-furnished apartment

5 hours -

Asante Kotoko needs structure that would outlive any administration – Opoku Nti

6 hours -

JoyNews exposé on Customs officials demanding bribes airs on July 29

6 hours -

JoyNews Impact Maker Awardee ships first consignment of honey from Kwahu Afram Plains

7 hours -

Joint committee under fire over report on salt mining lease granted Electrochem

8 hours -

Life Lounge with Edem Knight-Tay: Don’t be beaten the third time

8 hours -

Pro-NPP group launched to help ‘Break the 8’

8 hours