Audio By Carbonatix

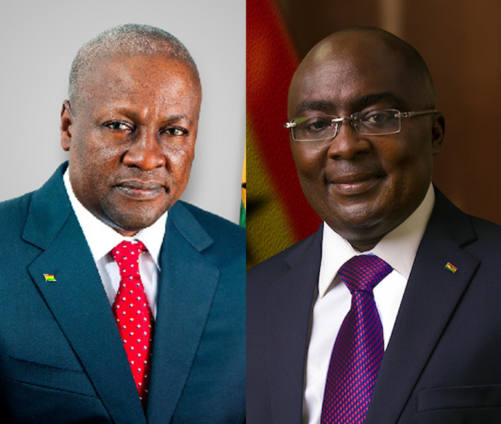

Some tax analysts have cast doubts over the ambitious tax proposals announced in the manifestos of the two major political parties, the New Patriotic Party (NPP), and the National Democratic Congress (NDC) to be rolled out under an International Monetary Fund (IMF) programme.

Both parties have promised to remove the Electronic Transaction Levy, the COVID-19 -Levy and reduce some taxes at the ports.

But Speaking to Joy Business, tax analyst Francis Timore Boi cautioned that the blanket removal of the taxes without alternative plans to boost revenue may derail the IMF programme.

He argued for example that the Covid-19 levy and the E-levy combined are projected to give the government about GH₵7.7 billion in 2025.

Mr Timore Boi expressed worry that no alternative revenue generation model has been proposed by the two major parties to make up for the shortfall that may occur as a result of the proposal to remove the taxes.

Read Also: NPP or NDC can scrap E-levy and betting tax, it won’t cost the economy much – Kwasi Peprah

He warned that this could go contrary to the IMF programme aimed at improving revenue and redirecting government expenditure to critical areas to help alleviate poverty.

“If any policy you seek to introduce may bring down revenue, the IMF may not be happy with that. You are planning to abolish the COVID-19 levy and the e-levy. COVID-19 levy alone in 2025 is estimated to bring in about GH₵5.6 billion. If you take it off, how are you going to replace it? In 2025, we are expecting E-levy to give us about GH₵2.1 billion and in 2026, it is projected to increase to about GH₵2.4 billion”.

Stressing the need to assess such tax proposals, Mr Timore Boi said the political parties must provide a workable budget that will provide a foresight of how the revenue shocks that will be created will be remedied.

“It is important because the budget has not shown us that you are going to introduce new taxes”.

He added that even though e- levy is an unpopular tax and the general sentiment is that it should go, there must be a discussion on how to fill the financial holes that will be created after its abolishment.

Latest Stories

-

GSTEP inducts Greater Accra finalists, equips young innovators with critical skills for regional showdown

5 minutes -

CID boss warns against school violence after athletics attack in Swedru

14 minutes -

Kotoka Int. Airport to introduce 3D scanners, end shoe removal for passengers

15 minutes -

Mahama urges private sector participation in industrial water supply reforms

15 minutes -

8 injured, 3 in critical condition after SHS violence – Awutu Senya DCE

27 minutes -

Interior Minister supports prison inmates with Ramadan food donation

27 minutes -

COA targets US$10m in investments for blue food sector through innovation hub

33 minutes -

Manufacturing must contribute to 15% of GDP by 2030 – Mahama targets

36 minutes -

Sports Minister orders NSA Director General to revoke 17 staff appointments over due process breach

40 minutes -

Stabilisation alone won’t transform economy – Mahama

42 minutes -

Aaron Kanor appointed Acting Commissioner of Customs

55 minutes -

Ashanti police kill suspected robbery kingpin; four accomplices arrested

1 hour -

UK says ‘nothing is off the table’ in response to US tariffs

1 hour -

Fifteen killed after helicopter crashes during Peru flood rescue

1 hour -

Briton among 19 killed in Nepal bus crash

1 hour