Audio By Carbonatix

Finance Minister Dr Cassiel Ato Forson has taken a firm stance against using taxpayer money to recapitalise the Bank of Ghana (BoG).

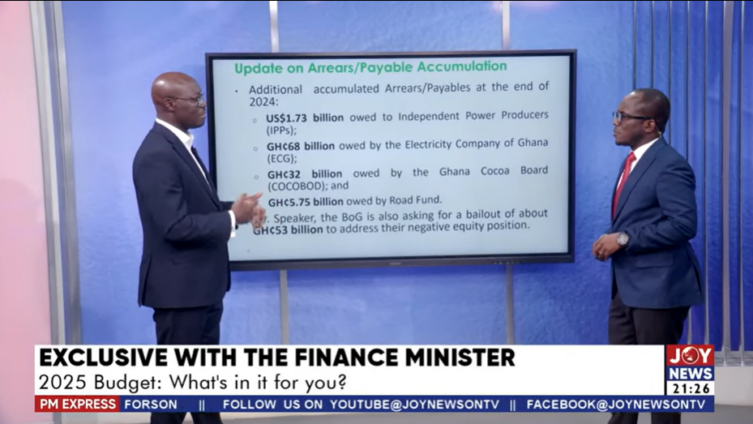

This follows revelations that the central bank had signed a memorandum of understanding (MoU) with the previous administration to receive a ¢53 billion bailout.

Speaking on Joy News’ PM Express on Tuesday, March 11, after presenting the 2025 Budget Statement to Parliament, Dr Forson made it clear that the government could not afford such a move at this time.

"On the back of the report that showed the ¢60 billion hole, remember, in my previous life as the Minority Leader, I kept saying that the Bank of Ghana had generated so much debt, so much deficit. As a result, their balance sheet is not healthy, and they have generated negative equity," he stated.

Dr Forson revealed that despite the financial crisis at the central bank, he had instructed BoG to find internal solutions rather than burdening the taxpayer.

"Apparently, the previous administration in the Bank of Ghana had signed an MoU for the Government of Ghana, or the taxpayer, to recapitalise the central bank with ¢53 billion. I've asked the Bank of Ghana to look within, cut expenditure because the taxpayer cannot afford ¢53 billion."

He questioned the bank’s spending priorities, particularly in light of its recent investments.

"First of all, they have to look within. You know, you've seen their new Head Office, a very big building. They have a choice—a choice to sell and lease back if they want. They have to look within and cut expenditure and reduce events. The taxpayer cannot afford ¢53 billion."

Dr Forson stressed that allocating such a significant sum to the BoG would deprive citizens of essential services and infrastructure.

"Giving ¢53 billion to the central bank will simply mean that we will have to deny the taxpayer some public good, like roads, like schools, like hospitals. Is that what we want? Can we afford it? At this stage, the answer is no. We cannot afford that. And so the central bank must look within.

"They have hotels, like guest houses and others. Why are they in the guest house business? They should sell some of them and use the money to recapitalise. The taxpayer cannot be used as a punching bag."

Despite his firm stance, Dr. Forson hinted at a willingness to negotiate, provided BoG made significant efforts to address its financial problems internally.

"If the central bank is able to come to me with a reasonable offer, we can have a conversation. But it must start from them."

He also suggested an alternative long-term approach for the bank’s recapitalisation.

"I have also said that they may have to consider winding back their profit over the next 10 years to recapitalise. That can also be done."

Latest Stories

-

UK social media campaigners among five denied US visas

5 hours -

BP sells stake in motor oil arm Castrol for $6bn

5 hours -

GPL 2025/26: Asante Kotoko beat Eleven Wonders to go third

7 hours -

Algerian law declares France’s colonisation a crime

7 hours -

Soldiers remove rival Mamprusi Chief Seidu Abagre from Bawku following Otumfuo mediation

8 hours -

Analysis: How GoldBod’s operations led to a $214 million loss at the BoG

8 hours -

Why Extending Ghana’s Presidential Term from Four to Five Years Is Not in the Interest of Ghanaians

8 hours -

Young sanitation diplomat urges children to lead cleanliness drive

8 hours -

Energy sector shortfall persists; to balloon to US$1.10bn in 2026 – IMF

8 hours -

Gov’t secures $30m Chinese grant for new university of science and technology in Damongo

8 hours -

Education Minister commends St. Peter’s SHS for exiting double-track, pledges infrastructure support

8 hours -

ECG to be privatised – IMF reveals in Staff Report

8 hours -

Accra Unbuntu Lions Club impacts 500,000 Ghanaians in 5 years of social service

8 hours -

VALCO Board holds maiden strategic meeting with management

9 hours -

African Festival: Nollywood star Tony Umez joins Nkrumah musical in Accra

9 hours