Audio By Carbonatix

Three men have admitted running a £70m tree-planting scam, taking advantage of changes that gave people early access to their pension pots.

Matthew Pickard, Stephen Greenaway, and Paul Laver all pleaded guilty to fraudulent trading in relation to Bournemouth-based Ethical Forestry Limited.

The now-defunct business cold-called people, offering them a pension review in which they were advised to withdraw money from their employer's schemes and invest it in tree plantations in Costa Rica.

But investigators said the three had no plans to look after or harvest the timber.

"Whether these three individuals started the business as a fraud, or it just developed, we will never know," said Jason Williams, who led the team at the Serious Fraud Office (SFO).

Pension liberation fraud schemes offer to give people early access to their funds, and involve transferring the pension pot to a scheme set up by fraudsters.

Several hundred employees would contact people from Ethical Forestry's call centre in Bournemouth, according to the SFO.

Rather than receiving independent advice, those who agreed to proceed entered what the investigators described as "a closed loop".

The firm offering the advice had been hired by Pickard, Greenaway and Laver and was paid commission on everyone they referred back to Ethical Forestry.

"In effect, once the member of the public had been convinced, out of the blue, to have a pension review, they were always going to be referred back to Ethical Forestry," explained Jason Williams.

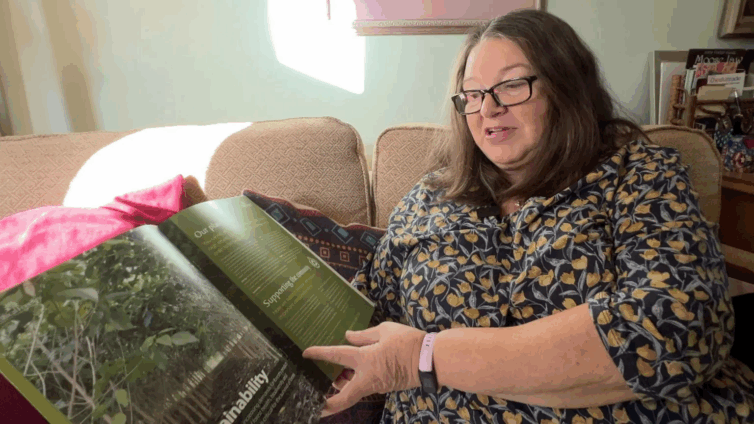

Julie Bertelli from Oxfordshire was one of the more than 3,000 people who fell victim to the scam.

She did not have a workplace pension, but wanted to invest some money left to her by a relative to help with her retirement.

Investing in Costa Rica, as it became the first tropical country to reverse deforestation, looked like it would not only be good for the planet, but also good for her bank balance.

'Very lavish lifestyles'

That was according to the brochures and seasonal updates she still keeps in a glossy folder, with Ethical Forestry's green sunshine logo on the front.

The paperwork even included GPS coordinates for all "her" trees, which she named "Brenda's Grove" in recognition of her late mother's love of forests.

But when she searched for them online, satellite images showed there was nothing there.

"I was shocked and appalled that this was all a big scam. I couldn't believe it, that I'd invested all that money," she said.

Julie later found out that her £12,000 stake made her a "relatively small fish, but to me, that is an awful lot of money that I've put in there".

The SFO said by 2012 it was clear the scheme was never going to pay back investors, let alone give them a return on their cash.

Instead of winding Ethical Forestry up, the directors gathered in more money, creating a so-called "Ponzi" scheme, and using some of the cash coming in to make small payments to existing investors.

Far more money, though, went to the directors, who also bought a complex tax avoidance scheme to protect their income.

"During the period, the three individuals withdrew £15m," according to Jason Williams.

"Certainly, some have had very lavish lifestyles, with luxury houses in Sandbanks.

"One defendant had a number of supercars that he went through, but there was very little to show for the money that had been taken, by the time we got there."

Ethical Forestry Limited was not alone in targeting people, largely in defined benefit schemes.

But this has been one of the largest and most complex investigations, according to the SFO.

Watchdogs have run a series of advertisements, warning people of the risks involved.

They were even the subject of a storyline in the BBC EastEnders soap, following a collaboration with The Pensions Regulator.

The regulator said its threat assessment indicated there was a continued decline in reports of pensions liberation fraud.

But that's little consolation for the likes of Julie Bertelli and the other Ethical Forestry victims.

Now living on her state pension at her home in South Oxfordshire, she accepts that the chances of seeing any of the money she hoped would provide a useful cushion for her retirement are probably zero.

"It's gone," she said, "whispers in the air. It's a shame, so tragic, and I'm so cross.

"But I'm very glad that they've been brought to justice."

Latest Stories

-

JOY FM rolls out “Safari Experience” — a refreshing Ghana Month escape into nature, culture and connection

60 minutes -

Ghana loses over GH¢4.5bn annually to traffic congestion, new study on urban mobility shows

1 hour -

ADB unveils new corporate cloth, determines to dominate industry

1 hour -

Peak Milk extends Ramadan support following courtesy visit to national Chief Imam

1 hour -

No solo bid for Ken Agyapong — Joojo Rocky Obeng dismisses ‘third force’ calls as politically ridiculous

1 hour -

Today’s Front pages: Friday, February 13, 2026

2 hours -

5 arrested for open defecation at Osu Cemetery

2 hours -

A Home that Travels: How the Diaspora carries Pan-Africanism across borders

2 hours -

Obituary: Hon. Stanley Basil Bade Carboo

3 hours -

Government to absorb COCOBOD’s $150m losses as Cabinet directs immediate cocoa purchases – Finance Ministry

3 hours -

Mpraeso MP demands immediate probe and arrest over alleged exploitation of young Ghanaian women

3 hours -

‘No bed syndrome,’ and how a hit-and-run victim was refused emergency care by Ridge, Police, Korle Bu hospitals for close to 3 hours before he died

3 hours -

Give Love a second chance on Valentine’s Day – Counsellor Perfect

3 hours -

GSS generates the numbers that drive national development – Government Statistician Dr Iddrisu

4 hours -

We are not policy advisers, we generate the data – Government Statistician clarifies GSS’ role

4 hours