Audio By Carbonatix

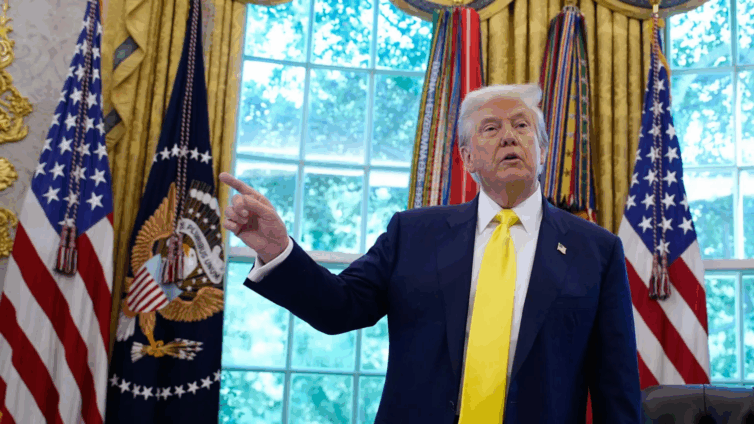

US President Donald Trump is pushing to make it easier for Americans to use retirement savings to invest in cryptocurrencies, private equity, property, gold and other kinds of non-traditional assets.

On Thursday, he ordered regulators to look for ways to change rules that might discourage employers from including such offerings in workplace retirement accounts, known in the US as 401ks.

The move is intended to eventually give everyday workers new access to investments formerly reserved for wealthy individuals and institutions, while opening up previously untouched pools of funding for firms in those fields.

But critics say it could increase risks for savers.

Most employers in the US do not offer traditional pensions, which come with a guaranteed payout after retirement.

Instead, employees are given the option of contributing part of their pay cheque to investment accounts, with employers typically bolstering with additional contributions.

Government rules have historically held the firms offering the accounts responsible for considering factors such as risk and expense.

In the past, employers have shied away from offering investments like private equity, which often have higher fees and face fewer disclosure requirements than public companies and can be less easy to convert to cash.

The order gives the Department of Labor 180 days to review rules and experts said any change was unlikely to be felt immediately.

But investment management giants such as State Street and Vanguard, known for their retirement accounts, have already announced partnerships with the likes of alternative asset managers Apollo Global and Blackstone to start offering private-equity focused retirement funds.

Trump's personal business interests include firms involved with crypto and investment accounts.

The Department of Labor in May rescinded guidance from 2022 that urged firms to exercise "extreme care" before adding crypto to investment menus in retirement accounts.

During Trump's first term, the Department of Labor issued guidance aimed at encouraging retirement plans to invest in private equity funds, but concerns about litigation limited take-up and former President Joe Biden later revoked it.

Latest Stories

-

Kingsford Boakye-Yiadom nets first league goal for Everton U21 in Premier League 2

17 minutes -

We Condemn Publicly. We Download Privately — A Ghanaian Digital Dilemma

2 hours -

Renaming KIA to Accra International Airport key to reviving national airline – Transport Minister

3 hours -

Interior Minister urges public not to share images of Burkina Faso attack victims

3 hours -

Unknown persons desecrate graves at Asante Mampong cemetery

3 hours -

I will tour cocoa-growing areas to explain new price – Eric Opoku

3 hours -

Ghana to host high-level national consultative on use of explosive weapons in populated areas

3 hours -

Daily Insight for CEOs: Leadership Communication and Alignment

4 hours -

Ace Ankomah writes: Let’s coffee our cocoa: My Sunday morning musings

4 hours -

Real income of cocoa farmers has improved – Agriculture Minister

4 hours -

I’ll tour cocoa-growing areas to explain new price – Eric Opoku

4 hours -

Titao attack should be wake-up call for Ghana’s security architecture – Samuel Jinapor

4 hours -

New Juaben South MP Okyere Baafi condemns Burkina Faso attack, demands probe into government response

4 hours -

A/R: Unknown assailants desecrate graves at Asante Mampong cemetery

4 hours -

What is wrong with us: Africans know mining, but do not understand the business and consequences of mining

5 hours