Audio By Carbonatix

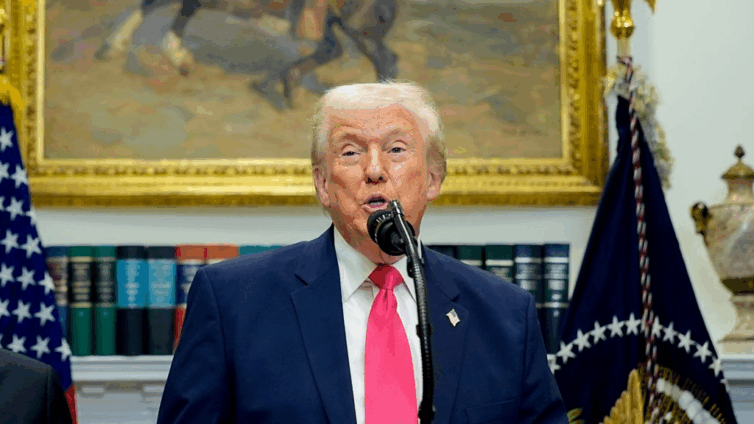

President Donald Trump said on Tuesday he would be announcing his choice to succeed Jerome Powell as head of the Federal Reserve early next year, further teasing out a months-long audition process despite having said he already knows who he will pick to lead the world's most important central bank.

In remarks at a cabinet meeting, Trump also said Treasury Secretary Scott Bessent - who has led the search process - does not want the top Fed job, and the president did not indicate who his preference may be.

Trump told reporters on Sunday he knows who he plans to pick as the successor to Powell, whose run as Fed chief comes to an end in May, but would not answer when asked if that choice was Kevin Hassett, his top economic adviser and the favourite in online wagering markets.

He said again on Tuesday that he has narrowed the list to one person.

"I guess a potential Fed chair is here, too. Am I allowed to say that? Potential. He's a respected person, that I can tell you. Thank you, Kevin," Trump said at a later White House event on Tuesday.

Hassett, 63, who chaired the White House's Council of Economic Advisers during Trump's first term, has proven his loyalty to the president through regular, if not weekly, television appearances on CNBC, Fox News and other channels, where he has endorsed Trump's sweeping import tariffs and calls for lower interest rates.

Trump, an avid television watcher, likely sees Hassett often, as opposed to most of the other candidates. Hassett, whose office is in the West Wing of the White House, also has direct access to the president and has helped shape his views on trade and economic issues, as well as monetary policy.

ADVOCATES OF LOWER INTEREST RATES

The others in the mix to succeed Powell include two sitting Fed governors - Michelle Bowman and Christopher Waller - former Fed Governor Kevin Warsh, and BlackRock's Rick Rieder. Bessent has said he has completed two rounds of interviews with each of them and was planning to present a narrowed list of finalists to Trump and other White House officials this month.

Trump has made no secret of his preference for someone who favours lower rates, and Hassett and the others have been vocal advocates for exactly that, a preference that could be challenged by a buoyant economy that has made many Fed officials wary of easier policy.

With an end to the process approaching, economists and financial markets have turned to what Trump's choice will mean for the monetary policy outlook under a new Fed leader likely to face an economy regaining momentum next year but struggling to create jobs and still throwing off elevated inflation.

"Regardless of who leads the Fed ... monetary policy is determined by economic conditions," James Egelhof, chief U.S. economist for BNP Paribas, said in a conference call about the bank's 2026 outlook.

That outlook included the expectation that resilient growth and persistent inflation would allow for just one rate cut next year following the one anticipated at the U.S. central bank's December 9-10 meeting, with Trump's new Fed chief left holding borrowing costs steady amid sticky 3% inflation.

The Fed has a 2% inflation target.

"The data will suggest little need for aggressive rate cuts beyond those we expect to be delivered," Egelhof said.

If the economy does evolve along that path, it could prove an early test of the new Fed chief's separation from Trump, and in particular his call for ultra-low rates. If Hassett gets the job, it could test his faith in the ability of supply-side policies to produce non-inflationary growth above the trend most of his colleagues believe is likely.

Judgments about the impact of artificial intelligence on trend growth, labor demand, and wages will likely be a central debate at the Fed in coming months and years.

RESISTANCE TO MORE EASING

The monetary policy outlook also hinges on a potentially fractious group of policymakers who will end up serving alongside the next Fed chief.

Powell - whom Trump long regrets having nominated for the top job in late 2017 - does not have to leave the Fed entirely after his leadership term ends in May, and he has not indicated what he will do.

Three other members of the Fed's Board of Governors were appointed by former President Joe Biden, and the remaining three are Trump appointees. The most recent among them - Stephen Miran, another Trump economic adviser and the most in favor of deep rate cuts - would have to step aside to make room for the new Fed chief nominee should Powell not resign as a governor after his leadership term expires or if Trump fails in his bid to remove Fed Governor Lisa Cook, one of the Biden appointees. Cook's case is now before the U.S. Supreme Court.

Analysts at LH Meyer, a research firm headed by former Fed Governor Larry Meyer, say they have "long assumed" that Powell will remain on the Fed board after stepping down as its chief as a buffer against Trump's efforts to exert control at the central bank. The analysts added that after Trump's effort to fire Cook, "Powell might believe in the cause even more strongly now."

Then there are the dozen regional Fed bank presidents, a flank that has featured the most vocal opponents to further rate cuts. The central bank has lowered rates by a quarter of a percentage point two times since September. One of the regional Fed presidents already dissented against the second cut, and two others with votes on policy this year have signaled they may resist a third one next week.

And next year's crop of rotating Federal Open Market Committee voters appears equally sceptical of more easing with inflation now in its fifth year above the target and the job market softening but not cratering.

Assuming policymakers' latest forecast for just one percentage-point rate cut in 2026 holds, "the new Trump Fed chair might be able to push through a second 2026 cut ... but no more," the LH Meyer team said, unless unemployment rises through the 4.5% level or inflation falls faster to target than anticipated.

Latest Stories

-

Daily Insight for CEOs: Prioritising scalable opportunities

5 minutes -

Death toll in ‘surprise’ attack in South Sudan rises to 178, local official says

7 minutes -

Chief Imam condemns killing of Iran’s supreme leader, calls for peace and respect for sovereignty

9 minutes -

Mental Resilience in Banking: Maintaining cognitive balance in high-stress financial decisions

17 minutes -

High Court dismisses bid to halt DVLA’s 2026 vehicle number plate contract

19 minutes -

The book of orphans with parents

53 minutes -

Liberia’s Ambassador to Ghana condoles family of slain Liberian, urges Justice

58 minutes -

The Kenkey Festival: 10 years of cultural projection through cuisine

1 hour -

Prayer or Poison? The deadly cost of fake prophets and miracle materials in Ghana

1 hour -

Seven decades of faith: Rev. Christie Doe Tetteh launches 70th birthday celebrations

1 hour -

Climate Evidence: Illegal logging of shea and other economic trees driving deforestation in Upper West

1 hour -

Bili Odum Writes: I am the blocker…

1 hour -

Ayawaso East by-election: I’ve advised all my supporters to stay calm and law-abiding – Baba Jamal

2 hours -

Chief of Staff’s committee completes review of 2,080 post-election public service appointments

2 hours -

Bush burning and biodiversity: Bonyanto’s 10-year model of zero-fire record

2 hours