Audio By Carbonatix

A coalition of civil society organizations, the Economic Governance Platform, has partly blamed Ghana’s recurring economic crisis on unguarded spending during election years.

According to the platform, incumbent political parties disregard all economic cautions and "spend recklessly" aiming to maintain power, leading the economy into shambles and running the country into debt.

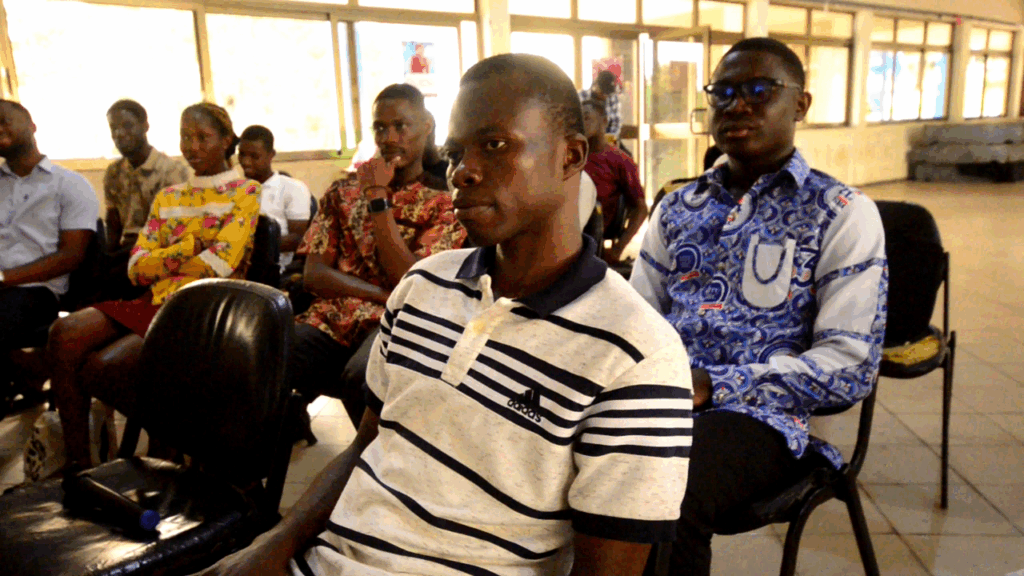

The Coordinator of the Economic Governance Platform, Abdul Karim Mohammed, made this known at an engagement organized by his outfit to enlighten the youth on Ghana’s economic issues, debt, and related topics.

He said that reports by the International Monetary Fund (IMF) have indicated that successive governments ignore the conditionalities on economic recovery and spend on electioneering activities to woo voters in their bid to maintain political power.

“It has been a cycle of falling into a debt trap. When we run to the IMF for a bailout, they help us stabilize and just when it appears that we are in good shape and the economy is about to take off we find ourselves in another debt trap again. So, it has become a major cycle.”

“One key observation is that we always seem to use the election or political cycle to mess with our economy. If you look at the current review from the IMF, it indicates that there were major trespasses in the implementation of the program.”

“We overshot a number of the indicators, our deficit, inflation targets, and the rest. It was simply because during election years, we seem to throw away every caution to the wind all for political expediency. It has been government after government”, he stressed.

He emphasized that leaders of the country must adopt strategies to break the cycle of incurring debt due to reckless spending of state resources for political gains.

“We need to break that cycle at some point because it is not taking us anywhere. We end up spending resources that will otherwise be used or invested in development servicing debt and leaving a lot more of our citizens behind in terms of development”, he said.

He pointed out the lack of transparency and streamlined management of the country’s debt where successive governments decide and determine “what must be part of the debt book”.

“When we go to the IMF, then we are compelled to bring everything into the balancing of the national debt, to the extent that the last one, when the debt sustainability analysis was done, we were found to have exceeded our debt, we were 105 percent of our GDP to debt ratio which was way above the 75% limit for lower middle income countries like Ghana”, he said.

Mr. Mohammed said that there are several internal factors which had led Ghana to consistently go cup in hand to international creditors for funds to rescue the ailing economy.

These he said have been slot pulsa compiled in the “Sustainable Debt Management in Ghana” report published by the Economic Governance Platform.

He identified structural weaknesses in the legislative approval of loans, stressing the need for ample time and adequate scrutiny by parliament before approval is given.

"These are technical financial documents prepared by experts, yet MPs are often given limited time to review them before approval. The consequences fall on the entire nation, as scarce resources are redirected from development projects to debt servicing," he said.

Latest Stories

-

Running Ghana by elections, not by plans: Galamsey as the consequence

1 second -

Israeli theatre scholar Prof Roy Horovitz brings cultural exchange to Ghana

4 minutes -

Awula Serwaa slams Amansie Central Assembly over ‘Galamsey Tax’ defence

17 minutes -

High airport infrastructure charges making Ghana’s aviation sector uncompetitive – stakeholders

19 minutes -

Mining Indaba: African integration requires collective will – Armah-Kofi Buah

22 minutes -

Drowning in hunger: Nawuni farmers struggle to survive amidst floods and climate change

24 minutes -

15 women arrested in New Juaben South over human trafficking, sex work charges

24 minutes -

Arrest officials issuing illegal mining licences, Ashigbey demands

25 minutes -

Nyasabga’s women farmers bear the brunt of climate change and land degradation, others turn to smart agriculture

41 minutes -

‘A Tax for Galamsey’: JoyNews petitions President Mahama to take action on investigative documentary

46 minutes -

From Ballot Lines to Academic Laurels: Multimedia’s Akwasi Agyeman earns PhD at University of Ghana

46 minutes -

Ghana’s gold refining deal could reduce commodity vulnerability – EM Advisory

53 minutes -

PPPs key to meeting Ghana’s infrastructure goals in 2026 – EM Advisory

54 minutes -

Ghana faces fiscal test as IMF programme ends in mid-2026, says EM Advisory

56 minutes -

Lawyer charged with defrauding a US-based nurse of $150k

59 minutes