Audio By Carbonatix

Panic gripped Wall Street on Wednesday as investors fled shares amid fears over a US-China trade war and the health of the global economy.

The three main stock markets closed 3% down, with analysts pointing to signals the US may be heading for recession.

Weak data from Germany and China, and another attack on the US central bank by President Donald Trump, helped fuel a rush for haven assets like gold.

Analyst Oliver Pursche, from Bruderman, said the global picture was precarious.

"What's happening in Hong Kong, what's happening with Brexit and the trade war, it's all a mess," the chief market strategist said. "Every central bank around the world is trying to prop up economies and every politician around the world is trying to destroy economies."

News that Germany's GDP contracted in the second quarter, and that China's industrial growth in July hit a 17-year low, had already spooked markets in Europe. The FTSE 100 closed down 1.5%, while in Germany and France the markets finished more than 2% lower.

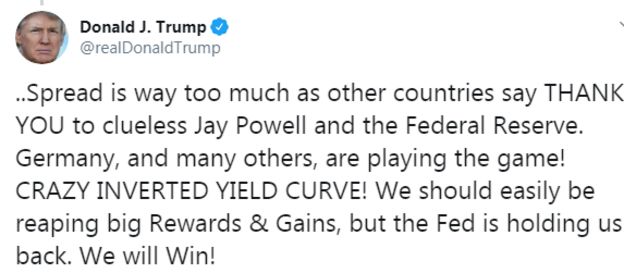

Another fear was that the bond market was flashing recession warnings. The yield on two-year and 10-year Treasury bonds inverted for the first time since June 2007. This odd bond market phenomenon is seen as a reliable indicator of possible recession.

Meanwhile, the CBOE volatility index - the so-called fear index - jumped 4.26 points to 21.78, and spot gold prices rebounded, rising more than 1%. All of the 11 major sectors in the S&P 500 were in the red, with energy and financial suffering the largest percentage loss. Banks also fell heavily, with Citigroup down more than 5%.

Earlier on Wednesday, White House trade adviser Peter Navarro told Fox Business Network the central bank should cut rates by half a percentage point "as soon as possible", an action he claimed would lead to stock markets soaring.

Despite the US delaying the 1 September imposition of tariffs on some Chinese imports into the US, it has done little to ease concerns.

"The challenge is that Trump's trade policy has proven so erratic that you cannot relieve the sense of uncertainty," said Tim Duy, an economics professor at the University of Oregon.

As of September last year, the US central bank had a relatively rosy outlook for the economy, expecting that the stimulus from the Trump administration's massive $1.5tn tax cut package and spending in 2018 would sustain growth and justify steadily higher interest rates.

Mr Trump wants to make the economy a central part of his case for his 2020 re-election campaign.

In an interview scheduled to air on Fox Business Network on Friday, former Fed chief Janet Yellen said she felt the US economy remained "strong enough" to avoid a downturn, but "the odds have clearly risen and they are higher than I'm frankly comfortable with".

Earlier on Wednesday, White House trade adviser Peter Navarro told Fox Business Network the central bank should cut rates by half a percentage point "as soon as possible", an action he claimed would lead to stock markets soaring.

Despite the US delaying the 1 September imposition of tariffs on some Chinese imports into the US, it has done little to ease concerns.

"The challenge is that Trump's trade policy has proven so erratic that you cannot relieve the sense of uncertainty," said Tim Duy, an economics professor at the University of Oregon.

As of September last year, the US central bank had a relatively rosy outlook for the economy, expecting that the stimulus from the Trump administration's massive $1.5tn tax cut package and spending in 2018 would sustain growth and justify steadily higher interest rates.

Mr Trump wants to make the economy a central part of his case for his 2020 re-election campaign.

In an interview scheduled to air on Fox Business Network on Friday, former Fed chief Janet Yellen said she felt the US economy remained "strong enough" to avoid a downturn, but "the odds have clearly risen and they are higher than I'm frankly comfortable with".

Fed attack

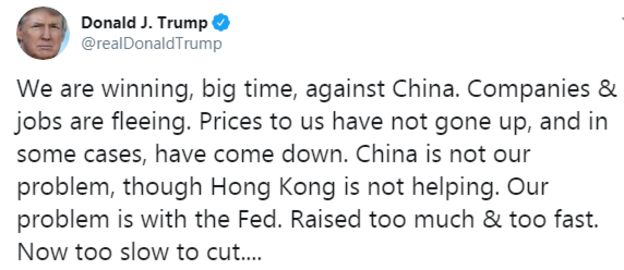

Mr Trump again attempted to deflect the market turmoil onto the US Federal Reserve and its interest rate policy, calling Fed chief Jerome Powell "clueless". In raising interest rates four times last year "the Federal Reserve acted far too quickly, and now is very, very late" in cutting borrowing costs, the president tweeted. "Too bad, so much to gain on the upside!"

Earlier on Wednesday, White House trade adviser Peter Navarro told Fox Business Network the central bank should cut rates by half a percentage point "as soon as possible", an action he claimed would lead to stock markets soaring.

Despite the US delaying the 1 September imposition of tariffs on some Chinese imports into the US, it has done little to ease concerns.

"The challenge is that Trump's trade policy has proven so erratic that you cannot relieve the sense of uncertainty," said Tim Duy, an economics professor at the University of Oregon.

As of September last year, the US central bank had a relatively rosy outlook for the economy, expecting that the stimulus from the Trump administration's massive $1.5tn tax cut package and spending in 2018 would sustain growth and justify steadily higher interest rates.

Mr Trump wants to make the economy a central part of his case for his 2020 re-election campaign.

In an interview scheduled to air on Fox Business Network on Friday, former Fed chief Janet Yellen said she felt the US economy remained "strong enough" to avoid a downturn, but "the odds have clearly risen and they are higher than I'm frankly comfortable with".

Earlier on Wednesday, White House trade adviser Peter Navarro told Fox Business Network the central bank should cut rates by half a percentage point "as soon as possible", an action he claimed would lead to stock markets soaring.

Despite the US delaying the 1 September imposition of tariffs on some Chinese imports into the US, it has done little to ease concerns.

"The challenge is that Trump's trade policy has proven so erratic that you cannot relieve the sense of uncertainty," said Tim Duy, an economics professor at the University of Oregon.

As of September last year, the US central bank had a relatively rosy outlook for the economy, expecting that the stimulus from the Trump administration's massive $1.5tn tax cut package and spending in 2018 would sustain growth and justify steadily higher interest rates.

Mr Trump wants to make the economy a central part of his case for his 2020 re-election campaign.

In an interview scheduled to air on Fox Business Network on Friday, former Fed chief Janet Yellen said she felt the US economy remained "strong enough" to avoid a downturn, but "the odds have clearly risen and they are higher than I'm frankly comfortable with".DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Latest Stories

-

The book of orphans with parents

10 minutes -

Liberia’s Ambassador to Ghana condoles family of slain Liberian, urges Justice

15 minutes -

The Kenkey Festival: 10 years of cultural projection through cuisine

25 minutes -

Prayer or Poison? The deadly cost of fake prophets and miracle materials in Ghana

28 minutes -

Seven decades of faith: Rev. Christie Doe Tetteh launches 70th birthday celebrations

41 minutes -

Climate Evidence: Illegal logging of shea and other economic trees driving deforestation in Upper West

41 minutes -

Bili Odum Writes: I am the blocker…

45 minutes -

Ayawaso East by-election: I’ve advised all my supporters to stay calm and law-abiding – Baba Jamal

51 minutes -

Chief of Staff’s committee completes review of 2,080 post-election public service appointments

59 minutes -

Bush burning and biodiversity: Bonyanto’s 10-year model of zero-fire record

1 hour -

Baba Jamal votes, calls for peaceful election in Ayawaso East by-election

1 hour -

Legal Education Reform Bill, 2025: Analysis and recommendations for a transformative legal training in Ghana

1 hour -

Police presence at polling stations speaks negatively of our democracy — Boakye Agyarko

1 hour -

Gov’t to commence enrollment for affordable homes under National Homeownership Fund

1 hour -

We make the wrong choices when money rules elections – Boakye Agyarko

1 hour