Audio By Carbonatix

The Chief Executive of the Ghana National Chamber of Commerce (GNCCI) says government must not overburden the private sector in its bid to secure an International Monetary Fund (IMF) bailout.

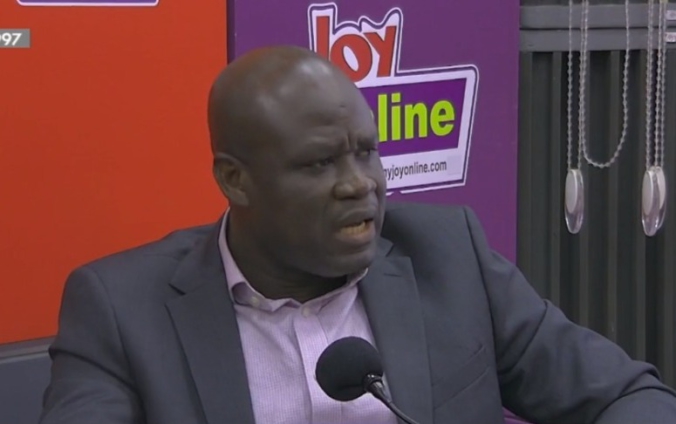

Speaking in an interview on Joy FMs Top Story on Tuesday, Mr Mark Badu-Aboakye suggested that government reduces its expenditure instead of introducing new taxes.

He added that “when you [government] help the businesses to grow and you don’t overburden them at the production level and they grow and excel and they make a lot of revenue, you will get a lot of money from corporate tax.”

“You [Government] don’t have to overburden the private sector to get your revenue and ask us to tighten our belt,” he said.

The CEO of GNCCI stated that the International Monetary Fund will not be pleased if, after giving Ghana the fund, the country's businesses collapse.

He, therefore, urged the government to build and empower the private sector.

His comments come in the wake of Parliament's passing of new revenue measures after reports indicating that the country cannot make progress with the IMF without the revenue measures.

Reacting to this, he said the IMF did not specifically make such a comment but recommended for the revenue measures be enhanced.

According to him, in enhancing the revenue stream, government ought to improve the efficiency of the collection of taxes and ensure compliance.

This, according to him will rake in more revenue than the projected GHȼ4 billion to be accrued from the new revenue measures.

“In Ghana, research has shown that those who are supposed to pay taxes are about 13 million people and less than 5 million are paying. If we rope in all those who are supposed to pay and everyone will be paying, we will get the money that the government is looking for, instead of piling taxes day in and out on the few businesses and individuals they can identify.”

According to him, the approach of pilling taxes on businesses is “a lazy way of getting the revenue.”

Mr Badu urged government to abolish tax exemptions, adding that a lot of revenue will come from that action.

He also called on the government to engage taxpayers on the revenue measures for consensus building.

Latest Stories

-

Some banks move to sell assets of PBC over GHC 300 million debt

4 minutes -

Uefa fears impact of Premier League spending rules

4 minutes -

EU to sign historic defence pact with Ghana in global security pivot

7 minutes -

Liverpool lose to Galatasaray in Slot’s 100th game in charge

15 minutes -

Iran begins laying mines in Strait of Hormuz, sources say

21 minutes -

Joey Barton refused bail after ‘attack at golf club’

27 minutes -

GH¢68.7bn gov’t arrears bombshell: Parliament orders probe over suspected fraud

31 minutes -

The public display of students’ academic results in basic schools: A case against a damaging practice

46 minutes -

GOIL jumps GH¢0.21, MTN Ghana surges past GH¢6.30 in record-breaking GSE session

1 hour -

NAIMOS disrupts illegal mining activities at Gwira Banso-Eshiem

2 hours -

Ashesi hosts Kensei Kai Foundation’s maiden Inter-University Karate Camp

2 hours -

21 suspects arraigned in Tamale Circuit Court over narcotics offences

2 hours -

A nation that prays for political failure

2 hours -

Kumasi Mayor inspects key inner-road projects, promises major upgrade of road infrastructure

2 hours -

Manhyia South MP questions authenticity of audit report presented to Parliament

2 hours