Audio By Carbonatix

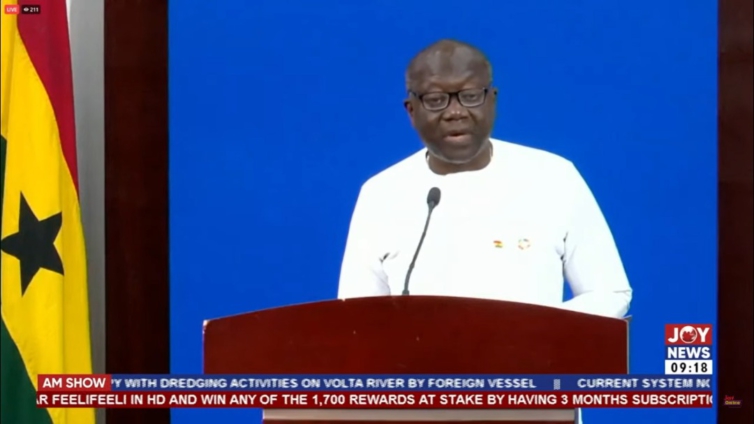

Finance Minister, Ken Ofori-Atta, has expressed confidence that government would reach a Staff-Level Agreement with the International Monetary Fund soon for a programme aimed at restoring macroeconomic stability and protecting the most vulnerable.

To this end, it is determined to implement a wide-ranging structural and fiscal reforms to restore fiscal and debt sustainability and support growth.

Speaking at the launch of the Debt Exchange Programme, Mr. Ofori Atta said the objective of the programme is to alleviate the debt burden in a most transparent, efficient, and expedited manner.

“In this context, by means of an exchange offer, the Government of Ghana has been working hard to minimize the impact of the domestic debt exchange on investors holding government

bonds”.

The Finance Minister noted that the domestic debt exchange is part of a more comprehensive agenda to restore debt and financial sustainability, adding “we are also working towards a restructuring of our external indebtedness, which we will announce in due course”.

“This is a key requirement to allow Ghana’s economy to recover as fast as possible from this crisis. This is also a key requirement to secure an IMF support”, he explained.

Mr. Ofori-Atta also expressed optimism that the measures put in place, including those outlined in the 2023 Budget Statement and underpinned by a successful IM programme will witness a stable and thriving economy for Ghana from 2023.

Accordingly, he said there is an anticipation that inflation will be returned to single digit, ensuring that real returns on these new bonds will be protected.

The domestic debt operation involves an exchange for new Ghana bonds with a coupon that steps up to 10% as soon as 2025 (with a first interest payment in 2024) and longer average maturity.

Existing domestic bonds as of December 1, 2022, will be exchanged for a set of four new bonds maturing in 2027, 2029, 2032 and 2037.

The predetermined allocation ratio includes 17% for short bonds, 17% for the intermediate bond, 25% for the medium-term bond and 41% for the long-term bond.

The annual coupon on all of these new bonds will be set at 0% in 2023, 5% in 2024 and 10% from 2025 until maturity. Coupon payments will be semi- annual.

Latest Stories

-

NAIMOS taskforce intensifies anti-galamsey crackdowns in Ashanti Region

6 minutes -

70-year-old visually impaired killed in fire incident at Sefwi Adjoafua

14 minutes -

Curfew lifted in Nalerigu and surrounding communities – Ministry of the Interior

17 minutes -

Central Regional Minister charges MMDCEs to exceed expectations or face sanctions

19 minutes -

Open Letter from a Medical Doctor to the Health Minister on the Charles Amissah investigation

26 minutes -

Benjamin Asare: the ultimate winner from Sunday’s Super Clash

27 minutes -

Foreigners committing crimes in Ghana without consequences – Vicky Bright

37 minutes -

Court of Appeal quashes KNUST directive for lecturer to apologise to colleagues

41 minutes -

Iranian Embassy in Ghana responds to the remarks of the Israeli Ambassador to Ghana

44 minutes -

GNFS confirms six deaths, seven injured in Accra-Nsawam highway petrol tanker fire

1 hour -

President Mahama commissions new Ghana embassy chancery in Addis Ababa

1 hour -

Kyei-Mensah-Bonsu questions timing of OSP investigation into alleged vote buying in NPP Presidential Primary

1 hour -

Photos: Dreams FC suffer 1-0 defeat at home to Karela

1 hour -

Ghana needs clear policy to tackle galamsey, our past methods fell short – Kyei-Mensah-Bonsu

1 hour -

Mahama pushes urgent rollout of Pan-African payment system at AU Summit

1 hour