As part of the government's comprehensive COVID-19 recovery programme, a new fiscal measure was expected to be implemented on January 1, 2024.

According to the Finance Ministry, VAT of 15% would be charged on residential electricity customers consuming more than 30 kWh once it is implemented.

This formed part of measures to recover losses and generate revenue post-pandemic.

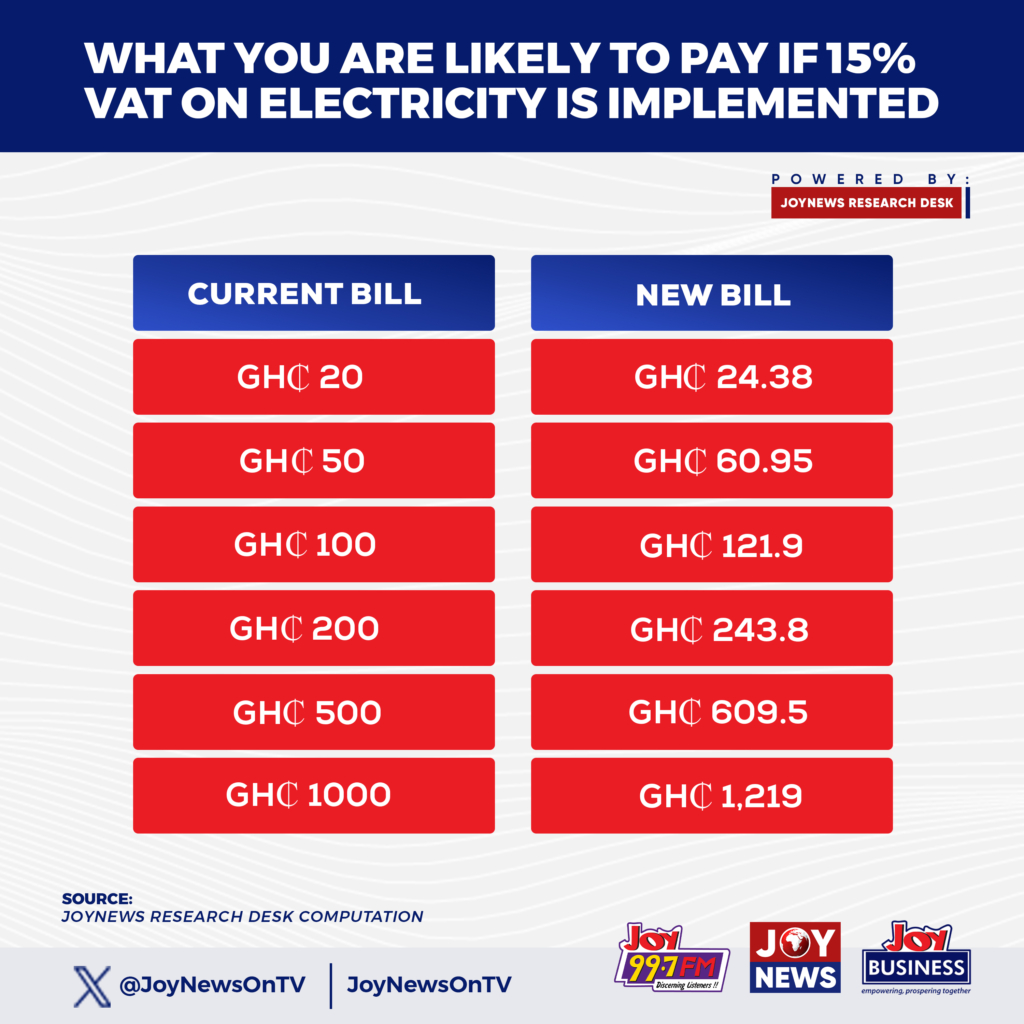

The graphics below shows how much a residential consumer is likely to pay after the 15% VAT is slapped on current electricity bills.

The government, having initially provided relief, now faces the challenging task of striking a balance between economic recovery and the financial burdens placed on its citizens.

Many consumers were priced out after enjoying power for free during the heat of the pandemic and households that enjoyed a 50% discount on their bills during the pandemic have been paying more after the free lunch and they will definitely pay more as a result of this tax move.

The VAT which comes with 2.5% NHIL, 1% Covid-19 Recovery Levy and additional 2.5% GETFund Levy is expected to boost government's medium term fiscal target where revenue mobilisation is a key component.

JoyNews understands that government already told the IMF it was going to go heavy on the removal of VAT exemptions on certain products and services and this particular move may be one of them.

According to the Fund, Ghana loses close to $1.6 billion or GHȼ17 billion from VAT exemptions.

In the 2024 fiscal year, the Government of Ghana is hoping to get more than 80% of its projected revenue from taxes and VAT is a big component – about GHȼ37 billion cedis will be raised compared to last year target of GHȼ23.7 billion.

Latest Stories

-

Paris 2024: Opening ceremony showcases grandiose celebration of French culture and diversity

3 hours -

How decline of Indian vultures led to 500,000 human deaths

3 hours -

Paris 2024: Ghana rocks ‘fabulous fugu’ at olympics opening ceremony

4 hours -

Trust Hospital faces financial strain with rising debt levels – Auditor-General’s report

4 hours -

Electrochem lease: Allocate portions of land to Songor people – Resident demand

4 hours -

82 widows receive financial aid from Chayil Foundation

5 hours -

The silent struggles: Female journalists grapple with Ghana’s high cost of living

5 hours -

BoG yet to make any payment to Service Ghana Auto Group

5 hours -

‘Crushed Young’: The Multimedia Group, JL Properties surprise accident victim’s family with fully-furnished apartment

5 hours -

Asante Kotoko needs structure that would outlive any administration – Opoku Nti

6 hours -

JoyNews exposé on Customs officials demanding bribes airs on July 29

6 hours -

JoyNews Impact Maker Awardee ships first consignment of honey from Kwahu Afram Plains

7 hours -

Joint committee under fire over report on salt mining lease granted Electrochem

7 hours -

Life Lounge with Edem Knight-Tay: Don’t be beaten the third time

8 hours -

Pro-NPP group launched to help ‘Break the 8’

8 hours