Audio By Carbonatix

In a bold move to reshape the energy sector and alleviate debt burdens while ensuring a steady power supply for industries, the government has initiated a series of measures, including quarterly tariff increments.

To align with the IMF’s revenue mobilization objectives, Ghana unveiled a comprehensive Medium-Term Revenue Strategy in September 2023.

This strategic framework focuses on crucial tax policies and revenue administration measures essential for achieving both Ghana's domestic goals and the IMF's program revenue objectives.

Watch video: JoyNews' Isaac Kofi Agyei explains why Government of Ghana is introducing a 15% VAT of electricity

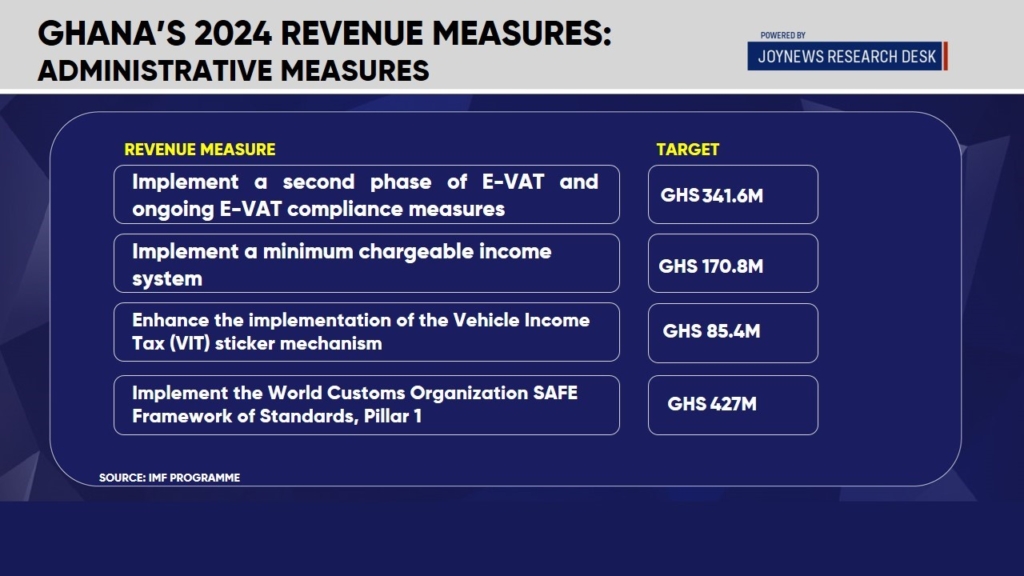

Ghana has already taken significant strides towards enhancing revenue generation, implementing measures such as quarterly adjustments to electricity tariffs, raising the VAT rate from 12.5% to 15%, restructuring the E-levy, and eliminating discounts on customs benchmark values.

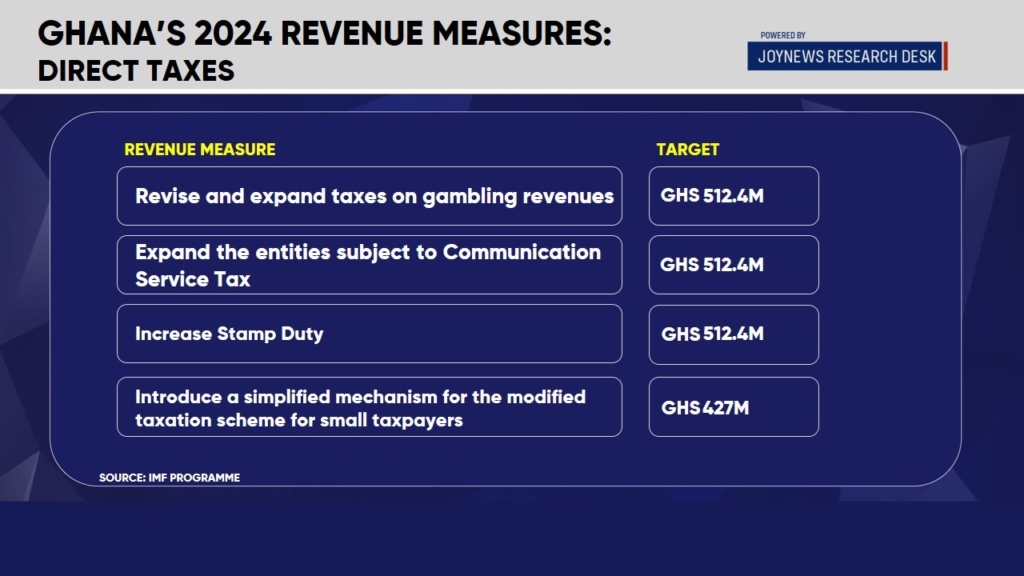

Looking ahead to 2024, the government plans to introduce additional measures, encompassing 12 tax reforms and the implementation of new tax mechanisms.

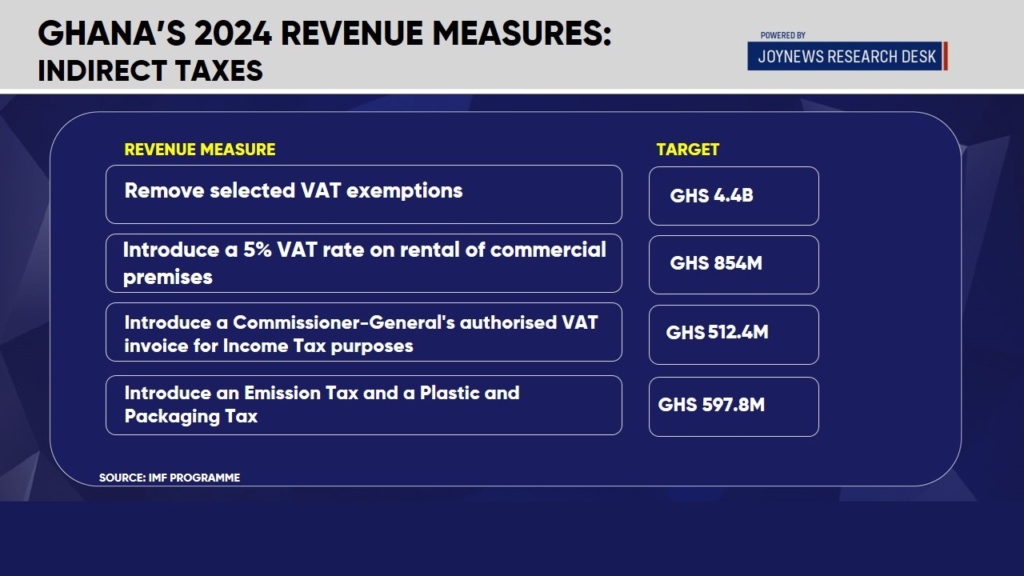

One of the pivotal strategies involves the removal of selected VAT exemptions, amounting to approximately GHS4.4 billion this year.

Also read: VAT on power consumption: From free electricity to taxing times

Additionally, there will be revisions to income-based taxes and a scrutiny of the headline rate of the Communication Services Tax (CST).

The Government of Ghana also aims to expand taxes on gambling revenues, heighten Stamp Duty, introduce a 5% VAT rate on the rental of commercial premises, and unveil new taxes, such as the Emission Tax and the Plastic and Packaging Tax.

Adding more, the government is set to strengthen the implementation of the Vehicle Income Tax (VIT) sticker mechanism and embark on the reform of corporate income tax by gradually phasing out tax holidays and exemptions.

It is crucial to note that these measures are intrinsic to the government's independent revenue mobilization strategy and not dictated by the IMF.

As Ghana navigates these reforms, stakeholders and citizens alike will closely observe the impact on various sectors and the overall economic trajectory.

Latest Stories

-

Securing children’s tomorrow today: Ghana launches revised ECCD policy

2 hours -

Protestors picket Interior Ministry, demand crackdown on galamsey networks

2 hours -

Labour Minister highlights Zoomlion’s role in gov’t’s 24-hour economy drive

2 hours -

Interior Minister receives Gbenyiri Mediation report to resolve Lobi-Gonja conflict

2 hours -

GTA, UNESCO deepen ties to leverage culture and AI for tourism growth

3 hours -

ECG completes construction of 8 high-tension towers following pylon theft in 2024

3 hours -

Newsfile to discuss 2026 SONA and present reality this Saturday

3 hours -

Dr Hilla Limann Technical University records 17% admission surge

3 hours -

Meetings Africa 2026 closes on a high, Celebrating 20 years of purposeful African connections

3 hours -

Fuel prices to increase marginally from March 1, driven by crude price surge

4 hours -

Drum artiste Aduberks holds maiden concert in Ghana

4 hours -

UCC to honour Vice President with distinguished fellow award

4 hours -

Full text: Mahama’s State of the Nation Address

4 hours -

Accra Mayor halts Makola No. 2 rent increment pending negotiations with facility managers

4 hours -

SoulGroup Spirit Sound drops Ghana medley to honour gospel legends

5 hours