Audio By Carbonatix

The Centre for Policy Scrutiny (CPS) has raised concerns over the 2026 budget’s ambitious revenue projections, warning that unrealistic targets could undermine Ghana’s fiscal stability if not carefully managed.

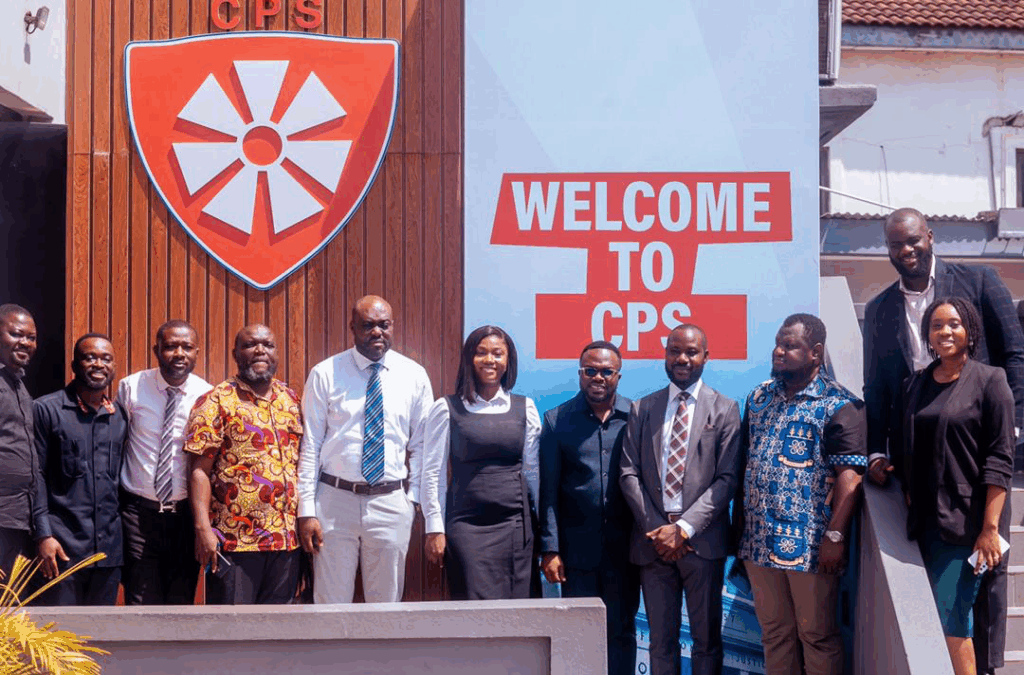

During a media briefing on Thursday, November 20, 2025, on its Review of the 2026 Budget, CPS noted that while government has made strides in stabilising the economy through lower inflation and declining interest rates, the projected revenue figures in the 2026 budget appear overly optimistic given current economic realities.

“Revenue mobilisation remains a major challenge for Ghana. While we commend the government’s efforts to control expenditure and maintain macroeconomic stability, the budget’s revenue targets may be difficult to achieve without substantial improvements in tax compliance, efficiency, and enforcement,” Executive Director, Dr Adu Owusu Sarkodie said.

The CPS review highlighted that government plans to increase tax revenues significantly next year, relying on both domestic collections and growth in the informal sector.

It warned that without structural reforms, such as digitalisation of tax systems and stricter monitoring of revenue leakages, these projections could fall short, potentially forcing the government to resort to additional borrowing.

“Failure to meet revenue targets could limit the government’s ability to fund critical infrastructure and social programs,” the review added.

“It could also put pressure on the fiscal deficit and compromise the sustainability of public finances.”

The CPS emphasised the importance of aligning budget expectations with realistic economic performance indicators.

It urged the Ministry of Finance, together with the Ghana Revenue Authority (GRA), to strengthen measures for revenue collection, enhance transparency, and ensure that assumptions underpinning the budget are grounded in verifiable data.

Despite these concerns, CPS acknowledged positive aspects of the 2026 budget, including its focus on disinflation, lower interest rates, and investments in infrastructure and job creation.

However, the centre stressed that without credible revenue mobilisation strategies, these gains may be at risk.

It maintained that while the 2026 budget presents opportunities for accelerated recovery, the success of the plan hinges on realistic revenue mobilisation and fiscal discipline.

“Ambitious targets are beneficial only if backed by effective execution. Otherwise, they risk becoming a source of fiscal vulnerability rather than a driver of sustainable growth,” Dr Sarkodie emphasised.

Latest Stories

-

Africa’s top editors converge in Nairobi to tackle media’s toughest challenges

1 hour -

Specialised courts, afternoon sittings to tackle case delays- Judicial Secretary

1 hour -

Specialised high court division to be staffed with trained Judges from court of appeal — Judicial Secretary

2 hours -

Special courts will deliver faster, fairer justice — Judicial Secretary

2 hours -

A decade of dance and a bold 10K dream as Vivies Academy marks 10 years

2 hours -

GCB’s Linus Kumi: Partnership with Ghana Sports Fund focused on building enduring systems

3 hours -

Sports is preventive healthcare and a wealth engine for Ghana – Dr David Kofi Wuaku

3 hours -

Ghana Sports Fund Deputy Administrator applauds GCB’s practical training for staff

3 hours -

Ghana Sports Fund strengthens institutional framework with GCB Bank strategic partnership

4 hours -

UBIDS to Complete Abandoned Projects Following GETFund Financial Clearance – Vice Chancellor

4 hours -

Nii Moi Thompson questions Anokye Frimpong’s ‘distorted history’ narratives

5 hours -

Anthony O’Neal set to receive Ghanaian citizenship, prepares to launch ‘Class on the Bus’ Initiative

5 hours -

South Tongu MP inspects GH₵500,000 surgical equipment, supports District Court with logistics

6 hours -

Kpasec 2003 Year Group hosts garden party to rekindle bonds and inspire legacy giving

7 hours -

Financing barriers slowing microgrid expansion in Ghana -Energy Minister

7 hours