Audio By Carbonatix

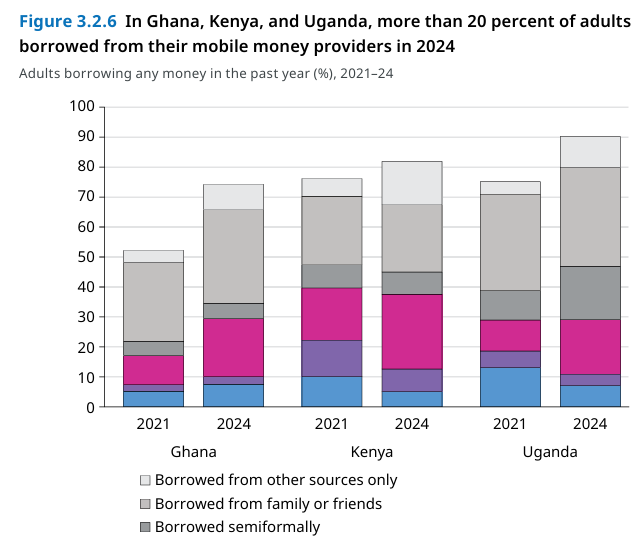

Twenty –two percent of adults in Ghana borrow from mobile money providers.

According to the World Bank’s 2025 Global Findex Report, 74% are formal borrowers.

“In Ghana, the rise in borrowing through a mobile money account between 2021 and 2024 drove an overall increase in formal borrowing over that period”, the report explained.

Despite similar levels of overall borrowing by gender in all three economies (Ghana, Kenya and Uganda), the report said borrowing from a mobile money provider differs according to gender in these economies.

For instance, in Ghana, women are 4.0 percentage points less likely than men to borrow from this source, whereas in Kenya and Uganda, the gaps are 16 and 13 percentage points, respectively.

Similar gaps, however, exist between adults from the poorest 40% and wealthiest 60% of households by income.

The Global Findex 2025, in addition to asking questions about borrowing through a mobile money provider, for the first time asked about other sources of digital credit, to capture data on people who do not borrow through a mobile money account, but rather through some other digital method.

“In particular, the survey asked separately about applying for and receiving a loan through a mobile phone: 1.0 percent of adults in low- and middle-income economies borrowed only this way (and not through a mobile money account, from a bank or similar financial institution, or through a credit card), including 3 percent of adults in Sub-Saharan Africa”.

According to the report, this region is home to all seven of the world’s economies in which at least 5% of adults report they borrowed through a mobile phone but did not borrow formally otherwise.

Although this source of digital credit is one to watch, given the overall small share of adults who used it but did not borrow formally and the uncertainty about who provides the digital credit, Global Findex 2025 does not include it in its definition of formal borrowing.

Latest Stories

-

Samini’s ORIGIN8A storms Apple Music Ghana charts at No. 7

3 hours -

Kim Jong Un chooses teen daughter as heir, says Seoul

3 hours -

Morocco to spend $330m on flood relief plan

3 hours -

Ghana’s gold output hits record 6 million ounces in 2025, industry group says

3 hours -

‘I’m a lover boy, not womaniser’ – 2Baba on fatherhood, marriage to Natasha

4 hours -

Tems becomes first African female artist to have 7 entries on Billboard Hot 100

4 hours -

Police arrest three for the alleged possession of firearm without license

4 hours -

Suspected robber shot dead by police while fleeing with officer’s vehicle

4 hours -

Head porter charged over mobile phone theft

4 hours -

Tuchel extended England stay for ‘amazing players’

4 hours -

Gender Ministry holds stakeholders’ meeting to strengthen Ghana’s adoption system

5 hours -

Atletico Madrid put four past Barcelona in Copa del Rey semi-final

5 hours -

Tottenham are ‘not a big club’ – Postecoglou

5 hours -

Nottingham Forest close in on Pereira appointment

5 hours -

England to face Spain and Croatia in Nations League

5 hours