Audio By Carbonatix

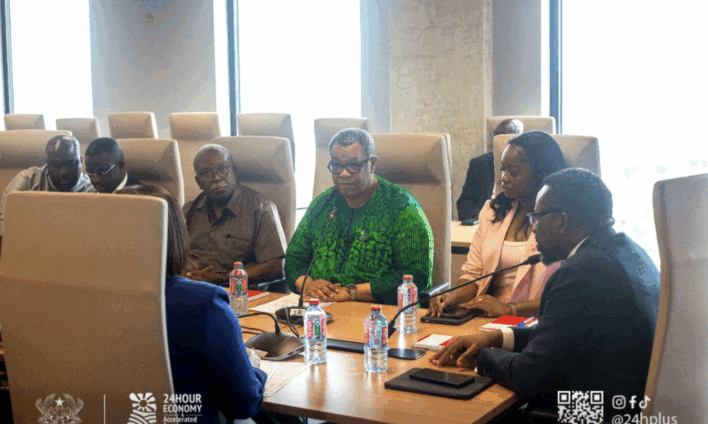

The 24-Hour Economy Secretariat has held a high-level meeting with the Bank of Ghana to align the flagship policy with the country’s broader macroeconomic framework.

The engagement forms part of the Secretariat’s ongoing consultations with key stakeholders to share details of the 24-hour economy policy, obtain institutional feedback, and secure strategic partnerships for implementation.

A statement issued by the 24-Hour Secretariat said the Central Bank is one of the latest institutions to be engaged as the programme transitions into its operational phase.

Mr Goosie Tanoh, Presidential Advisor on the 24-Hour Economy Programme, expressed appreciation to the Bank for the opportunity to engage its leadership and technical teams.

He said Ghana’s immediate priority was to build a resilient economy anchored on macroeconomic stability.

He commended the Bank of Ghana for providing the stability required to create platforms for growth, expansion, and increased economic activity, including higher domestic production and export output.

The Presidential Advisor said the 24-hour economy initiative is intended to deepen these gains by providing a targeted micro-level response to the macroeconomic stabilisation achieved.

He described recent economic indicators as notable, citing sustained treasury bill performance and a decline in inflation as evidence of a strengthening foundation for long-term growth.

A major focus of the discussions was the proposed establishment of a Food Security and Price Stabilisation Fund.

The Fund is expected to help moderate commodity price volatility, reduce food inflation, and enhance national food security, complementing existing monetary policy measures.

The meeting also explored practical areas of collaboration between the Secretariat, commercial banks and the central bank.

Proposals discussed included the development of a 24H+ credit policy and enterprise financing framework, coordinated appraisal of credit requests, syndicated and direct lending opportunities, and balance sheet support for eligible 24-hour enterprises subject to due diligence.

Additional areas covered include recognition of credit insurance schemes to strengthen collateral frameworks, regulatory considerations for 24-hour loan portfolios, foreign exchange hedging instruments to support SME lending at reasonable rates, and digital platforms to expand access to trade and finance.

It is expected that the deliberations with the Bank of Ghana will result in key strategic regulatory policy initiatives which will enhance the financial services infrastructure under which Ghanaian companies are expected to thrive.

Latest Stories

-

Alisson injury not ‘a big thing’ despite missing Galatasaray

29 minutes -

Scholes ‘did not intend to be offensive’ to Carrick

37 minutes -

23 players sent off after mass brawl in Brazil

41 minutes -

Court remands pastor over alleged child abuse images

45 minutes -

Anthropic sues US government for calling it a risk

54 minutes -

Live Nation reaches settlement in US monopoly case

59 minutes -

G7 to take ‘necessary measures’ to support energy supplies

1 hour -

Star Assurance rewards 10 more customers in grand finale draw of “40 Reasons to Smile” promo

1 hour -

Guinea opposition leader urges ‘direct resistance’ after 40 parties dissolved

1 hour -

Suhum MP calls for sincere dialogue on labour issues, warns against politicisation

2 hours -

We have instituted measures to diversify our reserves – BoG Governor

2 hours -

Ban on pay-TV services at the Presidency in force; my office is the only place with DSTV – Kwakye Ofosu

2 hours -

Fuel prices could hit GH¢17 if the Middle East crisis persists – COMAC

2 hours -

Cedi records modest appreciation on improved liquidity, but external risks linger

2 hours -

Dr Agnes Naa Momo Lartey organises briefing meeting with Ghana’s delegation to CSW70

2 hours