Audio By Carbonatix

Actor, John Dumelo, has criticised the Majority Leader, Osei Kyei-Mensah-Bonsu for celebrating his 65th birthday with an E-levy cake.

The actor-turned-politician described the move as insensitive on the part of the Minister of Parliamentary Affairs.

Mr Kyei-Mensah-Bonsu together with some prominent government officials including the Vice President, Dr Mahamudu Bawumia were captured on camera cutting an E-levy cake to usher in the celebration of the plush birthday party in Kumasi.

Following the circulation of the video, a section of Ghanaians were irked by it.

Many considered it as a mockery of the calls being made by the citizenry for the government to drop the tax policy.

The Suame legislator has, however, refuted the assertion arguing that the E-levy cake was not the official pastry for his party.

According to him, the cake was brought in as a gift when the celebration was almost over.

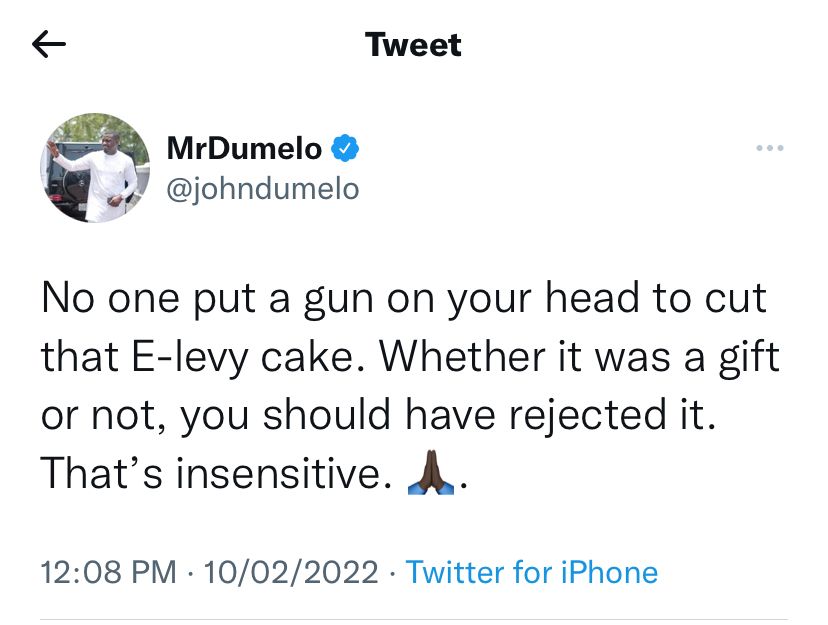

But in response on Thursday, Mr Dumelo said that the Majority Leader should have rejected it.

“No one put a gun on your head to cut that E-levy cake. Whether it was a gift or not, you should have rejected it,” the actor wrote on Twitter which he subsequently deleted.

He further added that Mr Kyei-Mensah-Bonsu’s decision to cut the cake makes it “insensitive” to the plight of Ghanaians.

E-levy

Finance Minister Ken Ofori-Atta, presenting the 2022 budget on Wednesday, November 17, announced that the government intends to introduce an electronic transaction levy (E-levy).

The levy, he revealed, is being introduced to “widen the tax net and rope in the informal sector”. This followed a previous announcement that the government intends to halt the collection of road tolls.

The proposed levy, which was expected to come into effect in January 2022, is a charge of 1.75% on the value of electronic transactions. It covers mobile money payments, bank transfers, merchant payments, and inward remittances. There is an exemption for transactions up to GH¢100 per day.

Explaining the government’s decision, the Finance Minister revealed that the total digital transactions for 2020 were estimated to be over ¢500 billion (about $81 billion) compared to ¢78 billion ($12.5 billion) in 2016. Thus, the need to widen the tax net to include the informal sector.

Although the government has argued that it is an innovative way to generate revenue, scores of citizens and stakeholders have expressed varied sentiments on its appropriateness with many standing firmly against it.

Even though others have argued in support of the levy, a section of the populace believe that the 1.75% e-levy is an insensitive tax policy that will deepen the already prevailing hardship in the country.

Latest Stories

-

Iran declares 40 days of national mourning after Ayatollah Ali Khamenei’s death

39 minutes -

Family of Maamobi shooting victim makes desperate plea for Presidential intervention

2 hours -

Middle East turmoil threatens to derail Ghana’s single-digit gains

2 hours -

Free-scoring Semenyo takes burden off Haaland

3 hours -

Explainer: Why did the US attack Iran?

3 hours -

Peaky Blinders to The Bride!: 10 of the best films to watch in March

4 hours -

Crude oil price crosses $91 as Strait of Hormuz blockade chokes 22% of global supply

4 hours -

Dr. Hilla Limann Technical University records 17% admission surge; launches region’s first cosmetology laboratory

5 hours -

Over 50 students hospitalised after horror crash ends sports tournament

5 hours -

Accra–Dubai flights cancelled as Middle East tensions deepen

6 hours -

See the areas that will be affected by ECG’s planned maintenance from March 1-5

7 hours -

Kane scores twice as Bayern beat rivals Dortmund

7 hours -

Lamine Yamal hits first hat-trick in Barcelona win

7 hours -

Iran says US and Israel strikes hit school killing 108

7 hours -

What we know so far: Supreme Leader Khamenei killed, Trump says, as Iran launches retaliatory strikes

8 hours