Audio By Carbonatix

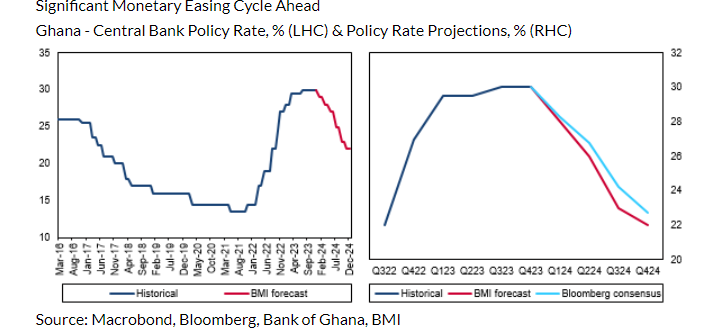

The Bank of Ghana will cut the policy rate by another 100 basis points to 28.00% at the next Monetary Policy Committee meeting in March 2024, Fitch Solutions has predicted.

This will be the second consecutive time if the Central Bank goes ahead to reduce the policy rate.

It disclosed this in its latest article dubbed “More Interest Rate Cuts On The Way In Ghana, Following Cautious Start Of Easing Cycle”. Here is a report.

“We expect that the BoG will cut the policy rate by another 100bps to 28.00% at the next MPC meeting in March. Inflation will remain on a downward trend over the coming months, in part driven by statistical base effects and the lagged impact of monetary tightening”.

Already, the UK-based firm is predicting an 800 basis points decline in the monetary policy rate to 22.0% in 2024.

It pointed out that the disinflation process will continue throughout 2024, supported by base effects.

Moreover, a gradual improvement in investor sentiment and a $600 million International Monetary Fund disbursement will keep the exchange rate stable at roughly GH¢12.00 to a dollar on the interbank market throughout quarter one of 2024.

As such, it alluded that the price pressures stemming from imported goods and services will remain limited over the coming months, supporting the ongoing disinflationary trend.

The Bank of Ghana cut its policy rate to 29.00% on January 29, 2024.

This Fitch Solutions said was in line with its expectations of a monetary easing cycle in January prompted by a significant slowdown in inflation.

“We believe that the Bank of Ghana (BoG) will cut the benchmark interest rate by another 700 basis points (bps) to 22.00% by year-end, following a 100bps cut to 29.00% on January 29. In line with our expectations, the BoG kicked off a monetary easing cycle in January, prompted by a significant slowdown in inflation, which fell from 35.2% y-o-y in October to 23.2% in December”.

Latest Stories

-

Nkwanta South MCE commissions new classroom block at Mmen Akura JHS

2 minutes -

Prosecute Amansie Central DCE to deter others – Suame MP

4 minutes -

GenCED demands accountability over Vote-Buying in Ayawaso East NDC Primary

5 minutes -

Project Ghana as reliable global partner – Mahama tells new ambassadors

6 minutes -

Sofoline vendors credit sanitation campaign for better health and sales

15 minutes -

‘Arrest him now’ – Ashigbey demands DCE’s arrest over ‘A Tax For Galamsey’ expose

16 minutes -

NDC’s decision to probe voter inducement a good step – Political analyst

17 minutes -

Over $100m your gov’t spent on National Cathedral could’ve completed half of Suame Interchange – Agbodza to Asenso-Boakye

21 minutes -

How Lindsay-Gamrat built Atlantic Catering into a 600-employee business in 10 years

22 minutes -

NPP Kpando leaders call for unity and renewed focus on 2028 after primary

23 minutes -

A Tax For Galamsey: JoyNews exposé links DCE to GH₵6,000 ‘galamsey fees’

27 minutes -

Chāo-Shì launches platform to create portable digital reputations for informal workers

32 minutes -

Nkenkaasu 24-Hour Economy Market

35 minutes -

Outer ring road makes Suame four-tier design obsolete – Roads Minister

37 minutes -

Avoiding Unexpected Tax Exposure in Ghana’s Petroleum Sector: Practical guidance for investors, contractors and sub-contractors

40 minutes