Audio By Carbonatix

In a bold move to reshape the energy sector and alleviate debt burdens while ensuring a steady power supply for industries, the government has initiated a series of measures, including quarterly tariff increments.

To align with the IMF’s revenue mobilization objectives, Ghana unveiled a comprehensive Medium-Term Revenue Strategy in September 2023.

This strategic framework focuses on crucial tax policies and revenue administration measures essential for achieving both Ghana's domestic goals and the IMF's program revenue objectives.

Watch video: JoyNews' Isaac Kofi Agyei explains why Government of Ghana is introducing a 15% VAT of electricity

Ghana has already taken significant strides towards enhancing revenue generation, implementing measures such as quarterly adjustments to electricity tariffs, raising the VAT rate from 12.5% to 15%, restructuring the E-levy, and eliminating discounts on customs benchmark values.

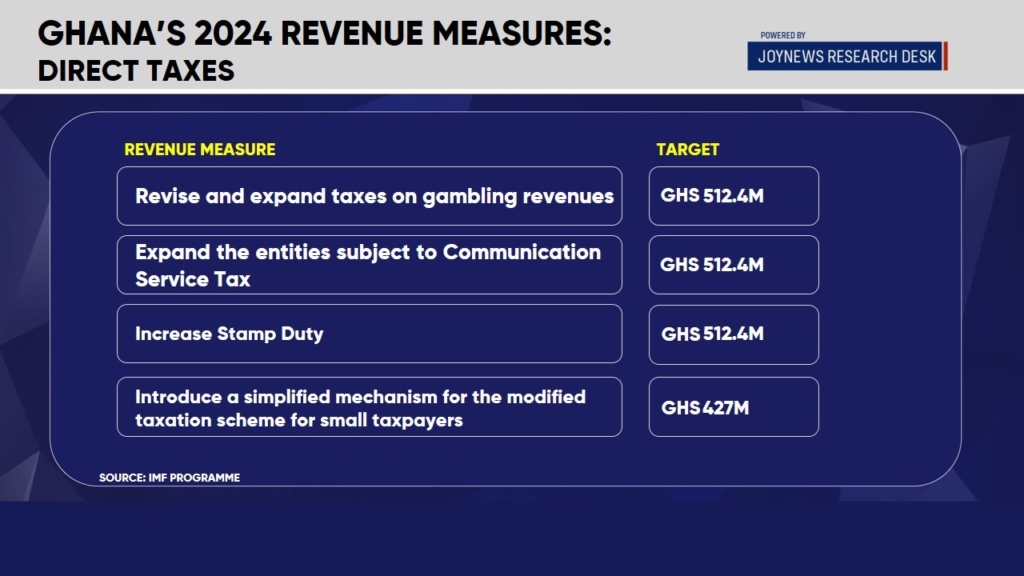

Looking ahead to 2024, the government plans to introduce additional measures, encompassing 12 tax reforms and the implementation of new tax mechanisms.

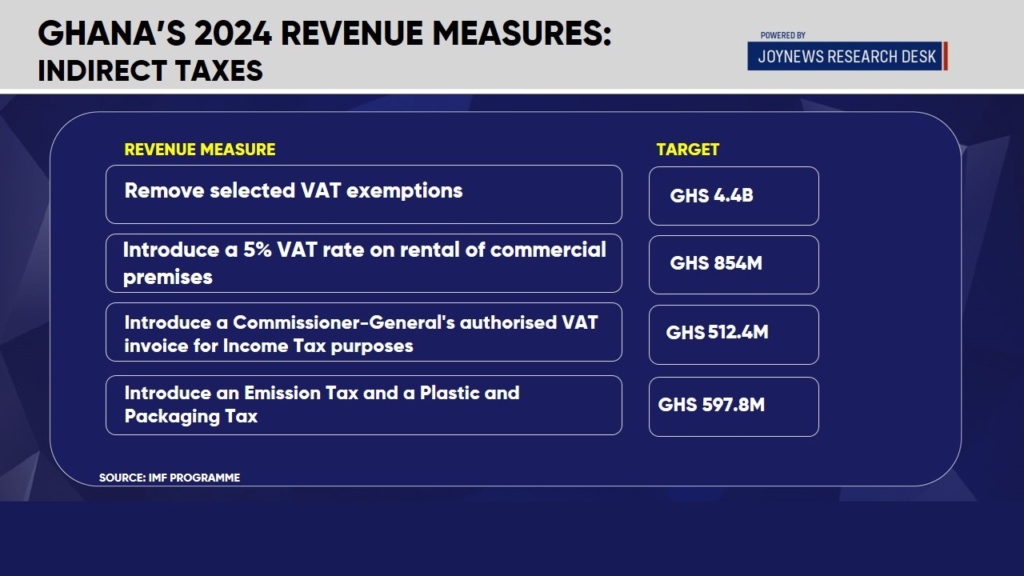

One of the pivotal strategies involves the removal of selected VAT exemptions, amounting to approximately GHS4.4 billion this year.

Also read: VAT on power consumption: From free electricity to taxing times

Additionally, there will be revisions to income-based taxes and a scrutiny of the headline rate of the Communication Services Tax (CST).

The Government of Ghana also aims to expand taxes on gambling revenues, heighten Stamp Duty, introduce a 5% VAT rate on the rental of commercial premises, and unveil new taxes, such as the Emission Tax and the Plastic and Packaging Tax.

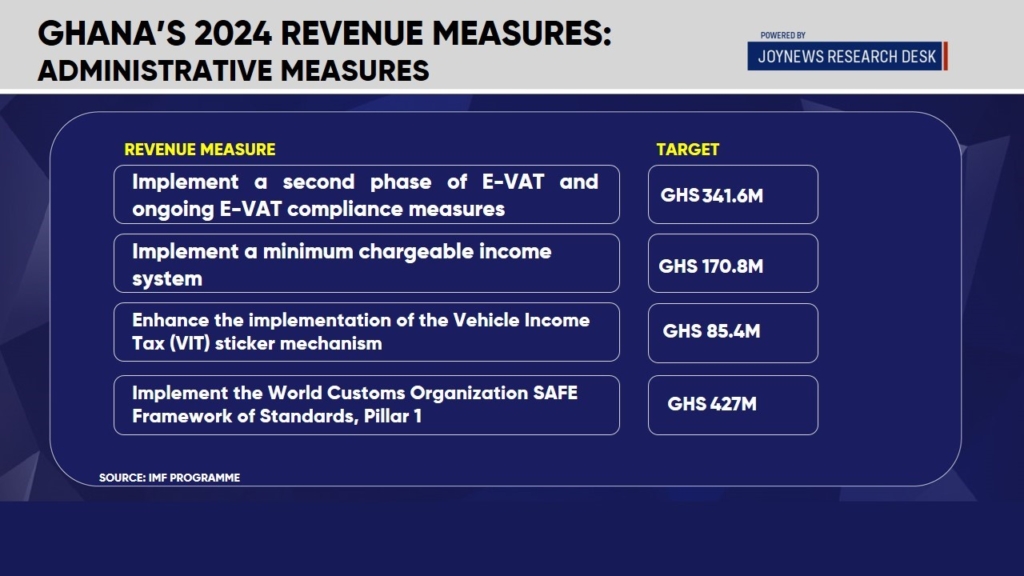

Adding more, the government is set to strengthen the implementation of the Vehicle Income Tax (VIT) sticker mechanism and embark on the reform of corporate income tax by gradually phasing out tax holidays and exemptions.

It is crucial to note that these measures are intrinsic to the government's independent revenue mobilization strategy and not dictated by the IMF.

As Ghana navigates these reforms, stakeholders and citizens alike will closely observe the impact on various sectors and the overall economic trajectory.

Latest Stories

-

‘He was my dorm mate’: Former Dep. GES Director settles debate over Chairman Wontumi’s Prempeh College credentials

13 minutes -

MTN Ghana rings in massive GH¢7.8 bn profit as digital and fintech revenues surge

15 minutes -

Government extends ‘Nkoko Nkitinkiti’ broiler initiative to schools

24 minutes -

Farmer drags gov’t to Supreme Court over ‘extortionate fees’ and ‘restrictive licensing’ for industrial cannabis

34 minutes -

Eastern Region: 38 suspects, including teenagers, arrested in galamsey raid

1 hour -

NDC predicts crushing defeat for party member now an independent candidate in Ayawaso East by-election

2 hours -

President Mahama rallies Black Stars and fans for 2026 World Cup glory

2 hours -

No bed syndrome “unacceptable” – Mahama warns hospitals after engineer’s tragic death

3 hours -

Photos: State of the Nation Address

4 hours -

Trump ‘not thrilled’ with Iran after latest talks on nuclear programme

4 hours -

Paramount set for $111bn Warner Bros takeover after Netflix drops bid

5 hours -

Prime Insight to dissect the State of the Nation Address this Saturday

5 hours -

‘Absolutely worth it’: Former Deputy GES Director-General defends double-track legacy

6 hours -

Amanda Clinton writes: Ghana legalised hemp and regulated it like cocaine

6 hours -

Central Tongu MP introduces common exams as Adanu hands over new classroom block at Mafi-Seva

7 hours