Audio By Carbonatix

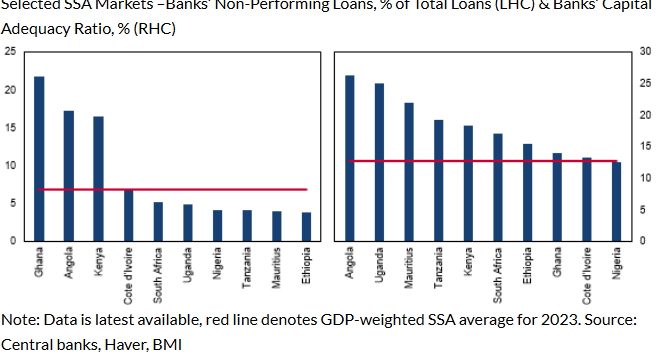

Ghana’s banking sector is particularly vulnerable, with a high non-performing loan (NPL) ratio of 21.8% and a Capital Adequacy Ratio (CAR) of 14.0%.

According to Fitch Solutions, this is a result of the domestic debt exchange programme (DDEP) and high interest rates.

In its paper titled “US Tariffs Increase Risks for SSA Banks”, Ghana has the highest NPLs among the 10 top Sub-Saharan Africa countries, whilst its CAR is the third weakest.

Despite upcoming challenges, it however said SSA banks are generally well-positioned, supported by robust capital adequacy ratios (CAR) and decent loan quality.

“We anticipate improvements in most sectors’ capital, driven by regulatory enhancements in markets such as Nigeria and Kenya, alongside improving economic conditions in most markets.”

“Our core view remains that interest rates will fall in 2025 for most markets, which will help improve loan quality. Very high profits following steep interest rate hikes in recent years will also provide banks a sufficient reserve for 2025”, it mentioned.

Monetary Policy Expectations to Impact Banks’ Profits

It continued that US tariffs will impact SSA banks in relation to monetary policy, and thus expect banks to face increased uncertainty as policy expectations shift.

“If interest rates remain elevated for longer than we currently expect, this could adversely impact loan quality and growth, potentially deterring credit extension if consumers and businesses remain uncertain about interest rates”. While higher interest margins – which currently exceed 50% in all the largest SSA banking sectors aside from Nigeria– could bolster profits, this effect, it said, may be offset by weaker loan growth and increased provisioning for higher NPLs.

Conversely, a quicker-than-expected decline in interest rates, following economic growth concerns, would reverse these effects.

Fitch Solutions added that his uncertainty complicates strategic planning for banks in the region, affecting loan quality risks, lending activity, income from interest and fees and commissions.

Latest Stories

-

Samini thrills fans at the 2025 Samini Xperience concert

22 minutes -

Ghana EXIM Bank repositioned to reduce import bill on rice, poultry – CEO assures

28 minutes -

Photos: Hundreds turn out for Joy FM’s 2025 family party in the park

1 hour -

Volta Regional House of Chiefs renew call on Immigration to remove inland barriers at Sogakope, Asikuma

1 hour -

Police Christmas special operation: 27 suspects rounded up in Savannah Region

1 hour -

Seven hospitalised after gunshots disrupt jummah prayers in Ho

2 hours -

70 mothers receive Christmas hampers from MTN after delivering at KATH

2 hours -

Let’s prove our readiness power through deeds, not words – Afenyo-Markin to NPP faithful

2 hours -

Stonebwoy brings the house down at BHIM Festival 2025

2 hours -

Development flourishes where peace and cooperation prevail – Roads Minister

2 hours -

Children enjoy a day of fun and laughter at Joy FM’s Party in the Park 2025

2 hours -

Joy FM Party in the Park 2025: Shakers Royal Band ignites excitement

2 hours -

MTN Ghana hands over hampers to 25 newly born ‘bronya’ babies at Cape Coast Hospital

3 hours -

Kwanpa Band thrills patrons as Joy FM Family Party in the Park

3 hours -

Lawyer arraigned over alleged GH¢800k excavator fraud

3 hours