Audio By Carbonatix

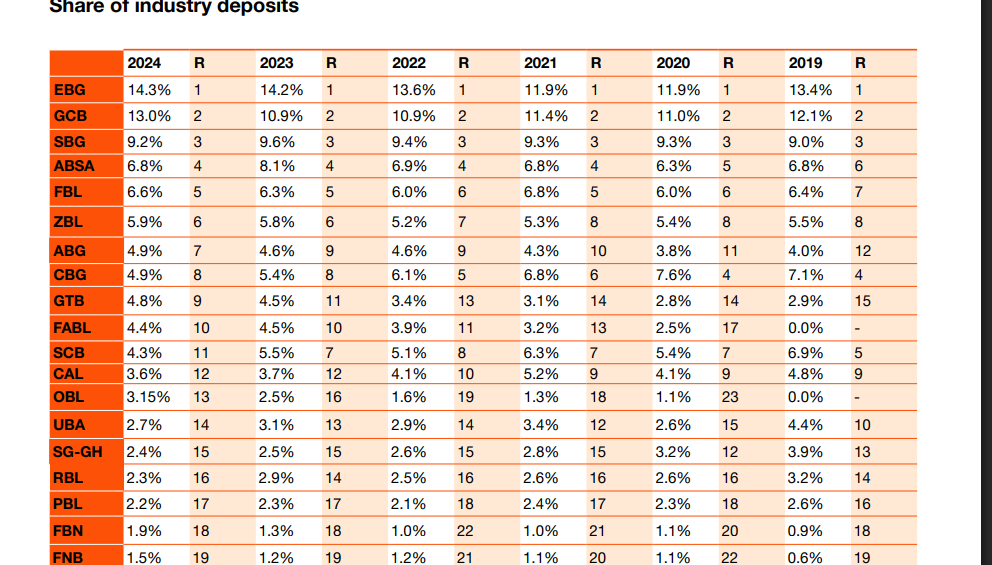

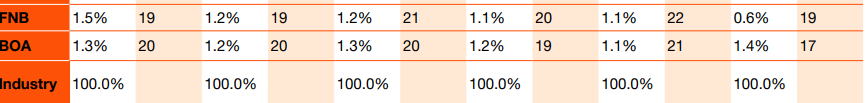

Ecobank Ghana continued its position as the biggest bank in Ghana in 2024 with a market share of 14.3%, according to the 2025 Ghana Banking Sector Survey by PwC.

It was followed by GCB Bank with a market share of 13.0% in 2024, from 10.9% in 2023.

According to the report, the expansion of the two banks highlights the high level of trust these institutions enjoy among retail and corporate clients.

Their success in deposit mobilisation can be attributed to a variety of strategic initiatives. These included leveraging an extensive physical branch network, each operating more than 250 outlets nationwide, to improve accessibility in both the urban and rural areas.

Additionally, their sustained investment in digital banking infrastructure significantly enhanced convenience for clients, particularly the younger, tech-oriented demographic. Their rollout of targeted savings and investment products further attracted clients such as SMEs and salaried professionals seeking flexible and secure financial solutions.

Standard Bank and Absa consolidated their standings as the third and fourth largest banks by total deposits, expanding their combined deposit base by GH₵6.9 billion.

In the mid-tier category, banks such as Zenith Bank, Consolidated Bank Ghana and First Atlantic Bank remained steady in the 6th, 8th, and 10th positions, respectively.

Access Bank Ghana rose from ninth to seventh place, while GT Bank improved its standing from 11th to 9th.

Conversely, Standard Chartered Bank dropped from 7th to 11th, suggesting competitive or operational headwinds.

Overall, the ten leading banks captured over 50% of the industry’s total deposits, affirming their influence in shaping sector dynamics.

Across deposit types, there was broad-based growth: current accounts surged by 37.4%, savings accounts rose by 44.2%, and both certificates of deposit and call deposits showed marked increases.

Deposits from other banks also increased sharply by nearly 50%, indicating a rise in interbank confidence and activities to support the new cost to deposit ratio requirements.

Notably, time and fixed deposits declined by 6.2%, likely driven by changing interest rate expectations and a growing preference for more flexible financial instruments.

Latest Stories

-

Senyo Hosi demands national framework for renaming public infrastructure

3 minutes -

The Intentional Money Playbook: Winning with your personal finances in 2026 (Part II)

16 minutes -

Paul Adom-Otchere reveals past proposal to rename Kotoka Airport after Kofi Annan

29 minutes -

KIA: Gov’t proposed ‘Accra International Airport’, not Kwame Nkrumah International Airport – Atta Issah

30 minutes -

Fire ravages container shops on Spintex Road

43 minutes -

Plan to rename KIA is about settling long-standing political score – Paul Adom Otchere

46 minutes -

Livestream: Newsfile discusses KIA renaming, NPP unity test and inflation credibility

1 hour -

Zambia scraps taxes on Fugu from Ghana for personal use following social media drama

2 hours -

Gunfire silences prosperity as PLO Lumumba warns of ‘bleeding’ African continent

4 hours -

African Leaders must shift from speeches to action – P.L.O Lumumba

4 hours -

Ace Ankomah demands radical overhaul of Ghana’s science and innovation sector

4 hours -

Trump signs executive order threatening tariffs for countries trading with Iran

5 hours -

From Hollywood to the homeland: Why African countries are courting black American stars

5 hours -

Ambulance service slams ‘taxi transfer’ of newborn as viral negligence claims debunked

5 hours -

High stakes in Ayawaso East as NDC delegates head to the polls today

6 hours