Audio By Carbonatix

Fidelity Bank Ghana has entered into a strategic partnership with the National Lottery Authority (NLA) to digitise lottery operations, expand market access, and strengthen regulatory control across Ghana’s lottery ecosystem.

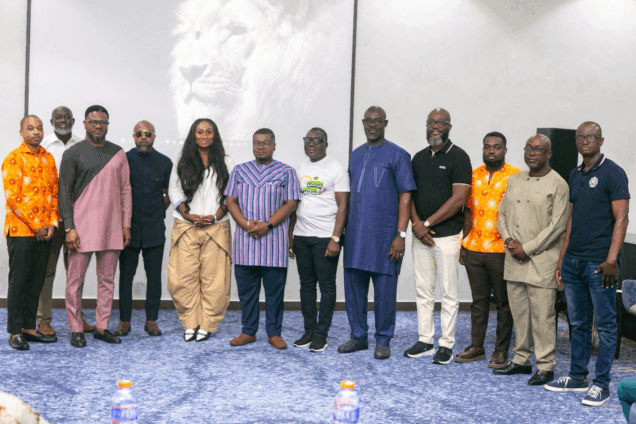

The partnership was unveiled during an engagement session at Palms by Eagles, attended by NLA management and Regional Sales Managers in Accra.

It seeks to address longstanding operational and market challenges facing the Authority, including the dominance of informal lottery operations and ageing infrastructure that limits reach, efficiency, and player engagement.

The initiative will deploy a modern digital lottery platform supported by enhanced payment infrastructure, the rollout of 5,000 new Android-based Point of Sale (POS) terminals, and the introduction of instant prize payouts for winnings below GH¢30,000.

Speaking at the event, the Director-General of the National Lottery Authority, Mohammed Abdul-Salam, highlighted the urgent need for industry transformation.

“For several years, the National Lottery Authority has faced significant operational and market challenges.

"The growth of illegal lottery operations has diverted substantial revenue that should have supported national development projects.

"At the same time, our infrastructure required modernisation to meet the expectations of today’s digital consumer.

"Partnering with Fidelity Bank gives us the technological strength and financial expertise needed to reposition the NLA, expand our reach, and restore confidence in the official lottery system.”

He noted that as Ghana continues to experience rapid digital financial adoption, modernising lottery operations has become necessary to maintain relevance and sustain contributions to national development initiatives.

“Ghanaians have embraced digital financial services, and it is important that the lottery sector evolves to meet these expectations.

"By leveraging Fidelity Bank’s digital and payments capabilities, we are positioning the NLA to operate more efficiently, expand our reach, and formalise a significant portion of the currently unregulated market,” he added.

Delivering his remarks at the engagement session, John-Paul Taabavi, Divisional Director, Corporate and Institutional Banking at Fidelity Bank Ghana, emphasised the partnership's broader national significance.

“Today marks an important milestone for two Ghanaian institutions coming together with a shared purpose.

"We are here to reclaim a narrative and rebuild an industry that belongs to the people of Ghana. This partnership creates a clear path toward growth, transparency, and renewed public confidence.”

Mr. Taabavi explained that while demand for lottery participation remains strong, access, trust, and system reliability have limited the NLA’s ability to fully capture market activity.

“The issue is not demand. Ghanaians continue to play. The real challenge is access, trust, and relevance in a digital age.

"When the formal system does not operate at full capacity, the informal market steps in to fill the gap. This partnership is designed to close that gap and reposition the NLA at the centre of Ghana’s digital economy.”

The partnership is expected to drive significant revenue growth for the NLA, with projections targeting a tenfold increase in total deposits over the next three years.

Increased revenue is expected to strengthen the Authority’s contributions toward national development initiatives, including education, healthcare, and infrastructure.

Additionally, the expanded digital and retail channels are expected to create new opportunities for LMCs and agents by increasing sales volumes and simplifying operational processes.

Both institutions emphasised that the partnership represents a long-term commitment to building a transparent, efficient, and inclusive lottery system that benefits all stakeholders.

Latest Stories

-

Suspend it now – University non-teaching unions reject GTEC retirement directive, warn of disruption

4 hours -

Court remands scrap dealer over Yunzu Company robbery

6 hours -

Court sentences unemployed man to 15 years for robbery

6 hours -

ECG to cut power in parts of Accra West on February 11 for planned maintenance

7 hours -

BoG announces guidelines to govern foreign exchange spot interventions

7 hours -

Intelligence report uncovers weapons transfers under Sudanese Army oversight to South Kordofan

7 hours -

119 people died during mediation efforts in Bawku conflict – Mahama

7 hours -

Trade Ministry to lead raw material expansion for 24-hour production, youth jobs & exports

7 hours -

Migration induced by coastal erosion: The Shama experience

7 hours -

Ghana’s economy to expand by 5.67% in 2026

7 hours -

A/R: ECG surcharges over 2,200 customers for illegal connections, recovers over GH¢4.3bn in 2025

8 hours -

With galamsey still ongoing, who is buying the gold? – Oppong Nkrumah questions gov’t

8 hours -

Avoiding Fiscal Risks in GCR’s deal with GoldBod

8 hours -

Suame Interchange won’t affect NPP votes in Ashanti – Asenso-Boakye

8 hours -

Mahama receives Transition Committee report on UGMC transfer to University of Ghana

8 hours